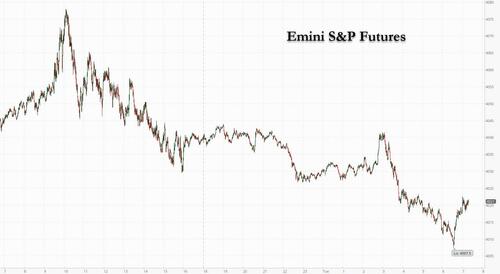

US equity futures showed no sign of rebounding on Tuesday from the Nasdaq’s worst single-day drubbing in over a month, with investors growing nervous ahead of this week’s barrage of central bank meetings which include the BOE and ECB Thursday and start tomorrow, when the Fed is expected to hike rates by 25bps; a barrage of earnings reports from some of the world’s biggest companies is also keeping investors busy.

Futures for the Nasdaq 100 and the S&P 500 indexes slipped 0.6% and 0.3%, recovering from even bigger losses earlier in the session as doubts continue to grow about the sustainability of a four-month old rally, which has accelerated further since the start of the year. The Nasdaq benchmark tumbled more than 2% on Monday, its largest decline since Dec. 22 . Despite the pre-Fed jitters, however, both the S&P 500 and the Nasdaq 100 are poised for their best start to a year since 2019 as optimism over slowing inflation and resilient economic growth fueled appetite for risk. However, the start of the earnings season with corporate warnings and reiteration of the Fed’s resolve to raise rates have put a damper on the recovery. Treasury yields dipped, the dollar edged higher and oil extended its recent losses.

In premarket trading, chipmaker stocks slumped with NXP Semiconductors NV dropping more than 4% after a disappointing first-quarter forecast. Exxon Mobil surpassed profit expectations for the ninth time in 10 quarters, but shares are down premarket as the company signaled investors won’t see any additional rewards. McDonald’s also fell as much as 1.8% after its operating margin for the fourth quarter misses the consensus estimate. Its 2023 forecast for the measure also trailed. Moderna and BioNTech are also dropping in US premarket trading after Pfizer’s 2023 outlook included softer revenue estimates for its Covid vaccine and pill than analysts expected (MRNA dips 2.4% and BNTX, which is partner on PFE’s shot, falls 2%). On the plus side, General Motors jumped more than 5% after posting forecasts that beat analysts’ estimates; its results lifted shares of automakers Ford and Stellantis. Here are some other notable premarket movers:

“Markets are tense,” said Raphael Thuin, head of Capital Markets Strategies at Tikehau Capital. “They haven’t made up their minds about the ongoing earnings season,” he said, noting visibility also remains low on the outlook for inflation and how policy makers intend to keep price growth in check. He warned that a surprisingly hawkish tone from the Fed could trigger a backlash across markets. The US central bank will conclude its meeting on Wednesday and is widely expected to raise rates by 25 basis points.

Signs of earnings pressure are complicating the picture for investors hopeful that the Fed will ease off on its aggressive rate-hike cycle: According to data compiled by Bloomberg, earnings per share estimates for the S&P 500 have fallen since peaking in June 2022, while revenue projections have flatlined. Margins are coming under pressure as slowing inflation erodes pricing power.

“The prospect of a stabilization of interest rates at 5% after March is shifting the focus from the rate side to the growth side,” said Willem Sels, chief investment officer at HSBC Private Bank. “Mixed earnings will probably continue to lead to some volatility in coming weeks, so we are neutral on developed-market equities for now.”

European stocks extended a decline after data suggested the euro area will avoid a recession after unexpectedly expanding at the end of 2022, prompting traders to ramp up bets on monetary tightening by the ECB. The Stoxx 600 was down 0.7% with miners, financial services and energy the worst performing sectors. Gross domestic product edged up by 0.1% in the final quarter, Eurostat said Tuesday, defying economist estimates for a contraction of 0.1%. While German and Italian output shrank, France and Spain recorded expansion. There was also stronger-than-anticipated data on Monday from Ireland. Among individual stock movers in Europe on Tuesday, Swiss lender UBS Group AG dropped more than 3% after reporting a slump in revenue at its key wealth management business. Unicredit SpA surged after the Italian lender reported better-than-expected profit. Here are some of the biggest European movers on Tuesday:

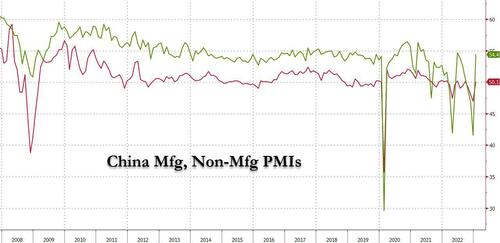

Asian stocks fell for a second day as mainland Chinese shares pulled back after Monday’s advance, with traders awaiting key decisions from major central banks this week. The MSCI Asia Pacific Index declined as much as 1.2%, dragged lower by technology shares after Samsung Electronics posted weaker-than-expected fourth-quarter results. Equity markets in Hong Kong, South Korea and Taiwan retreated. China’s CSI 300 Index fell even after the latest economic data showed manufacturing and services expanded for the first time in four months as the nation exited from Covid Zero.

The benchmark gauge shied away from a bull market after a recent rally fueled by the return of foreign investors took a breather. “Stocks generally have had a very good run recently despite concerns of a US recession and Fed hawkishness,” said Chetan Seth, an Asia Pacific equity strategist at Nomura. “So there is naturally a huge focus on US payrolls data this Friday and what Chair Powell has to say this coming Thursday early morning in Asia.” Interest-rate decisions are scheduled this week for the Federal Reserve, the European Central Bank and the Bank of England. The Fed is widely expected to raise rates by a quarter percentage point, with investors on the lookout for any changes in the future tightening path. The MSCI’s Asian benchmark was poised for a monthly gain of around 8%, its best January performance since 1994. The gauge has rallied 23% since Oct. 31 on China’s rebound, beating the S&P 500 by 19 percentage points

Japanese equities erased earlier gains, ending the day lower ahead of major central-bank decisions this week. The Topix Index fell 0.4% to 1,975.27 as of the market close in Tokyo, while the Nikkei declined 0.4% to 27,327.11. Daiichi Sankyo Co. contributed the most to the Topix’s decline, decreasing 4.9%. Out of 2,165 stocks in the index, after its 3Q results. 1,382 rose and 696 fell, while 87 were unchanged. “This week we have the US jobs report and the FOMC meeting,” said Hideyuki Suzuki, general manager at SBI Securities. “We’ll have to monitor the Fed meeting.” Interest-rate decisions are scheduled this week for the Federal Reserve, the European Central Bank and the Bank of England.

Australian stocks also dipped, with the S&P/ASX 200 index edging 0.1% lower to close at 7,476.70, dragged by losses in mining and real estate shares. Australian retail sales declined for the first time in 2022 in December, suggesting consumers are beginning to rein in spending in response to rapid inflation and rising interest rates. In New Zealand, the S&P/NZX 50 index fell 0.6% to 11,967.72.

Indian stocks closed little changed amid a volatile session ahead of the federal budget’s presentation on Wednesday. HDFC Bank and software makers were key drags on benchmark index. Adani Group stocks were mostly higher as the conglomerate’s flagship firm successfully concluded its $2.5 billion follow-on share sale, helped by demand from institutional investors. Seven out of 10 companies controlled by Adani Group advanced while the decliners were led by Adani Total Gas, which plunged 10%. The S&P BSE Sensex rose slightly less than 0.1 percent to 59,549.90 in Mumbai, while the NSE Nifty 50 Index moved by a similar amount. Fifteen of the 20 sector sub-gauges compiled by BSE Ltd. advanced, led by services-sector companies, while energy firms were the worst performers. Stocks in Asia and Europe were mostly lower as investors await key decisions from major central banks this week. Cigarette and FMCG-products maker ITC contributed the most to the Sensex’s gain, increasing 2.2%. Half the 30 shares in the Sensex index rose and half fell.

In FX, the Bloomberg Dollar Spot Index rose 0.2% to its highest level since Jan. 24, as broader market sentiment turned cautious with the Federal Reserve set to kick off its two-day meeting, while the European Central Bank and the Bank of England both issue policy decisions on Thursday. The Norwegian krone and Australian dollar are the weakest among the G-10’s while the Japanese yen outperforms. “The price action suggests market participants are nervous over a hawkish policy surprise from central banks including the Fed this week, and/or a lot of good news has already been priced into markets now in anticipation of China’s economy reopening more fully,” MUFG analysts wrote in a note

In rates, treasuries edge up, pushing the 10-year yield 2bps lower to 3.51%, with gilts underperforming by ~1bp in the sector, helping unwind some Treasury gains seen in Asia session. Gilts lag, and markets trade with a broad risk-off tone with S&P 500 futures lower, adding to Monday’s slide. The two-year yield slips 0.2bps to 4.23%, keeping the inverted two-year/10-year yield curve little changed. Bunds gain, led by a 2.5 basis point slide in the five- year yield to 2.33%. German 10-year yields are lower by 2bps while the UK equivalent is unchanged. US economic slate includes employment cost index and consumer confidence.

In commodities, crude futures decline, with WTI down 1.7% to trade near $76.60. Spot gold falls roughly $18 to trade near $1,905

Looking to the day ahead now, and data releases include the first look at Q4 GDP for the Euro Area. Alongside that, we’ll get the French CPI release for January, as well as German unemployment for January and UK mortgage approvals for December. In the US, there’s then the Conference Board’s consumer confidence for January, the ECI, the MNI Chicago PMI for January, and the FHFA house price index for November. Finally, earnings releases include ExxonMobil, Pfizer, McDonald’s, UPS, and Caterpillar.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined following the weak lead from global counterparts added to the cautiousness heading into the upcoming risk events, while a rebound in Chinese PMI data failed to inspire a rally as the region also digested a slew of earnings updates. ASX 200 was subdued as the outperformance in defensives was offset by losses in tech and with Retail Sales at a larger-than-expected contraction. Nikkei 225 softened amid a deluge of earnings releases which impacted several of the largest movers in the index, although losses were contained by better-than-expected data releases. KOSPI suffered amid losses in its largest constituent Samsung Electronics which posted its lowest quarterly operating profit in 8 years and flagged macroeconomic uncertainties will persist this year. Hang Seng and Shanghai Comp. were pressured despite the strong Chinese PMI data which topped forecasts and returned to expansion territory, while attention was also on preliminary earnings and reports that US President Biden's team is weighing fully cutting off Huawei from US suppliers.

Top Asian News

European bourses are lower across the board, Euro Stoxx 50 -0.6%, as the upside after France's CPI fizzled out and reverted back to APAC performance. Sectors are mostly in the red with Banking names outperforming post-earnings while Basic Resources lag given the risk tone and USD. Stateside, futures are similarly pressured and have been in-fitting with European peers throughout the session ahead of key Employment Cost data, ES -0.5%.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

After putting in a very strong start to 2023, markets lost a fair bit of ground yesterday as investors grew a little concerned about the sustainability of the current rally. There were several factors driving that, but an important one was the stronger-than-expected Spanish inflation print for January, which added to fears that inflation could prove more persistent than feared, meaning that central banks would need to keep up their hawkish stance for some time yet. That led equities and bonds to sell off over the last 24 hours, with the S&P 500 (-1.30%) putting in its worst start to a week so far this year, and second worst day of the year, just as 10yr Treasury yields rose +3.3bps as well. Clearly there’s still plenty to navigate over the course of the week, but with US financial conditions having eased to their most accommodative in months, there’s an awareness that the Fed could seek to reassert their hawkish credentials through tomorrow’s decision.

In terms of the specific moves, risk assets struggled for the most part, with big tech leading the declines as fears about higher rates ramped up again. That saw the NASDAQ shed -1.96% on the day (worst day since December 22nd), whilst the FANG+ index of megacap tech stocks saw an even larger decline of -3.41% (also the worst day since December 22nd). While megacap tech stocks led the declines, 80% of S&P 500 constituents lost ground yesterday with the worst single sector actually being energy (-2.29%) on lower oil prices, as Brent crude was down -2.03%. In fact, the only major sector to just finish positive on the day was the defensive consumer staples (+0.07%) group. On this side of the continent, the STOXX 600 (-0.17%) saw more modest declines and finished near the highs of the day before the last part of the US sell-off

As mentioned at the top, the day got off to a rough start after the Spanish inflation print for January came in significantly higher than expected. The release saw CPI come in at 5.8% on the EU-harmonised measure, which was an increase from the previous month’s 5.5% and a full point above the expected decline to 4.8%. In addition, core inflation (using the national definition) moved up to another multi-decade high of 7.5%, having been at 7.0% in December. So that’s bad news for hopes that we were now firmly trending downwards, and the acceleration of core inflation will raise concerns about how persistent its still proving. Next up is French inflation today with German consumer prices, slated for today, now being postponed to next week, seemingly due to technicalities over new base effects. Very intriguing! Staying with inflation, the US employment cost index (ECI) is a very important release today, especially ahead of the FOMC.

Even before the Spanish numbers, investors were already expecting that the ECB would be the most hawkish central bank this week, but that print served to ratchet that up further. For instance, investors are now fully anticipating a 50bps hike on Thursday, but pricing further out now points to 147bps of further hikes by July, which was up +8.9bps on the day. In turn, that led European sovereigns to underperform their counterparts elsewhere, with yields on 10yr bunds (+7.9bps), OATs (+8.3bps), Spanish bonds (+9.1bps) and BTPs (+10.2bps) all rising on the day.

Back to Germany, and we got a further piece of bearish news yesterday after data showed their Q4 GDP growth came in at a contractionary -0.2%, which was beneath expectations for an unchanged reading. That’s a bit of a knock since it goes against the more positive narrative recently that high gas storage and falling prices would aid the economy. It also means that if there’s another contraction in Q1, then the technical definition of a recession would be met.

In other news, it was widely reported yesterday that the EU are set to respond to the US’ Inflation Reduction Act by loosening the rules on tax credits. The proposals are set to be published tomorrow, but according to a Bloomberg who’d seen a draft it included a Net-Zero Industry Act to simplify regulations, among others. European Commission President von der Leyen is giving a speech on the issue tomorrow, and ahead of that, our European economists put out a report (link here) where they assess the technical details behind various policy options along with their pros and cons.

Back in the US, Treasuries might not have struggled as much as their European counterparts, but it was still a tough day as investors positioned ahead of tomorrow’s Fed decision. That meant yields on 10yr Treasuries were up +3.3bps, and the more policy-sensitive 2yr yield was up +3.5bps at 4.234%. As with the ECB, those moves were in part because investors ramped up their hawkish expectations of the Fed, with terminal rate pricing for June up +2.0bps on the day to a nearly 3-week high of 4.931%.

Late in the US session, there was news that the Biden administration was weighing fully cutting off Chinese technology company Huawei from American suppliers, including US chipmakers such as AMD, Intel, and Qualcomm. President Trump’s administration had initially named Huawei a national security concern, which meant that US companies were required to receive approval from the government before transacting with Huawei. According to Bloomberg, Huawei sales make up less than 1% of revenue for AMD, Intel, and Qualcomm. However, investors should keep an eye on possible knock-on effects if the US does ban sales to the Chinese company.

This morning in Asia equity markets across the region are trading in negative territory, taking their cue from Wall Street declines overnight. Those negative moves have come despite fresh economic data out of China showing a bounce in activity (more on this below). As I type, the Hang Seng (-1.27%) is the largest underperformer with the CSI (-0.79%) and the Shanghai Composite also drifting lower. Elsewhere, the KOSPI (-0.72%) is also losing ground as index heavy-weight Samsung Electronics' (-2.74%) operating profit plunged in 4Q of last year amid the global chip downturn. Meanwhile, the Nikkei (-0.21%) is also edging lower. US stock futures are indicating a muted start with those on the S&P 500 (-0.01%) just below flat while contracts tied to the NASDAQ 100 (-0.22%) are seeing slightly deeper losses.

Coming back to China, the official manufacturing PMI swung back to expansion in January after reporting a reading of 50.1 (in-line with consensus), up from a 34-month low of 47.0 in December as the nation ended strict Covid curbs. At the same time, sentiment among service-led businesses improved dramatically as the non-manufacturing PMI came in at an upbeat 54.4 figure (v/s 52.0 expected), marking the healthiest expansion since June 2022. Meanwhile in Japan, the unemployment rate remained unchanged at 2.5% in December with the job-to-applicant ratio staying at 1.35 (v/s 1.36 expected). Separately, retail sales rebounded +1.1% m/m in December, beating the market forecast for a +0.7% rise and against an upwardly revised -1.3% decline in the prior month. Industrial Production also beat a -1.0% consensus with a -0.1% m/m figure for December and compared to a +0.2% increase in November.

Elsewhere, the International Monetary Fund (IMF) upgraded its 2023 global growth estimates while stating that the EM growth slowdown may have bottomed out in 2022. They forecast that global GDP will likely expand 2.9% in 2023, an improvement of +0.2 percentage from its October prediction, mainly due to resilient demand in the US and Europe coupled with China’s reopening. Additionally, for 2024 it expects global growth to accelerate to 3.1%.

In terms of yesterday’s other data, it was generally on the more positive side. For instance, the European Commission’s economic sentiment indicator for the Euro Area in January moved up for a third consecutive month to 99.9 (vs. 97.0 expected), which is its highest level since June. Meanwhile in the US, the Dallas Fed’s manufacturing index rose to its highest since May at -8.4 (vs. -15.0 expected)

To the day ahead now, and data releases include the first look at Q4 GDP for the Euro Area. Alongside that, we’ll get the French CPI release for January, as well as German unemployment for January and UK mortgage approvals for December. In the US, there’s then the Conference Board’s consumer confidence for January, the ECI, the MNI Chicago PMI for January, and the FHFA house price index for November. Finally, earnings releases include ExxonMobil, Pfizer, McDonald’s, UPS, and Caterpillar.