After a rollercoaster week which saw a nonstop torrent of news, central bank announcements, earnings and market gyrations, DB's Jim Reid reminds us that the week after payrolls is - thankfully - quiet for data. Which is good because as Reid sarcastically notes, "it'll take until next month's release to decipher Friday's report." For now, however, let's quickly outline the highlights of the week ahead.

Given the blockbuster payrolls print, Fed Chair Powell's speech at the Economic Club of Washington tomorrow could be the highlight. The release valve post the blackout period will mean we have a mini deluge of other Fed speakers too including Vice Chair of Supervision Barr (tomorrow), New York Fed President Williams, Fed Governor Cook, Minneapolis President Kashkari and Fed Governor Waller (all Wednesday). Their comments on the payroll report will be devoured and it'll be interesting if they, and especially Powell, decide to slightly firm up the hawkish spin and be more explicit on a terminal rate above 5%. We continue to think we'll get that, but the market has been increasingly pricing a pause after March and cuts by year-end. To be fair, Friday saw terminal edge back above 5% (climbing +12.5bps to 5.025% on the day) with December 2023 contracts up +23bps to 4.58%. This week's Fedspeak on financial conditions will also be interesting as the relaxed attitude of Powell to them at the FOMC presser encouraged a big dovish market reaction. Much of this was reversed on Friday but the sensitivities to such comments remain high. There's plenty of other central bank speak this week. See it in the day-by-day calendar at the end.

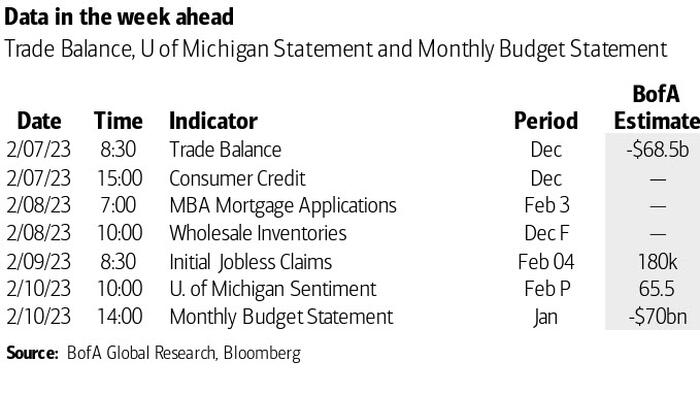

In terms of data, it's certainly a second-tier week ahead. The delayed German CPI report on Thursday might be one of the highlights. It was delayed due to technical issues around base year changes. Given the payrolls revisions, that does make one a little nervous (in either direction), but we will see. UK GDP numbers on Friday will be a highlight after the IMF last week suggested they would be one of the 2023 developed world growth laggards. In the US, the UoM consumer sentiment survey (Friday) and the usual inflation expectations will be a focus as usual.

Over in Asia, key macro indicators include China's CPI and PPI reports on Friday, with median Bloomberg estimates pointing to readings of 2.2% YoY (vs 1.8% in December) and -0.5% YoY (vs -0.7% in December), respectively.

Earnings season continues in the background. Just under half of S&P 500 firms have now reported with results from Disney, Uber (Wednesday) and PayPal (Thursday) among the key ones for the large cap index this week. Private capital managers will also be in the spotlight with KKR (Tuesday), Brookfield (Wednesday) and Apollo (Thursday) releasing results throughout the week. European Big Oil heavyweights also report including BP (tomorrow) and Total (Wednesday). Consumer-driven names including Chipotle, Royal Caribbean (tomorrow), PepsiCo and L'Oreal (Thursday) report with other notable earnings releases including Activision Blizzard (today), AstraZeneca and Siemens (Thursday).

Here is a day-by-day calendar of events

Monday February 6

Tuesday February 7

Wednesday February 8

Thursday February 9

Friday February 10

Finally, focusing on just the US, Goldman writes that key economic data release this week is the University of Michigan report on Friday. There are several speaking engagements from Fed officials this week, including Chair Powell; governors Waller, Cook, and Barr; and presidents Williams, Kashkari, and Harker.

Monday, February 6

Tuesday, February 7

Wednesday, February 8

Thursday, February 9

Friday, February 10

Source: DB, Goldman, BofA