While some will be secretly asking chat GPT to write a poem for their loved ones tomorrow ("Violets are blue, roses are red, humans are stupid and will soon all be dead"), those following markets will only care about one thing: the January CPI report (especially after the BLS just revised its seasonal adjustments and weight factors). As DB's Jim Reid writes this morning, "it only feels like yesterday that US inflation prints were seen as last year’s news given the recent falls. In addition, forecasts and breakevens suggested we were on a glide path to normality over the next few months and quarters."

However, as Reid warns, that view has received a bit of a jolt in the last 10 days:

- First we had payrolls print which raised the prospect that core services ex-shelter could stay stronger for longer.

- Then we had lots of hawkish central bank speak that the market had previously ignored but was now slowly waking up to.

- Then Manheim suggested US used cars (+2.5% mom in January) climbed at their fastest rate for 14-months, and...

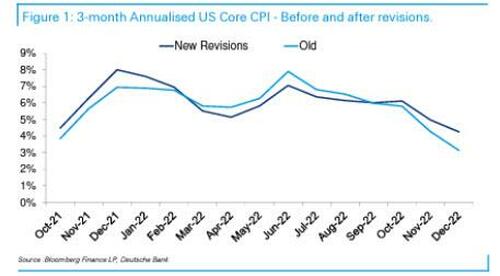

- Finally, we had US CPI revisions on Friday that have rewritten the last year of history and in turn reduced core inflation by around a tenth each month leading up to June and have increased it by an average of around a tenth in each month since August. As such the trend in core CPI hasn’t fallen as much as expected and we now haven’t seen any month less than +0.3% MoM. In addition 3m annualised core CPI ran at 4.3% in December rather than the 3.1% reported at the January 12th release. So although year on year hasn’t changed the momentum is notably different.

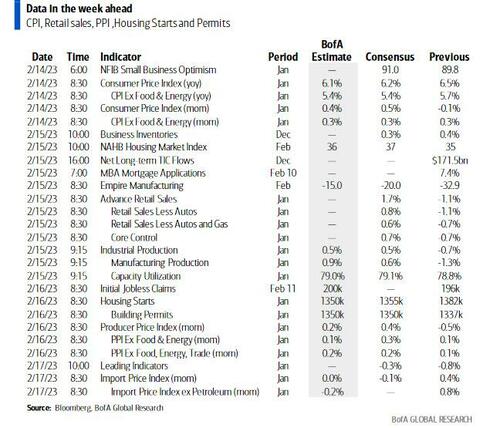

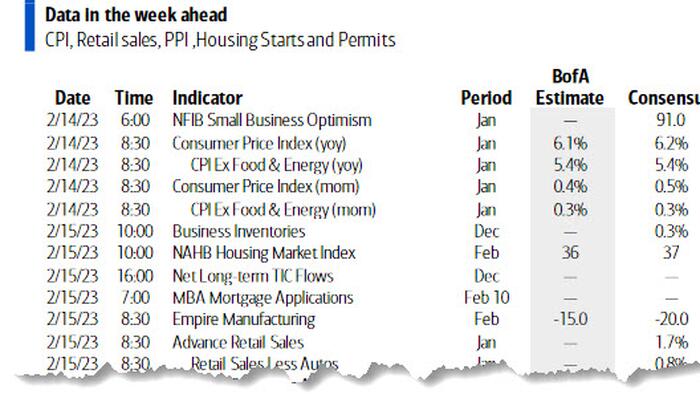

For tomorrow’s reading, higher gas prices should boost headline MoM CPI (consensus +0.5%). Last month this printed at -0.1% but got revised up to +0.1% on Friday. Core MoM should be stable (+0.4% consensus) but only because Friday’s revisions saw it edge up from 0.3% to 0.4% last month. As strong prints from this time last year edge out of the data, the YoY rates should fall around two tenths each to 6.2% and 5.5% (consensus unchanged at 5.7%), respectively. If you want to get more into the weeds see DB’s Justin Weidner’s preview here.

Staying with inflation, US PPI on Thursday is also important as the medical services component feeds directly into the equivalent within the core PCE number (out Feb 24th).

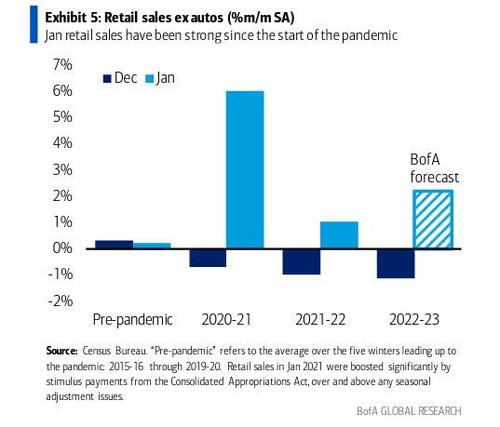

Elsewhere in the US we have leading indicators (LEI) on Friday which are expected to pickup, but stay in negative territory in January after an awful print for December. January retail sales on Wednesday is also expected to bounce back after a poor end to the year. In fact, according to BofA card data, retail sales will come in far hotter than expected, which may be an even bigger shock to the Fed than a hot CPI print... and certainly the market which is not expecting a big outlier here. More on that in a subsequent post.

There are also a couple of regional factory surveys (NY on Weds and Philli Thurs) which along with industrial production (Weds) are also all expected to bounce to varying degrees. Thursday will also see the usual jobless claims alongside housing starts and building permits (1.350 vs. 1.337k).

Fed speakers will have plenty of opportunity to address the data throughout the week, with at least ten appearances scheduled so far. There are a number of appearances from ECB officials as well. See the highlights in the day by day week ahead calendar at the end as usual.

Shifting to Europe, UK CPI (Weds) and labour market data (tomorrow) will be in focus following the recent more dovish BoE meeting. This week's CPI will also be calculated with new weights so our UK economists put out a note on the potential impact of the changes here.

Turning to earnings now, with nearly 350 of the S&P 500 members having reported, there will still be a few notable corporates releasing results but the reality is that we are past the biggest potential market movers for the macro world.

Here is a day-by-day calendar of events

Monday February 13

Tuesday February 14

Wednesday February 15

Thursday February 16

Friday February 17

Finally, turning to just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday, retail sales on Wednesday, and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week, including governors Bowman and Cook and presidents Barkin, Logan, Harker, Williams, Mester, and Bullard.

Monday, February 13

Tuesday, February 14

Wednesday, February 15

Thursday, February 16

Friday, February 17

Source: DB, Goldman, Bofa