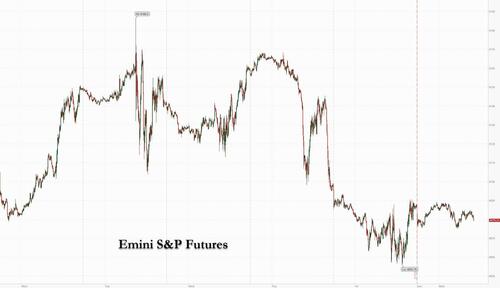

With US cash markets closed for the President's Day holiday, US equity futures traded in a tight range amid non-existant volumes, as did European stocks, while Asian stocks pushed higher as China’s mainland shares rebounded from a three-day slump after a Goldman report that penciled in a rebound on the back of an earnings recovery. Calls for further stimulus via lower rates also built up, prompting the nation’s banks to keep their lending rates unchanged. Emini S&P futures were down 0.2% to 4,080, near session lows after closing Friday at the highs.

On Monday, US President Joe Biden made a surprise visit to Kyiv and met with his Ukrainian counterpart Volodymyr Zelenskiy, declaring “unwavering support” in a show of solidarity as Russia’s invasion nears the one-year mark.

European stocks struggled for direction as the prospect of higher-for-longer interest rates counters optimism derived from a solid earnings season. The Stoxx 600 was up 0.1% with miners, chemicals and insurance the best-performing sectors while tech and media fall. Here are some of the biggest movers on Monday:

Earlier in the session, Asian stocks rose as China’s mainland shares rebounded from a three-day slump and investors assessed the outlook for US interest rates. The MSCI Asia Pacific Index advanced as much as 0.7%, led by financial and communication shares. Benchmarks gained in Vietnam, Hong Kong and Taiwan. China’s CSI 300 had its best day in almost three months on rising optimism that an economic recovery will sustain the reopening rally. Goldman Sachs Group said it expects Chinese stocks to reverse their slide since late January, as businesses reap windfall profits after the country emerges from its Covid restrictions.

A chorus of investors including Goldman is betting on Chinese equities to resume a rally as the world’s second-biggest economy deepens stimulus and relaxes pandemic restrictions. While this has sparked inflows into global assets tied to the Chinese economy, the broader sentiment in markets remains impaired, with the Fed resolute on its fight against inflation. Growing geopolitical tensions are also preventing investors from turning more bullish.

“The only place where the central bank will remain soft enough is China, to recover from a series of absurd Covid measures that pushed the economy into an unnecessary depressed zone,” Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, wrote in a note. “The geopolitical tensions aren’t going in the right direction for restoring confidence.”

“Current conditions suggest Asia could outperform if the US corrects in coming months,” Goldman Sachs strategists including Timothy Moe wrote in a note. The US brokerage is “constructive” on the outlook for Asia given 16% earnings growth in 2024 and “still-reasonable” valuations. Investors are still digesting last week’s commentary from two of the Federal Reserve’s most hawkish policymakers. The officials signaled they may favor returning to bigger interest-rate hikes in the future. While a bull-market rally in Asian stocks has petered out this month, the region’s shares are still more than 20% above a low reached in October.

In FX, the Dollar Index is up 0.1% while the Swedish krona is the best-performer among the G-10’s after core CPI surprised to the upside. The New Zealand dollar is the weakest.

In rates, UK 10-year yields fall 4bps on the day while the German equivalent is unchanged. Cash Treasuries are closed.

Oil futures advanced with WTI rising 0.6% trade near $76.80. Demand from China will climb by 800,000 barrels a day in 2023, according to the median estimate of 11 China-focused consultants surveyed by Bloomberg News. That would take consumption to an all-time high of about 16 million barrels a day, the survey showed. Spot gold is little changed around $1,843.

Investors also awaited clues on US consumer demand as Walmart Inc. and Home Depot Inc. were set to kick off a slew of retail earnings reports this week.

DB's Jim Reid concludes the abbreviate wrap

We survived half term. My wife will be bouncing with joy when she drops them off this morning. However our poor dog Brontë has an upset stomach and for the last 2 nights has asked to go outside almost every hour. So I'm a bit of a zombie typing this as we've taken it in turns to go with her but have both woken up every time. In fact, I'm finishing this off at 4am while Brontë is outside trying to find the appropriate spot for her latest endeavours. It's bringing bad memories back of having babies in the house. So if you want to know why the EMR is a bit early this morning (assuming it is by the time it clears) this is it.

Prior to the weekend, in the days where sleep was something I took for granted, DB's Matt Luzzetti followed up his street topping 5.6% US terminal rate forecast with an update of his US growth profile on Friday. The timing of the recession has been pushed back to Q4 from Q3 but the title "No landing is not an option for the Fed" says it all. See the note here.

After today’s US holiday (Presidents’ Day), the PCE report in the US (Friday) and global flash PMIs (Tuesday) will be the key data releases this week. Friday's one year anniversary of the war in Ukraine will also be closely watched, if for no other reason that to see whether it marks an escalation. A reminder that tomorrow at 1pm London time DB have a webinar on the conflict with expert Michael Kofman, the Research Director of the Russia Studies Program at the CAN, and will be discussing the latest developments in the conflict, the likely next steps in the war effort, the implications of recent sanctions, the prospects of a peace agreement, and the risks of escalation. The link to sign up is here.

Elsewhere we have the latest Fed minutes (Wednesday) and Japanese CPI (Thursday), with the earnings line-up including key US retailers (Walmart, Home Depot), major miners (BHP, Rio Tinto) and China's tech giants (Baidu, Alibaba).

So we'll have to wait until Friday for the main event this week as the latest core PCE deflator (DB and consensus at +0.5% mom vs. +0.3% last month) come out as part of the personal income (a strong +1.1% mom consensus, DB +0.6% vs. +0.2% previously) and consumption (DB and consensus +1.3% mom vs. -0.2%) report. The core PCE will likely continue to confirm the near-term inflation pressures. Last week's CPI showed that they were still relatively broad based with the trimmed mean and median CPI gauges rising the most since September. Median YoY CPI was the highest in the 40 year history of the calculation. Core goods prices rose while used cars fell. However used cars have been climbing in recent months and note that on Friday Manheim’s mid-month update showed used car growing +4.1% MoM in February which is the highest rate since October 2021. As page 7 of Justin Weidner's US inflation chartbook shows here, there is generally a 2-month lag between this series and the used car component in CPI.

If DB's forecast for core PCE is correct the YoY rate will be sticky at 4.4% and could edge up to 4.5% with the three-month (3.9% vs. 2.9%) and six-month (4.6% vs. 3.7%) annualised growth rates going back up.

Elsewhere in the US we have existing home sales (today) and new home sales (Friday) which may have been positively boosted by a warm January. The Fed minutes on Wednesday might be dated given the array of hawkish data and Fed speak since, but it will be interesting to see if the minutes were as dovish as the market interpreted the overall FOMC at the time.

Aside from the very important global flash PMIs tomorrow, an array of confidence metrics in Europe, including the ZEW and Ifo surveys (tomorrow and Wednesday) for Germany and consumer confidence for Germany and the UK on Friday, are also due.

Major data releases in Asia include the CPI report in Japan on Thursday and our Chief Japan Economist expects core ex. fresh food to come in at 4.2% YoY (vs +4.0% in December) and core-core ex. fresh food and energy to print 3.2% (+3.0%).

In corporate earnings, commodity companies will continue being in the spotlight with results due from key metals companies like BHP (today), Rio Tinto (Wednesday), Anglo American and Newmont (Thursday) and oil & gas players like Pioneer (Wednesday), EOG and Cheniere (Thursday), among others. In utilities, we will hear from Engie (Tuesday), Iberdrola (Wednesday) and PG&E (Thursday).

Amid the blowout retail sales report and upside beat for the CPI this week, all eyes will be on reports and commentary from large US retailers, with over 400 of S&P 500 firms having already released results. Key highlights include Walmart, Home Depot (Tuesday), TJX and eBay (Wednesday).

Finally, we will hear from some of China's most prominent firms when results are due from Baidu (Wednesday) and Alibaba (Thursday). Elsewhere, notable tech reporters include NVIDIA (Wednesday), Intuit, Autodesk and Block (Thursday). In Europe, we will also hear from Deutsche Telekom, Telefonica, Rolls-Royce (Thursday) and BASF (Friday).

Overnight in Asia, Chinese stocks are leading the rally with the CSI 300 (+1.18%), the Shanghai Composite (+0.99%) and the Hang Seng (+0.81%) all up by nearly a percentage point despite headlines about souring diplomatic relations between the US and China and North Korea’s missile test. A US/China meeting (the first since ballongate) in Munich between US Secretary of State Blinken and China's State Councillor Wang Yi doesn't seem to have gone well with little to agree about. Blinken also told US TV yesterday that "we are very concerned that China is considering providing lethal support to Russia in its aggressive against Ukraine".

Elsewhere other key markets in the region, including the Kospi (+0.38%) and the Nikkei (+0.03%), are modestly in the green and US stock futures are flat.

Looking back on last week now and markets have become noticeably more pessimistic on inflation after data releases pointed to better economic growth and continued price pressures. This was affirmed by the hawkish sentiment coming from central bank speakers on Friday. Fed Governor Bowman stated that the recent data releases have been ‘surprising’ and that she has not seen indications hikes are slowing the economy. Separately, Richmond Fed President Barkin was less hawkish favouring a 25bps hike at the March meeting, but he was emphatic that he was “still not ready to declare victory on inflation”.

Looking at the fed funds futures market, +28bps worth of hikes remains priced in for March, whilst the terminal rate priced in for July edged up to 5.282% on Friday, the highest rate for this hiking cycle. That left it up +10bps over the week. This hawkish sentiment was echoed in Europe, where the ECB’s Schnabel hinted at a 50bps increase in May and emphasised the risk markets were underestimating inflation. Against this backdrop, overnight index swaps at one point intraday moved to price in +125bps of rate hikes by the ECB’s September meeting, which would take the terminal deposit rate up to 3.75%. By the close, markets were pricing in +119bps, up +9.5bps over the week (+1bps on Friday).

Equities saw more two-way risk as markets reassessed how high central banks will need to go to regain their grip on inflation. However they held in well considering the moderate volatility. The S&P 500 fell -0.28% on Friday, and over the week the index was down by the same amount. The NASDAQ performed well considering the rates climb, closing up +0.59% on the week (-0.58% on Friday). European equities performed strongly relative to the US, with the STOXX 600 up +1.4% over the week (-0.20% on Friday). France’s CAC 40 was a significant outperformer, up +3.06% last week, its largest up move since the start of 2023 (-0.25% on Friday).

On Friday, US fixed income markets posted modest gains after erasing significant intraday losses. The US 10yr Treasury yield reached its highest level of 2023, up to 3.93%, before falling back over 10bps from the highs and -4.5bps on the day on Friday. In weekly terms, yields were up +8.3bps to 3.815%. The 10yr bund initially retreated with yields climbing +5bps, before falling back to finish down -3.7bps on Friday. However, the weekly move reflected the growing expectation of more rate hikes from the ECB, with 10yr bund yields up +7.6bps.

In commodity markets, oil saw a weekly drop as rising US inventories and prospect of further rates tightening outweighed Chinese energy demand improving. WTI crude fell -4.24% over the week to $76.34/bbl (-2.15% on Friday). European gas futures likewise retreated, down -9.63% over the week to €48.58, their lowest level since August 2021 (-6% on Friday). Finally, gold fell -1.24% on the week at $1839.37x/oz (flattish Friday).

Day-by-day calendar of events

Monday February 20

Tuesday February 21

Wednesday February 22

Thursday February 23

Friday February 24