One month ago, when looking at the latest Chinese credit data, we said that Beijing's credit flood is coming, even if the December data was a disappointment.

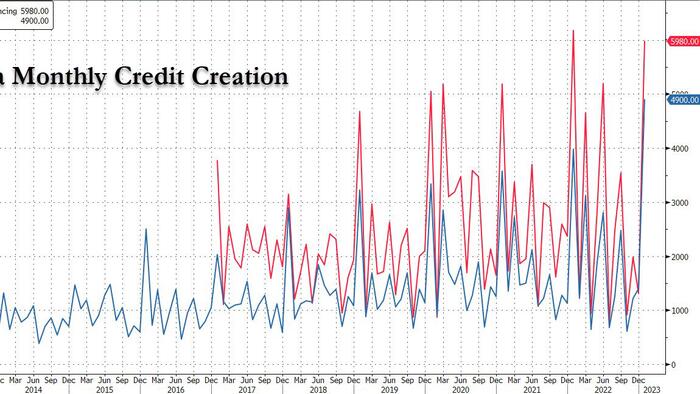

Then two weeks later, we got confirmation that this was indeed coming, when a local news paper said that "China Bank Lending in Jan. May Hit Record at Over 4T Yuan", to which our response was that China had just wasted 3 years in another pointless deleveraging experiment to get back where it started: with massive credit injections as the only means for growth.

Fast forward to today when just as we previewed a month ago, the Chinese Credit Flood arrived with a bang, and a record 4.9 trillion in new loans, which smashed expectations as did the Total Social Financing which came at a near record 6 trillion yuan, or almost $1 trillion in total new credit (i.e., new money) in just one month!

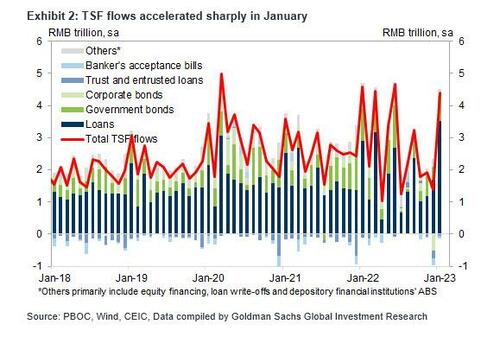

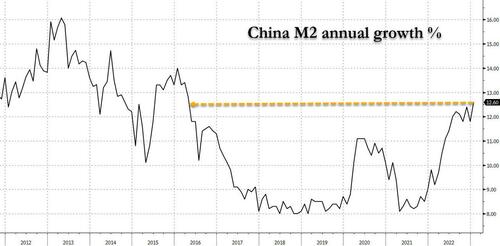

The big picture: Total RMB loans surprised the market to the upside mainly on stronger corporate loans – corporate loan growth accelerated to 23.7% month-over-month annualized in January from 16.9% in December, although short-term corporate loans grew faster than medium to long term loans. Household loan growth slowed in contrast – medium to long term loans to households (mostly mortgages) contracted in January vs December last year amid weak property transactions and early repayment of mortgages. Total social financing and M2 beat expectations as well on the back of stronger loan growth.

The key numbers:

Courtesy of Goldman's Maggie Wei, here are the main points from the report:

Bottom line, the January loan and credit data came red hot as we expected and as China warned, clearly expecting this outcome and hinting that there is much more to come (no surprise that the PBOC released more than 1trillion yuan in new liquidity in just the past three days). The acceleration in bank loans reflected policy support - commercial banks extended more loans to property developers after the "property 16 measures", and policy banks' credit facility targeting at infrastructure investment in recent months likely also added to overall RMB loan growth. At the same time, the sharp upward reversal in TSF growth indicates that Beijing has fully capitulated when it comes to new containing the next credit bubble and is now pursuing it wholeheartedly as it hopes to reverse three years of subdued growth by China's economy during its Zero Covid nightmare.

The question is how soon and how extensively China's massive credit impulse reboot will flood the world. One thing is clear: the burst higher in credit will lead to an even more powerful bounce in Chinese stocks in the near term.

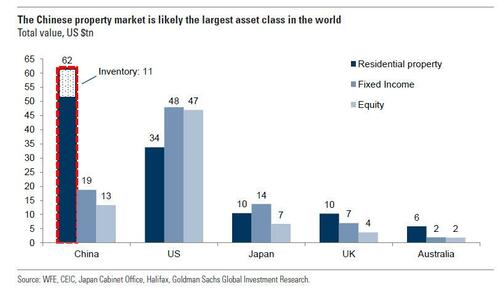

How widely that spreads across the globe remains to be seen and will be a function of how much inflation China manages to export to the world in the next year. This a topic we discussed in "Nikileaks Spooks Markets That Chinese Reopening May Be Inflationary, But Wall Street Disagrees." But what is perhaps most important is that the wobbly foundation of the world's biggest asset bubble - China's property market..

... is about to be reinforced with monetary concrete, as discussed in "In Huge Policy Reversal, China Will Ease "Three Red Lines" Rule To Kickstart World's Biggest Asset Bubble", and not long after expect all global "high beta" asset classes to follow suit.