Authored by Simon White, Bloomberg macro strategist,

Data just released from China show growth is finally gaining traction, with Europe and European stocks set to be the most direct G7 beneficiaries.

We’ve had a flurry of news from the Far East this morning. The Japanese PM has reportedly nominated Kazuo Ueda to be the next BOJ governor from April, in a surprise move. There is already much debate on how hawkish he will be, with market observers scrutinizing the limited runes on his historical record for clues.

There is unavoidable uncertainty here, but there is less doubt in China, where the data shows the country is now unequivocally turning a corner from Covid after several false starts.

China abruptly dropped Zero-Covid restrictions in December, and previous to this announced a raft of measures aimed at stabilizing its depressed property market.

Also, China directed lenders to front-load credit extension to businesses and consumers to expedite the economy’s recovery from the economic scarring from Covid lockdowns. Some banks are even throwing in Dyson hairdryers to encourage consumer borrowing.

But due to the credit system in China, liquidity does not always flow to where it is most needed. The banking system reflexively tends to favor the SOE sector, often leaving the weaker parts of the economy like the household and non-state corporate sector starved of much-needed fiscal assistance.

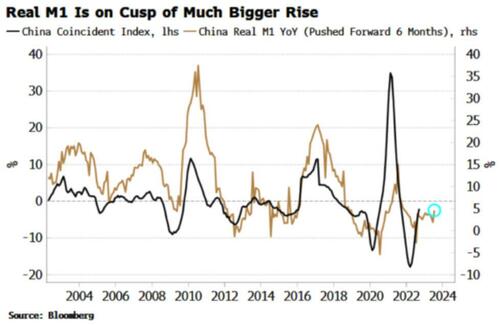

But when broad money growth begins to rise in real terms, this is normally a good sign credit is beginning to flow more freely to all corners of the economy. This is what we are now seeing, with year-on-year M1 growth rising to 6.7% from 3.7% last month, and real M1 now at 4.6%, its highest since late 2021.

January can often see a seasonal bump in money growth, but the rise in M1 was larger than expected, and comes at a time when we know there is a powerful combination of easing – fiscal, monetary and social – waiting in the wings with huge growth potential.

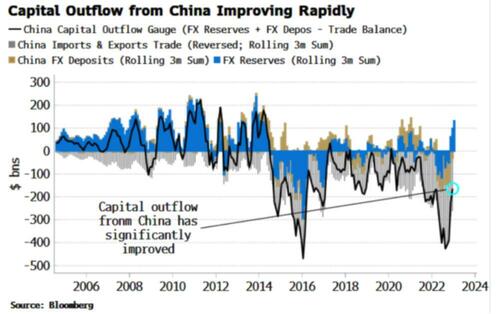

Moreover, capital outflow has decreased markedly from China, which will also significantly improve domestic liquidity conditions.

It has been easy to jump the gun with China, but it looks like it’s back as a global economic driver.

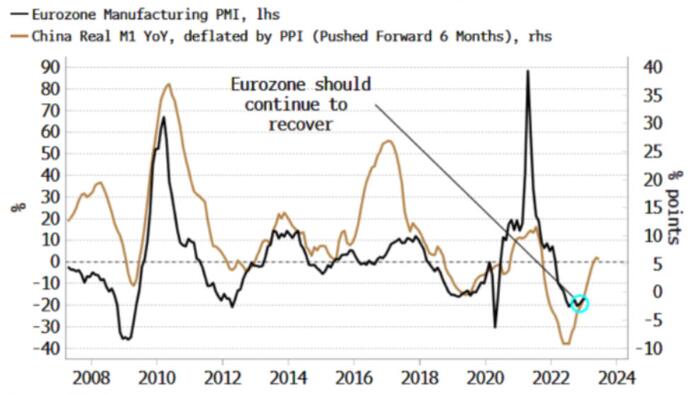

This has implications for global demand and supply, but one of the most direct G7 beneficiaries is likely to be Europe.