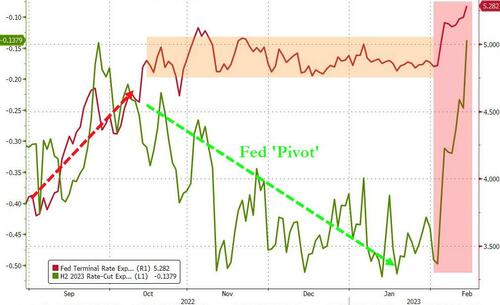

The 'Pivot' narrative is officially dead...

Source: Bloomberg

As hotter than expected Payrolls and and today's CPI sent rate-trajectory expectations soaring with the terminal rate at 5.30% (25bps hike odds: 100% Mar, 85% May, 65% Jun) and only 13bps of rate-cuts now priced in for H2 2023...

Source: Bloomberg

Love was definitely not in the air for markets early today as Goldman noted:

"Risk assets have spent recent weeks in a market friendly environment characterized by improving prospects for an economic soft landing in the US, better growth news in Europe and China, and a Fed that continued to decelerate the pace of tightening. While in-line, the CPI release is a reminder that the move lower in inflation towards the Fed's target may be more gradual than markets may have begun to price in... And this environment may also result in a higher-for-longer rate environment -- somewhat counter to a market that is still pricing in a Fed funds rate cut later this year."

FedSpeak began soon after the CPI print and didn't help...

0935ET Richmond Fed's Barkin Expects Inflation To Have "Lot More Persistence" Than Everyone Wants, Sees Case For Leaving Fed Rates Higher For Longer

1100ET Dallas Fed's Logan Says More Hikes May Be Needed Than Previously Seen

Then at 1300ET Philly Fed's Harker Says 'We Are Not Done Yet', But Fed Moving Closer To Having Rates Restrictive Enough which triggered the algos to panic-buy (we note that stocks rallied on a kneejerk that Fed is "likely close" to done on tightening - even though he clarified the time-frame for 'close' was 'this year' and 'we will hold rates in place')

At around 1400ET, JPMorgan's CFO Jeremy Barnum warned that Q1 invesment banking revenue will be down 20% YoY, with the Q1 central case for markets "a little worse" which took the shine off the Harker bounce.

This was not helped by New York Fed's Williams at 1405ET, Saying "Our Work Is Not Yet Done", Fed Still Has A Ways To Go To Control Inflation Levels; Says Inflation Is Far Too High, Will Take Several Years To Get Inflation Back To 2%.

And tomorrow we have retail sales (which whisper numbers suggest could come in hot) which could break a few more (bullish) hearts.

Consensus around the January retail sales centers on a rise of 2% from -1.1% in the December, according to a Bloomberg survey. Risks may be to the upside after Bank of America’s Brian Moynihan today said consumers remain resilient amid inflation. And the firm’s latest spending data show credit and debit card spending per household rose 5.1% year-over-year in January, versus a 2.2% climb in December.

And then the recession-frontrunning algos engaged. Nasdaq ended near the highs of the day while The Dow lagged with the S&P and Small Caps ending around unch

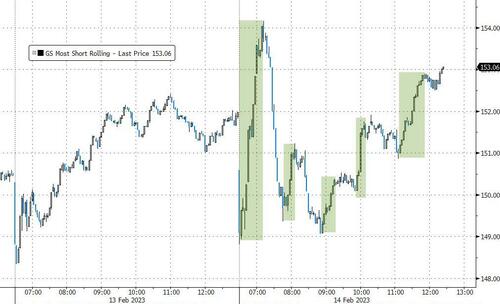

There were 5 efforts to ignite a squeeze today...

Source: Bloomberg

Of course that was all helped by the 0DTE mania and TSLA was a perfect example of that today as it reversed from ugliness after CPI to ending up over 7%...

We wonder if all that delta-squeeze energy was used up today and tanks will be empty for tomorrow's retail sales print.

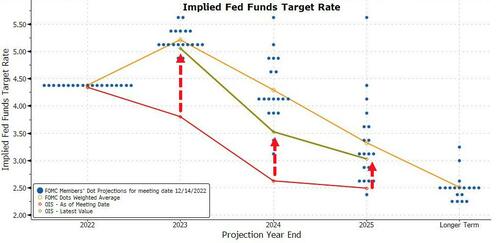

To understand how stocks are soaring as monetary policy expectations surge hawkishly, here's the Tl;dr:

Since the last DOTS (in December), the market has adjusted massively from dramatically more dovish than The Fed to in-line now for the end of 2023. It remains more dovish for the end of 2024 still...

Source: Bloomberg

Treasury yields soared across the curve with the short-end significantly underperforming (2Y +10bps, 30Y +3bps).NOTE the weakness in bonds stalled at the European close...

Source: Bloomberg

Bear in mind that the yield curve (2s10s) is now below -86bps - the most inverted since October 1981...

Source: Bloomberg

The Dollar ended the day practically unchanged after utter chaos around the CPI print and its aftermath...

Source: Bloomberg

Bitcoin surged back above $22,000...

Source: Bloomberg

Gold ended the day marginally higher after bouncing back from some serious intraday volatility...

Oil prices ended lower but WTI was well off its puke lows, after news of SPR releases was confirmed and hawkish CPI raised demand fears...

Finally, the last time stocks (S&P) were this expensive relative to (2Y) bonds was around March 2001...

Source: Bloomberg

And things did not go so well for stocks after that. Maybe, ahead of tomorrow's Retail Sales, there is an alternative after all.