High-stakes trade talks between the U.S. and China consumed a second day in London on Tuesday, leaving Wall Street investors on edge as the World Bank warned of a major economic slowdown from global trade tensions.

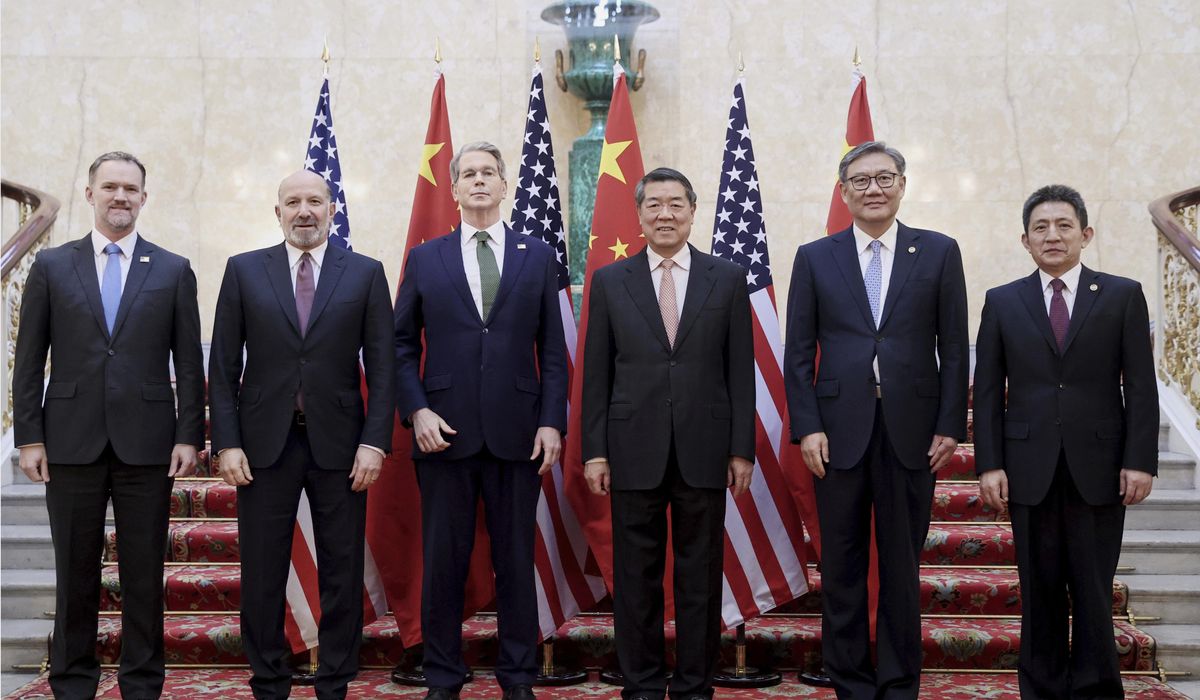

Commerce Secretary Howard Lutnick told reporters that negotiations were “going well” as he led the U.S. delegation alongside Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer.

“Everybody’s got their head down, working closely through it,” Mr. Lutnick told reporters. “If need be, we’ll be here tomorrow.”

China sent Vice Premier He Lifeng to lead its delegation.

Representatives from the world’s largest economies are sitting together in a London mansion to try and resolve trade tensions that began with a tit-for-tat tariff war in April.

The extended length of the negotiations underscores the complexity of the matters in debate, and “should not necessarily be interpreted to mean that the talks are in trouble,” said Wendy Cutler, a vice president at the Asia Society Policy Institute, a think tank in Washington.

“Negotiations take time and ironing out details is critical if any deal emerging from London is to stick,” she said.

In particular, the U.S. wants Beijing to commit to exports of rare earth minerals that automakers and military contractors need for their products. One of the minerals, samarium, is used in heat-resistant magnets that are critical components of missiles and fighter jets.

China, meanwhile, wants the U.S. to drop high tariffs on their goods, and export limits on semiconductors and high-tech technology to their companies.

“I expect that the two sides will strike a deal whereby Beijing expedites shipments for critical minerals and magnets to the U.S. in return for the U.S. relaxing certain high-tech export controls imposed in recent weeks,” Ms. Cutler said. “If indeed the U.S. agrees to move on export controls, this would be unprecedented as these matters have traditionally been off the table in trade talks.”

Wall Street stocks rose for a third day in a row as traders hoped for good news out of the talks.

Tariffs are taxes or duties paid by importers on the goods they bring in from foreign markets.

The World Bank said Tuesday that trade turbulence will be a drag on global economies. It projected that global growth would weaken to 2.3% in 2025 instead of its earlier prediction of 2.7%.

“This would mark the slowest rate of global growth since 2008, aside from outright global recessions,” the international finance institution said in its Global Economic Prospects report.

The U.S. economy would grow 1.4% in 2025, it projected — only half the 2.8% rate achieved in 2024.

“The world economy today is once more running into turbulence,” the report said. “Without a swift course correction, the harm to living standards could be deep.”

Mr. Trump unveiled a suite of tariffs against dozens of countries in early April, saying allies and foes alike took advantage of the U.S. market but didn’t reciprocate by letting in American products.

Unlike other countries that came to the negotiating table, China retaliated against Mr. Trump’s “Liberation Day” tariffs by imposing hefty levies on U.S. goods in April, sparking a trade war.

A de-escalation meeting in May knocked down sky-high tariffs from both sides. The U.S. is charging a 30% tariff on Chinese goods, and China is putting a 10% tariff on American goods that cross its borders.

• Tom Howell Jr. can be reached at thowell@washingtontimes.com.