LONDON, United Kingdom — Oil prices tumbled on Thursday after US President Donald Trump said the United States was close to making a deal on Iran’s nuclear program, which could pave the way for increased crude supplies.

The dollar continued to face pressure amid uncertainty over tariffs, while equity markets were largely lower.

“Traders focused on the prospect of a US-Iran nuclear deal, which could see economic sanctions lifted on the latter and potentially lead to greater supplies of oil,” noted Russ Mould, investment director at AJ Bell.

Trump’s remarks came after Iran held its fourth round of talks with the US administration, which has said it wishes to avoid a threatened military strike on Tehran’s contested nuclear program.

Both main crude contracts plunged more than three percent in value on hopes that US sanctions on Iran might be lifted as part of the deal.

That could, in turn, increase the Islamic Republic’s oil exports.

In European equities trading, London’s stock market edged up as official data showed Britain’s economy grew more than expected in the first quarter — before UK business tax hikes and US tariffs took effect.

Wall Street’s three main indices opened lower following a warning by Walmart of price hikes due to US tariffs that dampened sentiment, with the Dow shedding 0.4 percent.

Shares in Walmart slumped 4.7% after the company reported first-quarter revenue growth of 2.5%, which narrowly missed analyst expectations.

Profits came in at $4.5 billion, down 12.1% from the year-ago level but topping analyst expectations.

However, Walmart’s CEO warned of higher prices due to tariffs, welcoming a de-escalation of Trump’s trade war with China but saying the levies remain too high for the retailer to absorb.

“We will do our best to keep our prices as low as possible, but given the magnitude of the tariffs, even at the reduced levels, we aren’t able to absorb all the pressure,” Chief Executive Doug McMillon told investors.

Meanwhile, investors awaited fresh developments in trade talks, with countries looking to reach deals to avoid Trump’s tariff blitz.

With excitement from the China-US detente fading, markets are seeking new catalysts.

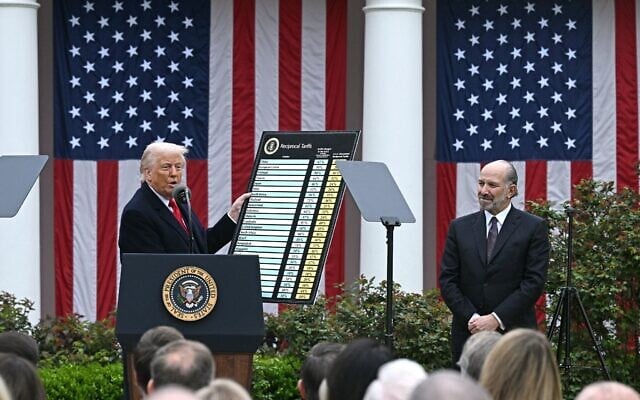

Stock markets have surged past the levels seen before Trump’s April 2 “Liberation Day” bombshell that hit countries worldwide with US tariffs.

After figures on Tuesday showed US inflation came in a little below forecasts in April, wholesale price data released on Thursday showed they unexpectedly fell 0.5% in April due largely to a sharp drop in services costs.

Briefing.com analyst Patrick O’Hare said the data showed a sharp drop in wholesale machinery and vehicle sales.

“That suggests wholesalers were likely absorbing some tariff impacts, which is good for the end customer but not necessarily for earnings,” he said.

April retail sales data, also released Thursday, came in nearly flat.

The 0.1% gain was significantly down from March’s revised growth of 1.7%, as buyers earlier sought to get ahead of Trump’s sweeping new tariffs, many of which took effect in April.

However, analysts have pointed out that the real impact of tariffs would not be seen until May’s figures are released and warned that there were still plenty of bumps in the road ahead.