Pattern Repeats - Imported Durable Goods Creating Deflation on U.S Consumer Prices - The Last Refuge

The Term-1 effect of deflation created by tariff policy is resurfacing in Term-2 even with larger tariff impacts across the network of global manufacturing exports. [DATA SOURCE]

In essence, there is little to no end result in price increases in the final price of consumer goods (Consumer Price Index). In fact, there is a slight deflationary aspect on CPI data from imported durable goods. The lower price of arriving imported durable goods is effectively putting downward pressure on US consumer prices. This is identical to the Term-1 result. A pattern is repeating. [PCE personal consumption expenditure / CPI consumer price index]

[Source – WH Council of Economic Advisors]

It sounds counterintuitive, but tariffs do not impact the final price of goods to USA consumers; there are just too many factors, too many elements within the Total Cost of Goods (TCG) within supply chain. Global energy prices, domestic energy prices, currency evaluations and fluctuations, state/govt subsidies to manufacturers, labor negotiations and production profit offsets are only a few of the components.

Additionally, and this is where U.S. consumers do not get a fulsome explanation from corporate media analysts, the tariff rate is applied to the ‘cost’ the exporter pays, not the final consumer price. A pair of jeans from China may be sold to the import company for $5 per pair. A 30% tariff raises the price of the jeans by $1.50 to $6.50. The tariff rate does not apply to the retail price of $50 paid by the consumer.

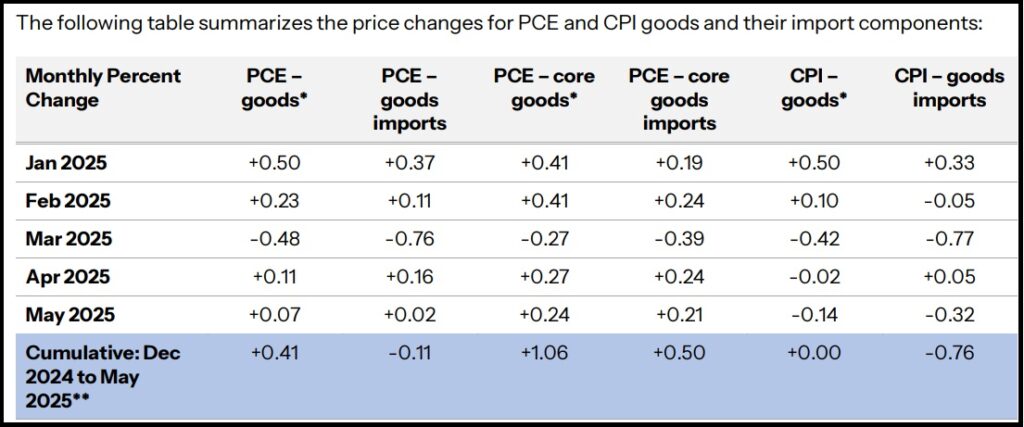

CEA ANALYSIS – The Council of Economic Advisers (CEA), after decomposing the Personal Consumption Expenditure Price Index into imported and domestic components, found that the prices of imported goods have not only fallen this year, but also declined faster than overall goods prices since February. These findings contradict claims that tariffs or tariff-fears would lead to an acceleration of inflation.

More commonly referred to as PCE or PCEPI, the Personal Consumption Expenditure Price Index is an inflation gauge watched closely by policymakers and financial markets. Overall goods prices in the PCE index have increased by 0.4 percent from December 2024 through May 2025, which corresponds to a 1 percent annualized rate.

Meanwhile, the imported component of PCE goods prices fell by 0.1 percent from December 2024 through May 2025. CEA’s directional findings using this method of analyzing the PCE are consistent across core goods (excluding food and energy), durables (which last for at least three years), and nondurables. The import contribution to inflation includes both the direct impact of imported final goods for consumption and indirect effects of imported intermediate inputs.

Similar analysis for the widely used Consumer Price Index (CPI) shows that imported goods have deflated 0.8 percent while overall goods prices have remained constant. There are a number of differences between PCE and CPI inflation, including scope of products included and weighting methodologies, so finding a similar pattern for CPI highlights the robustness of the results. (read more, pdf)