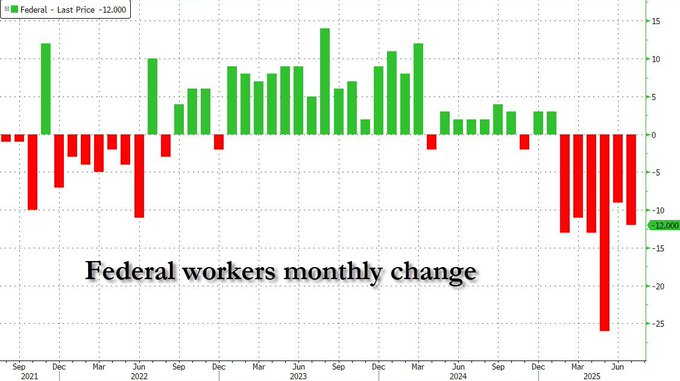

The Washington Post is very concerned about the economic datapoints coming from the DC area. Including: “the Trump administration’s overhaul of the federal workforce, including the elimination of thousands of federal jobs, is being acutely felt in a national capital region.”

The Washington Post is very concerned about the economic datapoints coming from the DC area. Including: “the Trump administration’s overhaul of the federal workforce, including the elimination of thousands of federal jobs, is being acutely felt in a national capital region.”

WaPo – In May, D.C.’s unemployment rate was 5.9 percent — the highest in more than three years. The number of federal workers turning to unemployment insurance is climbing steadily, with claims rising 64 percent between February and June — from 1,064 to 1,747. That surge is starting to show up in the city’s bottom line: In June alone, D.C. paid out more than $2.5 million in federal civilian jobless benefits, a sharp jump from earlier in the spring.

Maryland saw a similar spike, with payments nearly doubling since April. In Virginia’s Fairfax County, unemployment has reached levels not seen since mid-2021.

LAYOFFS – Layoffs tracked through Worker Adjustment and Retraining Notification Act notices are rapidly climbing. The federal WARN Act requires large employers to give advance notice before mass layoffs, offering an early signal of job market stress. So far this year, the D.C. region has recorded more WARN-notice layoffs than in any year outside the pandemic, with nearly 10,000 workers cut as of July — more than the total of the last two years combined. While the data mostly reflects private-sector job losses, it underscores how quickly layoffs are accelerating.

SPENDING – Consumer spending in D.C. is also starting to slip. Washingtonians are cutting back on things like dining out, clothing, and beauty products — and they’re doing so more sharply than people in other big cities. In June, spending at full-service restaurants was down 9 percent compared with the prior year, a steeper drop than in places like Atlanta, Boston and Miami. The same pattern shows up in categories like apparel and entertainment, pointing to a local slowdown even as spending elsewhere holds steadier.

TAX BASE – The D.C. Office of Revenue Analysis is forecasting a rare population dip in 2027 — a 0.2 percent decline — along with shrinking tax collections. In June, the city revised its tax revenue outlook for 2026 from one of growth to decline. The city expects only modest growth in 2027, with property and business taxes still lagging.

HOUSING – Predictably, with uncertainty looming, the real estate picture is starting to shift. “We still have a shortage, meaning there is more demand for housing than supply,” Lee said. “And with that, the prices go up.”

But inventory is climbing, a sign that fewer buyers are competing for homes. At the same time, new apartment construction is tapping the brakes — about 8,000 units went up in the first quarter of 2025, well below the usual 12,000 to 16,000 seen in recent quarters. (more)