I do not like this Canadian Prime Minister even a little bit; however, Mark Carney getting elected to run Canada would be the greatest benefit to MAGAnomics in the United States. The insufferable doofus is completely enthralled with the views, perspectives and ideologies of globalism.

Prime Minister Carney’s “conservative” opponent, Pierre Marcel Poilievre, is a softer, gentler, and more effeminate version of former U.S. Presidential candidate Mitt Romney: he growls through his cashmere. In short, Canada is screwed.

All of that said, the normal thinking Canadians need to get through a Romney to get to a Trump; so, perhaps it’s better if Canada just increases the speed of the downward economic slope by installing Carney.

Somewhere around 80% of Canadians have no concept of how their economy is functioning {GO DEEP}. Most Canadians seem to think they have some form of capitalistic system in operation and tweeking the knobs will fix things; it won’t.

So, from an American political perspective, having Mark Carney carry out his policies and watching the system therein collapse, might break the borg-mindset. It will be massively painful for Canadians when their currency hits around 0.25¢ to the US dollar. However, that currency collapse will ¹more than eliminate any Trump tariff impact.

Prime Minister Carney outlined yesterday how he will increase the industrial carbon tax in order to align with U.K and EU trade partners on the issue of climate change. Taxing carbon, he says, is the key to unlocking excellent trade agreements with other ‘global trade partners’ who can then fill the void created by disconnecting Canada from the USA economy.

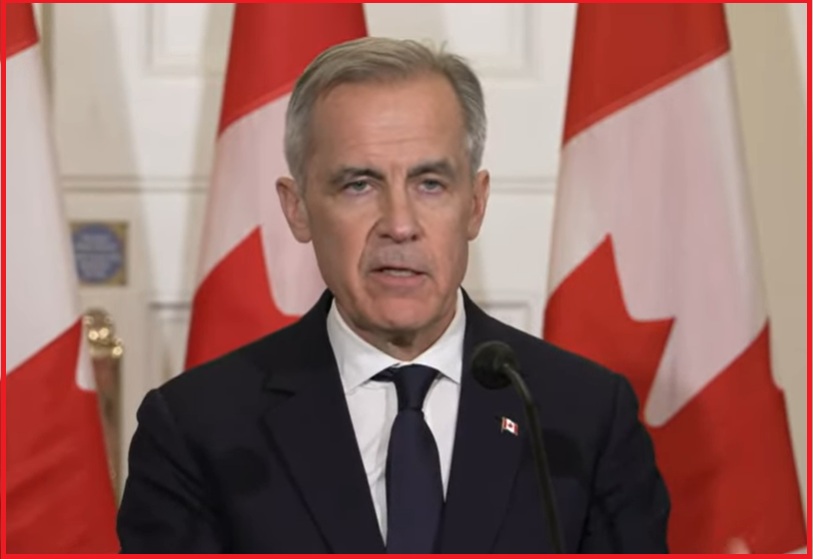

No, really, he said that. Carney believes it with all his heart. These economic comments come on the heels of Mark Carney telling French President Emmanuel Macron –in public– that Canada was the most European of countries outside the EU. WATCH THIS (prompted):

¹Here’s how it will happen. CAD = Canadian Dollar, USD = U.S Dollar

President Trump hits Canada with an approximately 50% tariff. Let’s say an import widget from Canada costs the purchaser/importer $100 CAD + 50% tariff, now $150 CAD.

$1 CAD = 0.70¢ USD

Without U.S. tariff, it costs $70 USD to purchase the $100 CAD widget.

With the U.S tariff it would take $105 USD to purchase $150 Canadian widget

However, due to economic policy, Canada’s dependence on the USA market and the tariff battle, the Canadian currency drops around 30%. $1 CAD now equals 0.50¢ USD

With currency drop it now costs $50 USD to purchase the original $100 Canadian widget. $75 USD with tariff.

BEFORE: $70 USD without U.S. tariff, or AFTER: $75 USD with 50% U.S. tariff. A net change of $5.

But wait, back to Mark Carney’s plan. As stated in his tariff policy, the prime minister will take income from the Canadian side of the tariff equation (countervailing duties) to subsidize the impacted export sector. Just like China and the EU did in ’17, ’18 and ’19, the Canadian government plans to offset the difference to the U.S. consumer by subsidizing the exporter with import tariff income. All of this is done to retain access to USA consumers.

The final outcome, the U.S. purchaser is back to the original price of $70, only now that same outcome is evident with an invisible $50 tariff.

This is what China tried to do. This is what the EU tried to do. This is what Canada is now planning to do to retain access to the U.S. market while they look for alternatives.

But wait, it gets better….

….. As the Canadian financial sector evaluates the likely drop in the CAD currency, they seek safe harbor investment to retain the value of their money. The reciprocal tariffs are hitting every currency. The Canadian finance sector purchases dollar and dollar-backed assets to retain their value. This approach increases the value of the U.S dollar.

In the final irony of this entire situation, the G7 is again scheduled to be held in Canada.

The picture below is from the last time the G7 was held in Canada.

History rhymes and a loving God creates the natural balance of things.