President Donald Trump is confronting the dragon behind the panda mask with precision. It’s very obvious the prior reconnaissance, trade probes and tariff tests of ’17, ’18, ’19, are paying dividends.

President Trump has cut off the transnational shipping lanes by globalizing the tariffs against China. Beijing is in a forced holding pattern waiting to see the outcome of Southeast Asia and European trade agreements.

President Trump has cut off the transnational shipping lanes by globalizing the tariffs against China. Beijing is in a forced holding pattern waiting to see the outcome of Southeast Asia and European trade agreements.

Having spent some serious time in the field in advance of ‘Liberty Day’ all of my contacts have the same message; China is trying to find position.

In a little reported reality, in order to offset the problem, many Chinese manufacturers have actually continued the production of several branded product lines (very well-known and established brands) despite the absence of orders for the finished goods from the companies.

Several shipments of those finished goods have started to arrive at China-partnered ports. This is very interesting, because it may lead to market dumping of a higher quality product than most anticipate.

Within the apparel sector, ASEAN consumers cannot afford the fashion branded product at the prices determined by the actual brand owners. However, there is now a strong likelihood -based on what is being reported by the receivers- that the product itself will be marketed -likely dumped- without the brand label. This is actually high-quality apparel distributed for a fraction of the price of the brand.

I’ll be getting more details on this soon, however, it looks like the broad outlines are verified by multiple sources. I’ll use some fake names to explain.

China is sending finished “branded” goods to the Philippines, without labeling. The receiving company awaits instructions.

Ex. “Lululemon” products arrive finished, but missing labels – the product is identical, but the IP is now stripped. The product, a summer or fall lineup, is then rebranded “Opal” apparel (fake name example) made in Philippines, packaged in a similar high-end fashion and shipped to USA where a new -mostly online- branded and marketed store sells the items. The marketing is done through a massive purchase of digital ad space on social media, with big incentives for fashion influencers.

The current holding point (screwing up the works for Beijing) is the unknown future U.S. tariff rate against Philippines; but the manufacturing and subsequent inventory buildup is happening. I am told this same process is happening in small durable goods, albeit at a slower pace.

The Chinese delegation currently running through Europe, is prepositioning for a sector-by-sector severely discounted manufacturing operation.

The Chinese delegation currently running through Europe, is prepositioning for a sector-by-sector severely discounted manufacturing operation.

The goal is to secure purchase contracts at prices that simply cannot be ignored given the scale of the increase in profit margin being offered. This is not a black-market operation per se’, this is a dark market strategic play with massive financial incentives for aligning.

Meanwhile, Treasury Secretary Scott Bessent and U.S. Trade Representative (USTR) Jamieson Greer have begun meetings in Geneva with a Chinese delegation led by Vice Premier He Lifeng. A motorcade of black cars and vans was seen coming and going from the home of the Swiss ambassador to the United Nations.

Talks between the U.S. and China are being moderated/facilitated by the Swiss (think finance sector motive) and taking place in the 18th-century “Villa Saladin” overlooking Lake Geneva. The optics of the discussion are grand; the estate was given to the Swiss in 1973.

Playing the role of Panda, Mrs Sun Yun, director of the China program at the Stimson Center, said it is the first time Lifeng and Bessent have talked. However, given the position of President Trump comfortably willing to wait-out the dragon thrashing, panda Sun doubts the Geneva meeting will produce any substantive results.

BEIJING (Reuters) -China’s factory-gate prices posted the steepest drop in six months in April while consumer prices fell for a third month, underlining the need for more stimulus as policymakers grapple with the economic toll from a trade war with the United States.

A prolonged housing market downturn, high household debt and job insecurity have hampered investment and consumer spending, keeping deflationary pressures alive. Now, the economy is also facing increasing external risks from trade barriers.

[…] “Even if China and the U.S. can make progress and cut tariffs in trade negotiations, tariffs are unlikely to go back to the level before April,” Zhang added. “More proactive fiscal policy is necessary to boost domestic demand and address the deflation problem.”

[…] The Chinese government is implementing a wide range of measures to stimulate consumption across different sectors and last week announced a raft of stimulus measures, including interest rate cuts and a major injection of liquidity.

As the trade war between the world’s two largest economies weighs on exports, China’s retail giants, including JD.com and Alibaba-owned Freshippo, have initiated measures to help exporters pivot to the domestic market. That could further depress prices as business and consumer confidence remain subdued due to the uncertain outlook. (read more)

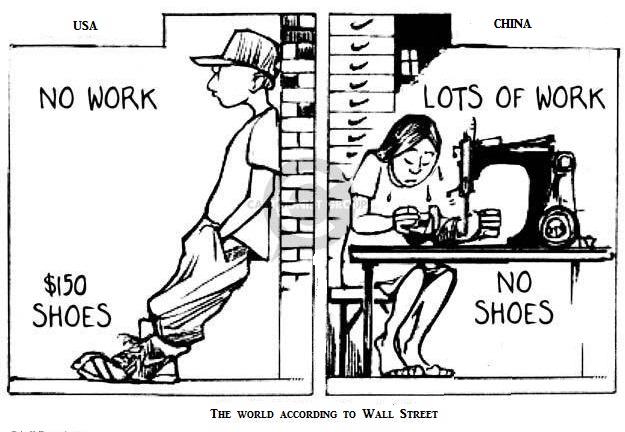

Beijing does have a consumption base within China; however, that consumption is dependent on income. If the Chinese factory workers are not working, they do not have income to spend; the proverbial catch-22. Hence, the continued manufacturing, shipping and inventory buildup being described as arriving in ASEAN nations (Vietnam, Philippines, Malaysia, Cambodia, Thailand, etc.).

I suspect we are about to witness the largest global dumping operation in the history of consumer goods.