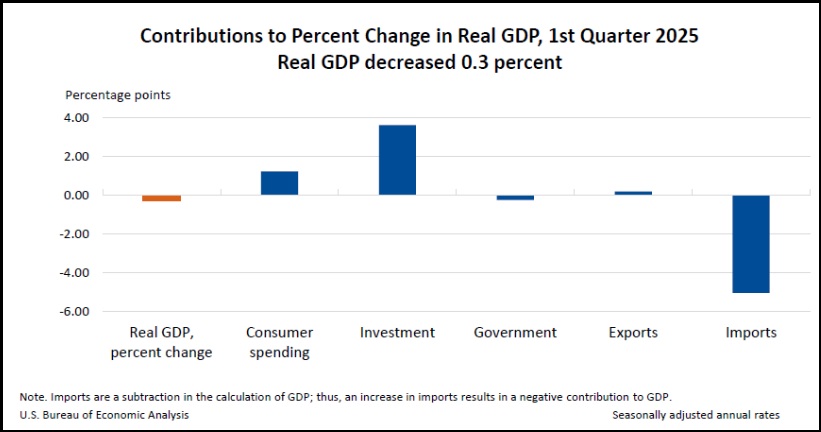

The absolute key to the first quarter GDP result is to remember that ‘imports‘ are a deduction in the economic equation of Gross Domestic Product. The GDP is the valuation of all goods and services produced in the USA minus the value of imports.

The Bureau of Economic Analysis (BEA) releases the results of the first quarter GDP. The overall economic growth seems low at 0.3% until you look at how U.S. companies responded in February and March to the tariff announcement.

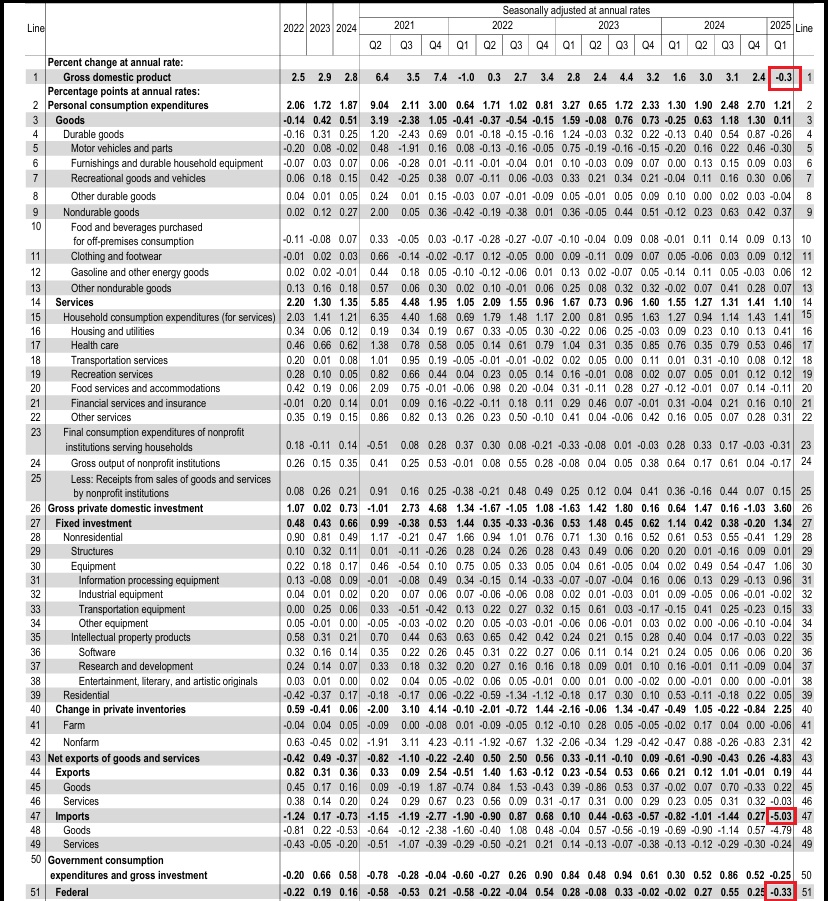

Companies proactively purchased massive amounts of products in advance of the tariffs leading to an overall increase in imports of 41.3%. Which results in a 5.3% deduction to GDP. Every dollar of those imports is a deduction to the GDP equation, giving the false appearance of lower domestic production.

There was a massive surge in import goods purchases of 50.9% versus the prior period [Table 1, line 20]. That’s the largest periodic increase in import purchases I have ever seen. Simultaneously, fixed asset investment in equipment for domestic production surged 22.5% [Table 1, line 11].

Put both of these metrics together and what you see are U.S. companies building consumer inventory from overseas (imports) while simultaneously preparing themselves to shift production into the USA. The massive import purchases are a bridge to cover the time needed to shift the manufacturing from overseas to the USA. This is exactly what we want to see.

To give more detail to the economic shift, we turn to Table 2 and look at the contribution impact to the GDP equation.

Here we can see that imports surged and led to a 5.03% deduction to the GDP equation. Meaning if all things were equal without the Q1 surge in import purchases the GDP would have been +5.06%.

Meanwhile the impact of federal spending decreased 0.33% as President Trump makes the federal government smaller, and federal spending contribution less. The federal government is getting smaller as a percentage of GDP. Again, a very positive sign.

Investment in the USA is high. MAGA working.

Imports are temporarily high, as companies prepare to purchase less from overseas. MAGA working.

Following the increase in U.S. investment and following the increase in equipment purchasing; we will see an increase in jobs as a result of hiring Americans to use the equipment and create the products. If the workforce tightens up (illegal alien deportation continues) and unemployment lessens, then pressure is created on wage rates as companies compete for workers. Main Street starts winning again.

Attach welfare support to employment efforts and the dependency model shrinks.

This is very good news all around.