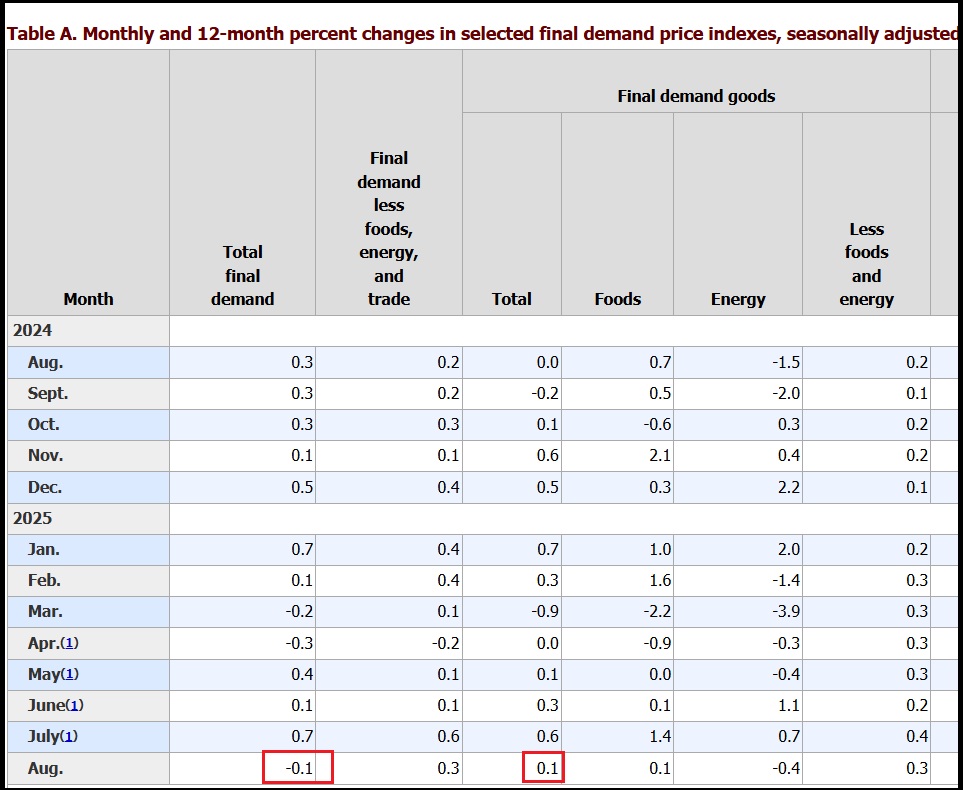

The financial punditry are verklempt, puzzled and perplexed as the wholesale inflation rate calculated by the Bureau of Labor and Statistics Producer Price Index [DATA HERE] shows a drop in PPI of -0.1% for August.

Despite the pundits claiming the Trump tariffs were going to drive up prices, the data shows the manufacturers of products are absorbing the majority of the tariff costs, the importers are absorbing the remnants and the consumer prices are not reflecting the tariff. Go figure!

Exactly as expected, the wholesale price of tariffs are being offset by production cost reductions by the export dependent manufacturing companies overseas. This is exactly what took place in the first term, and the situation is duplicating even with higher tariff rates.

Export dependent nations are squeezing their own productivity, their governments are subsidizing the critical industries and the tariffs are being absorbed before they even leave the docks. This is the USA “rust belt” in reverse. The same scenario played out in the USA for decades as domestic manufacturers tried to retain U.S. industry. Now the foreign countries are experiencing their own economic squeeze.

(NEW YORK) – Wholesale prices unexpectedly fell in August as businesses ate the bulk of Trump’s tariff costs, teeing up the Federal Reserve to slash interest rates next week.

The Producer Price Index, which measures final demand goods and services prices, declined 0.1% in August from the month before – significantly below estimates of a 0.3% rise, the Bureau of Labor Statistics said Wednesday.

Excluding volatile food and energy prices, core PPI also fell 0.1% in August from the previous month. The core figure is up 2.8% on a yearly basis.

Easing from a heated 0.7% pace in July, the calmer wholesale reading signaled that companies have been absorbing the tariffs in an effort to hold onto wary customers. (more)

CNBC even stumbled upon what created the “rust belt” in the U.S. WATCH:

At a 55% tariff rate against Chinese finished-goods imports, there will be ZERO inflationary pressure to the U.S. consumer.

None. Zero. Zippo. Zilch.

First, the producing economies who are dependent on exports will fight to retain their manufacturing capacity by increasing productivity and subsidizing their industry. The production costs will be lowered at the point of manufacturing.

Second, tariffs are paid by the importer based on the wholesale price of the product as delivered by the exporting country depending on the exporters’ tariff rate.

Tariffs are NOT LEVIED/PAID based on the retail price of the product as sold to the consumer.

Example: A pair of Denim Jeans made in China for Guess Brand. The Chinese manufacturer sells the jeans to Guess Brand for $10 a pair manufactured. Guess sells the jeans at retail in the USA for $100 (a $90 gross profit).

A 50% tariff on China means the jeans cost Guess Brand $15 instead of $10 (an $85 gross profit). A 50% tariff on Guess brand jeans, that retail for $100, changes the cost to the retail brand by $5.

Multinational corporations who have off shored their production and manufacturing to China are the ones screaming about tariffs. Ultimately in the final analysis, President Trump is exposing corporatism, multinational corporate vultures; he is not necessarily just exposing China.

In the example above the company makes $85 gross profit as opposed to $90 gross profit on the pair of jeans if they do not raise the retail price.

They don’t raise the price because their profit margins are already ridiculous, and that’s why consumer prices do not go up. A 50% direct tariff on Chinese goods only marginally hits the multinational corporation.

American consumers need to understand this dynamic better.