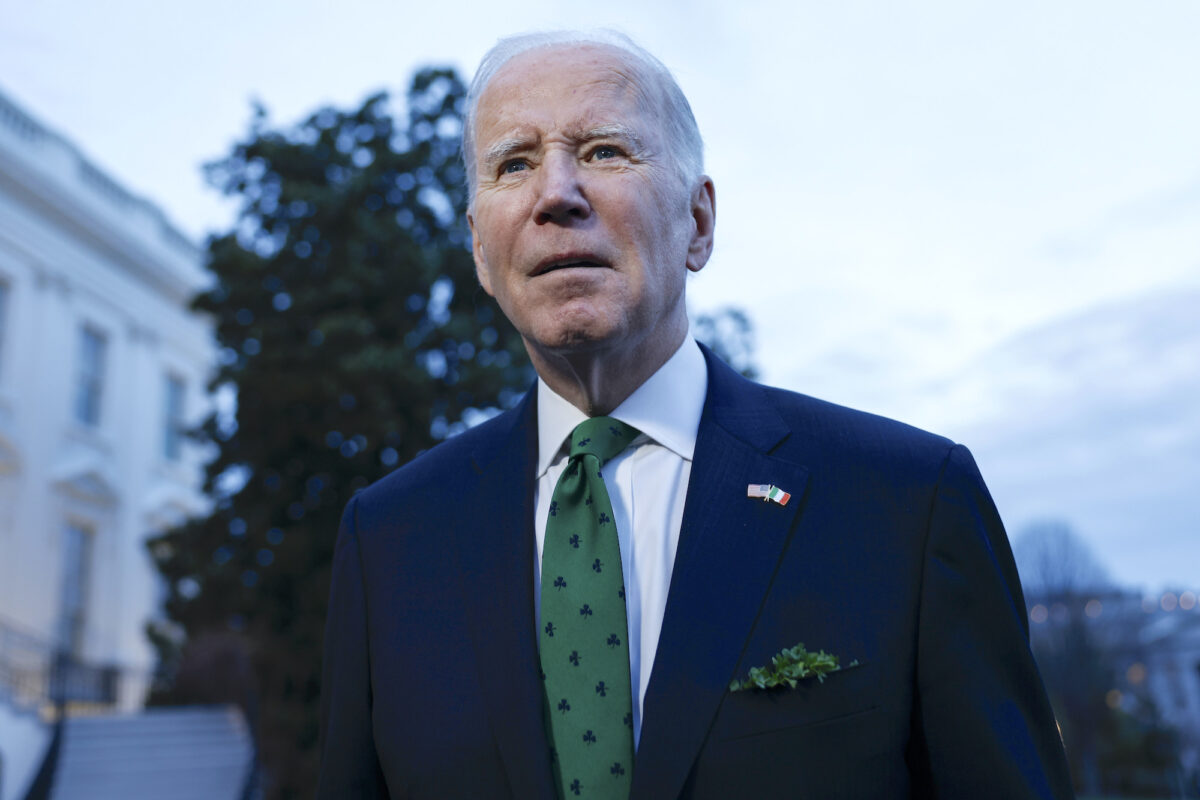

President Joe Biden is urging federal banking agencies to consider a series of reforms that would “reduce the risk of a future banking crisis” and refrain from penalizing community banks, says a White House official.

Speaking in a call with reporters on Thursday, the administration official confirmed that the president is recommending reinstating rules and regulations that were rolled back under former President Donald Trump for banks with assets between $50 billion and $100 billion.

This includes enhancing capital and liquidity standards, conducting supervised annual stress tests, mandating living wills or resolution plans (the company’s process of liquidation under U.S. bankruptcy code), and expanding long-term debt requirements.

“The president is urging the federal banking agencies to take steps to once again ensure strong oversight and supervision that includes strengthening supervisory tools, including stress testing, to make sure that banks can withstand high interest rates and other stresses and also reducing transition periods,” the White House official stated.

In addition, Biden is requesting the Federal Deposit Insurance Corporation (FDIC) to make certain that the costs associated with refilling the Deposit Insurance Fund (DIF) amid the Silicon Valley Bank (SVB) and Signature Bank failures will not be borne by community banks.

Appearing before the Senate Banking, Housing, and Urban Affairs Committee this week, FDIC Chair Martin Gruenberg confirmed that resolving SVB and Signature would cost the DIF $22.5 billion. Gruenberg revealed in his testimony that the FDIC would propose a special assessment on banks in May to repay the DIF following the uninsured deposit coverage.

Administration officials acknowledged that “things have stabilized considerably” since President Biden’s March 13 news conference. But while banking conditions have improved, these proposals are “really about making sure that we are protecting the resilience and stability of the banking system going forward,” the White House official noted.

“We are not in that crisis link situation that we faced a few weeks ago,” adding that “these changes … are common sense, straightforward changes.”

In the aftermath of the SVB and Signature failures, lawmakers have been trying to find the culprit behind these collapses.

Republicans say that the Federal Reserve and federal regulators “fell asleep at the wheel” despite spotting distress indicators at SVB as early as 2021. Barr purported that the banking system was robust and regulations were appropriate, but the bank managers ignored the warning signs. The White House blamed the previous administration for its lack of aggressive focus and tone.

Officials, including Fed Chair Jerome Powell and Fed Vice Chair for Supervision Michael Barr, have agreed with calls to strengthen rules in the banking system. Barr will also lead a review of what happened at Silicon Valley Bank and Signature and learn more about bank runs, uninsured deposits, business concentration, and social media’s influence on the financial system.

Democrats contend that Trump’s signing of the Economic Growth, Regulatory Relief, and Consumer Protection Act contributed to these failures. The legislation raised the minimum threshold for national banks to conduct stress tests to $250 billion and reduced the frequency. However, critics assert that SVB would have passed stress tests since they assessed how the company could handle falling GDP, rising unemployment, and tighter credit conditions.

“It’s like somebody going in for a test for COVID and getting a test for cholera,” said Sen. John Kennedy (R-La.) during the Senate committee hearing.

The White House official believes it is “less important” if SVB or Signature would have met individual liquidity, stress testing, and capital standards.

“The question is, by testing each of these different metrics by putting in place all of these different requirements, are we going to reduce the risk of the kind of bank failure that we’ve seen? And I think independent experts would say unequivocally yes.”

Speaking at the Future Investment Initiative Institute’s Priority summit in Florida on Thursday, former Treasury Secretary Steven Mnuchin said there should be a bipartisan push to bolster the FDIC insurance limit to $10 million or $25 million, “something that’s legitimate that small businesses that have operating accounts can have their money safe, people can have their money safe.”