Commentary

Consumer Price Index (CPI) day has been the same for most of the last 12 months. Data comes in and it’s not good. The mainstream media, however, immediately broadcasts the Biden administration spin that inflation is easing so stop worrying about it.

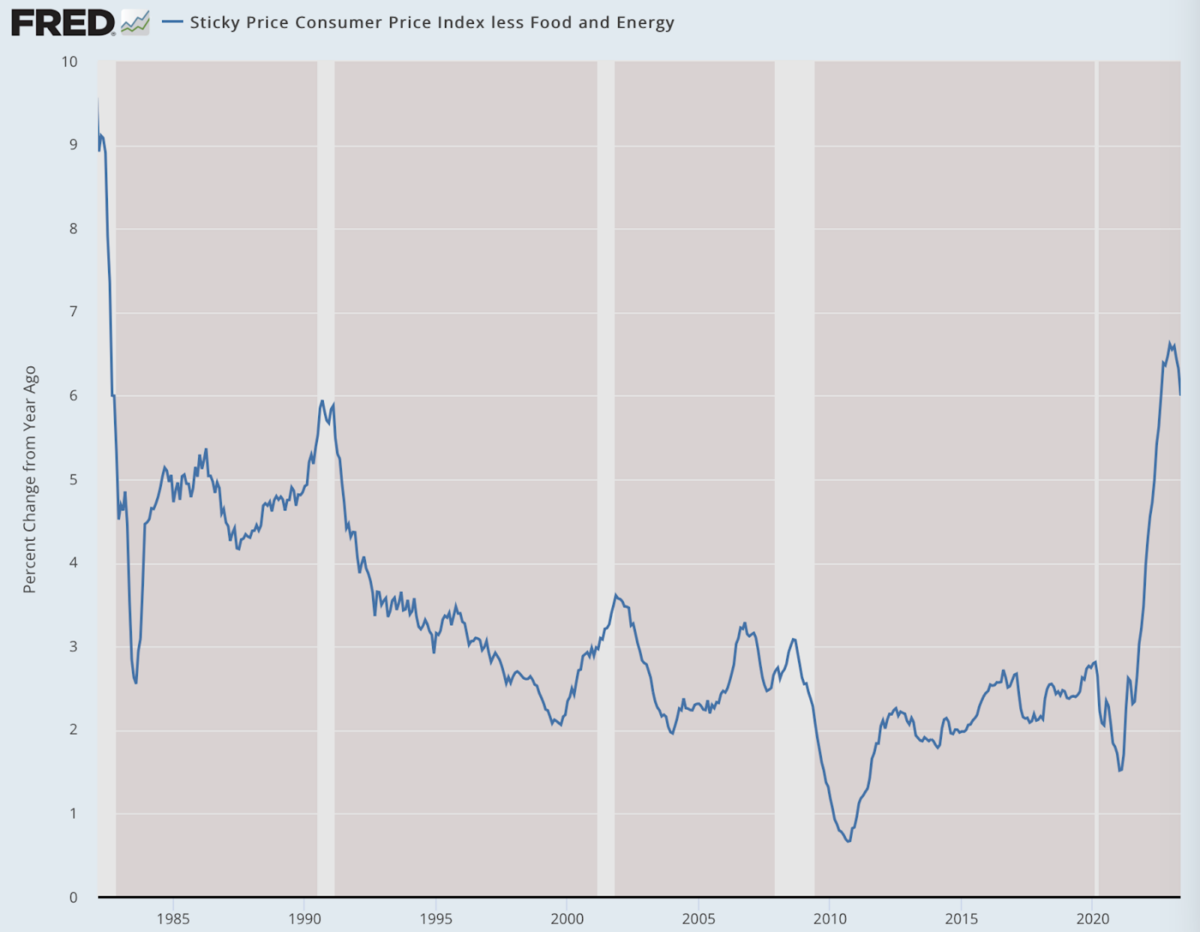

Today, the report is elevated beyond expectations: 0.2 percent for the month and 3 percent over twelve months. That’s 50 percent over the Fed target, meaning that this war is not won. But all immediate top stories announced that inflation is going away.

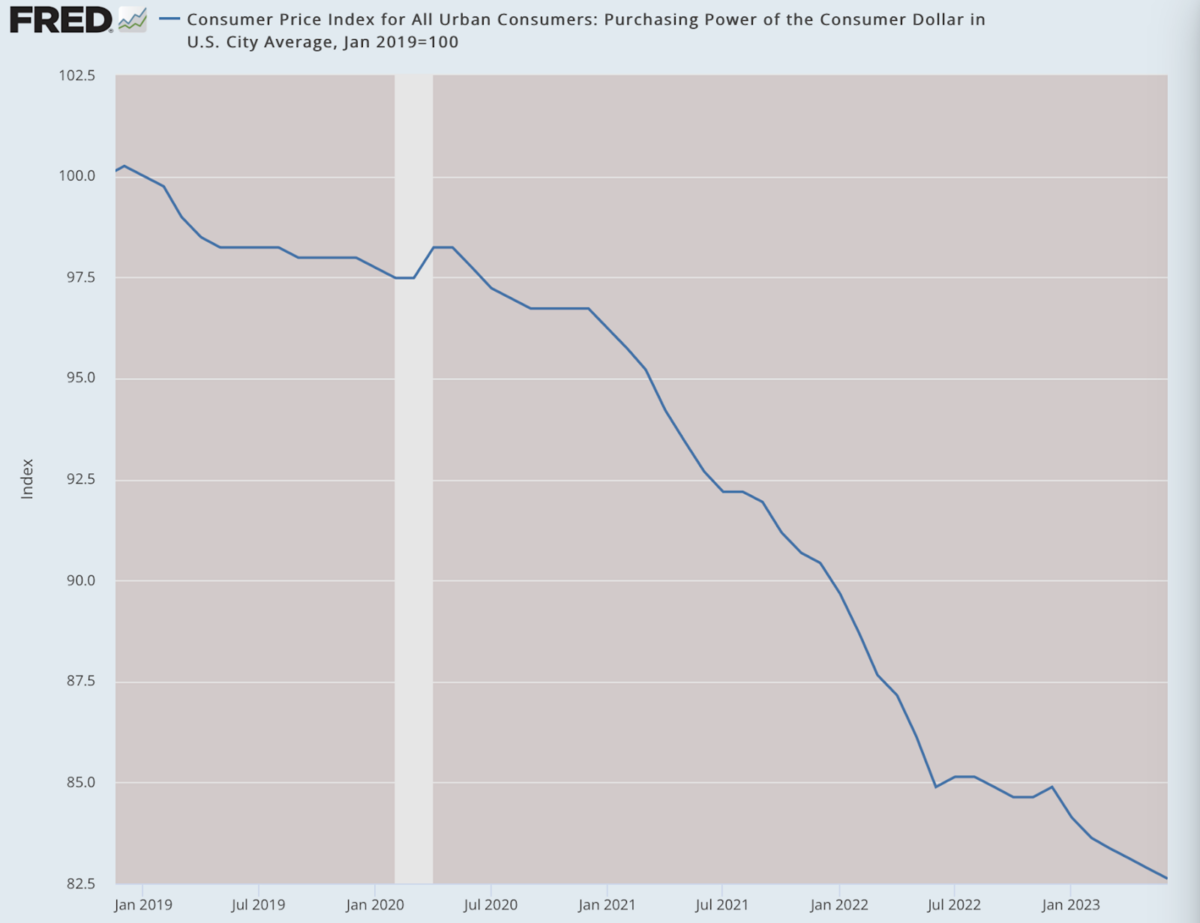

What’s most frustrating about this is that most people have no clue what these data mean. Many people I know are still waiting for 2019 prices to return. We aren’t even close to that. Even with 12 months of 0 percent inflation, overall prices will still be 17 percent higher than they were 4 years ago.

In other words, this is the new normal.

The Fed has absolutely no intention of allowing old prices to return. They have already pillaged the economy and they are actually quite proud of that. It was the ultimate economic swindle: pass out many trillions in money to individuals, families, and businesses, then take it all away a year later through the most vicious form of hidden taxation.

That really happened and very few understand how or why. That’s because no official sources admit it or talk about it. The Fed, which enabled this mass robbery, routinely denies any responsibility for this. Congress acts like nothing happened. And the Biden administration as usual dishes out lies and propaganda daily on its highly successful war against inflation.

Consider this: set the marker at January 2019 to today and you find that the dollar is worth $0.17 less in its purchasing power. That’s a wicked robbery taking place.

So prepare: as we approach late summer, the Fed will declare that it has won the last war against inflation. Now it must start a new two-front war: one against recession and one against deflation. They will do this with new steps toward quantitative easing. They will cease all interest rate pushes and instead try to keep the economy afloat all the way through the 2024 election.

In other words, the Fed will do everything possible to keep the Republicans from regaining the White House. They will do this by attempting to forestall a complete economic disaster until they can get Biden or Newsom safely into office. They will do this because the Fed is of course deep state and the Democratic Party is the Deep State party. This is not hard to understand.

But let’s return to the economics of the situation. There are certain kernels of conventional economic wisdom that are in fact completely wrong. One of them is that deflation is bad and must always be avoided. This is utter rubbish. Repeating it year after year going back many decades does not make it true.

Our best estimates of prices between 1870 and 1900 suggest a long-term and gentle decline in overall prices. And that makes sense: we experience very high growth rates sometimes in the range of 5 percent. High growth and falling prices are a natural experience in a growing economy when businesses are competing, resources are becoming more available, and wealth is being generated. Indeed, falling prices mean a strengthened currency! That’s a good thing and not a bad thing.

If we had a decent, humane, and intelligent Fed in operation, they should seek to tolerate a 17 percent deflation over the next four years. That would set us to 2019 before the coup d’état of 2020 that wrecked American liberty, law, and prosperity. That would be a great policy.

So why does it seem like all respectable experts are against deflation? As best I can tell, it is a holdover from a bad explanation of what was going wrong in the 1930s; that is, the Great Depression. The prevailing view at the time (and even now) is that what was causing the low productivity of the period was falling prices.

This is utter nonsense and an amazing confusion of cause and effect. The falling prices—rising purchasing power of the dollar—were not causing the economic depression. The falling prices were the solution to make the economic bust more tolerable to consumers. The Great Depression was not caused by deflation but rather represented a bust stage of the cycle that was kicked off by the artificial boom of the late 1920s. Then FDR made everything far worse and prolonged the downturn all the way to the Second World War by cockamamie corporatist policies that cartelized business, wrecked the dollar further, and interfered in free enterprise.

The only real salve of the entire period was the rising purchasing power of the dollar. And wouldn’t you know it, the “experts” looked at that and targeted the one saving grace of the decade as the one major problem to attack!

If you need more evidence that falling prices are not the enemy of economic thriving but rather evidence of it, consider the entire industry of computers and software over the forty year period of 1980–2020. Prices for hardware, software, and firmware, plus memory, completely crashed during this time. Computers fell in price by 80 percent while memory and software fell by 99 percent.

Thank goodness the Fed was not in charge!

Keep in mind that there is in nature no such thing as the Consumer Price Index. It is a statistical artifact highly sensitive to how it is collected and weighted. Prices in real life do not go up and down like the sea level. They are individuated by industry and the particulars of time and place. Ultimately, we are only pretending to do science by collecting this data, as interesting as it is. Indeed, the CPI didn’t even exist until 1917.

In a free society with private ownership and universal entrepreneurship and sound money, we would never have to think about such huge aggregates like the price level. We would just live life and enjoy rising prosperity. We are far from that ideal. But we could at least make one serious change: stop this insane anxiety about deflation. We need a good deflation right now. Make it a very long one if only to compensate consumers and business suppliers for the evil pillaging they have endured for the last three years.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.