Commentary

Last week was a grim reminder that the economic chaos of the lockdown period is far from over. Markets discovered that several major banks, which hardly anyone truly suspected were in trouble, faced closure and quick rescue for fear of contagion. The trouble was the same in each case: too many assets held in fixed-rate debt instruments in a period of rising rates.

The seemingly impregnable Credit Suisse is the latest casualty, saved only by a buyout from UBS, while the share price of First Republic continued to plunge despite the helping hand it received from the U.S. government and other banks. The culprit is the same in each case: too many cash drawdowns from its customer base even as its asset portfolio faced major market reassessment.

It’s easy to blame the Fed and the policies of rising rates are indeed the proximate cause. But one also must remember precisely why the Fed is forced into the position of shepherding the largest and fastest rate increases on record. Faced with the worst inflation in 40 years, the Fed had to get short-term rates in positive territory following 13 years of zero-interest rate policy.

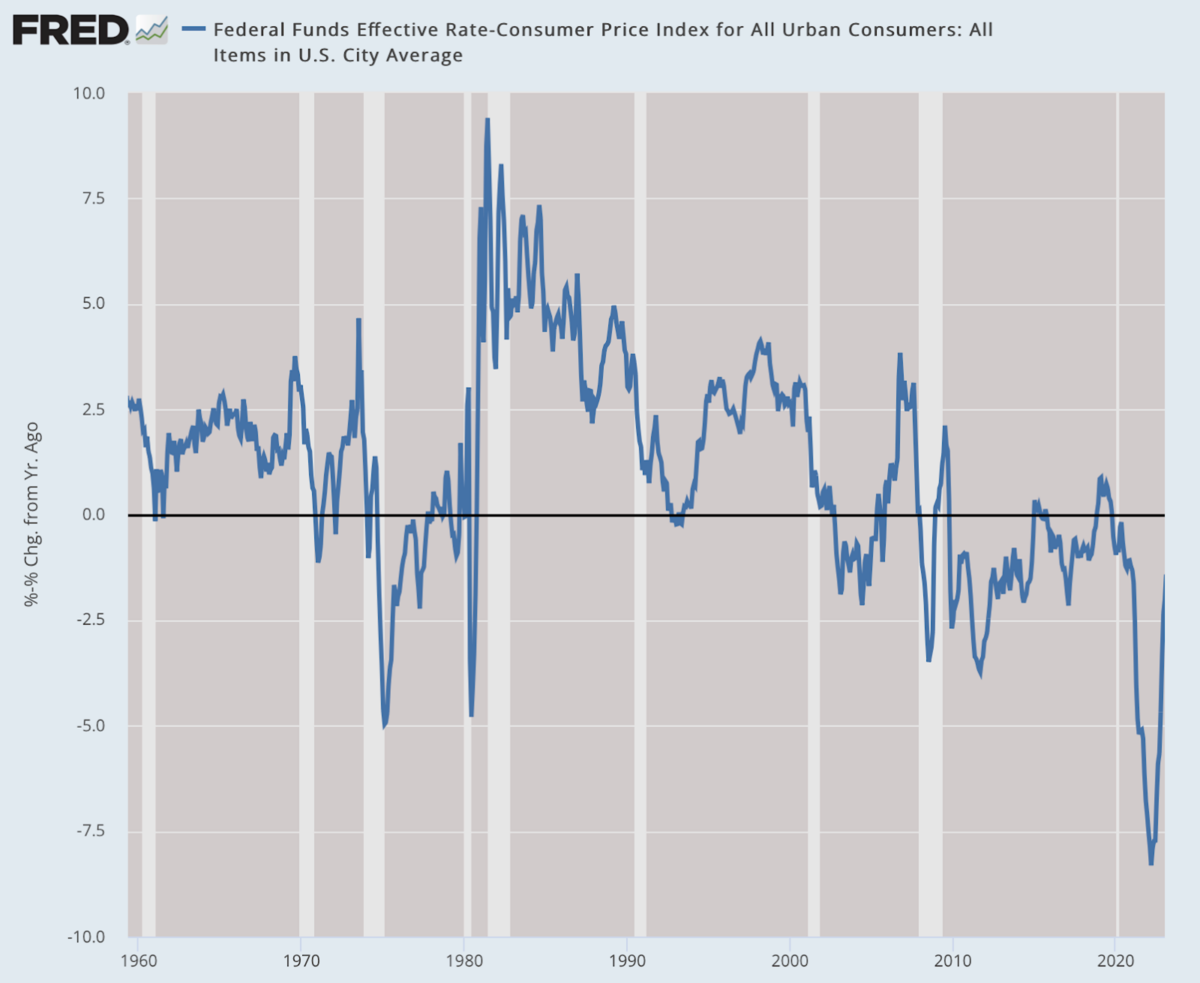

An outsider might believe that the Fed is somehow torturing markets with high rates today. But that’s far from true. The interest rate that the central bank is charging member banks is not yet in positive territory. We are still experiencing the longest period of negative interest rates (in real terms) since World War II.

In effect, we are still living in the world created by Ben Bernanke back in 2008. With inflation deeply embedded and persistent, there are still another 300 basis points to go in order to achieve the goal (the “terminal rate”) and that’s just on paper. No one knows for sure whether the plan will even work! If the experience of 1978–1980 is applicable here, the Fed has only just begun to fight.

The balance sheet of the Fed was released on Friday and it revealed underlying actions that made virtually no headlines but documented more than we wanted to know. The Fed has just reversed a year’s worth of work in trying to get its own house in order. It had worked hard to clean up its balance sheet full of U.S. Treasury debt. This past week, it bought a whopping $300 billion!

When the Fed is selling its portfolio of debt (or anything else on the asset side of the ledger) it is engaged in tightening money flows. When it is buying, it is doing the opposite because—here is the magic of central banking—it does so with newly created money. This is the driving force of inflation. So even while it is engaging in a rise against inflation, it is undertaking actions (not policies) that are working against that goal.

In other words, this is today a Fed that is only reacting to events. It is not making policy. It is only working to make the system survive. And for now, it seemed to accomplish that goal. Following an entire week of talk about the banking crisis that seemed to be emerging, there was a strange new calm coming upon Monday’s opening bell.

The magic elixir of easy money seems to have once again patched the problem. But haven’t we learned by now that this is merely an illusion? It only prolongs and even possibly worsens the problem of inflation. To be sure, there is a variable lag between central bank policies and the effect on prices. But if the Fed is truly attempting to arrest the inflationary problem, this is absolutely not the way to go about it.

The spooky feature of this last week is in observing how the Fed itself is no longer in a position to chart its own course. It has to react to events. People blabber often about the Fed’s dual mandate but that’s just what the textbooks tell you. The reality is that there is only one mandate: keep the banking and financial systems from falling apart. In pursuit of that one goal, everything else is merely window-dressing.

Markets can often seem extremely naïve about this point, until suddenly they are not. We are seeing signs now that they are waking up to the insoluble problem. Gold has shown new energy and will very likely hit new highs by the summer. As usual, it is the golden constant, not rising substantially in real terms but holding its value even during inflations. Based on what we are seeing here, investors around the world do not believe that it has been demonetized.

But the real action out there today is in the ultimate contrarian store of value: the decentralized hard money that comes in the form of Bitcoin. It has gained fully 70 percent during the last three months, thus massively outperforming every other conventional stock index. It’s not too early to declare an end to the crypto winter. The bullishness is affecting all the most reliable tokens, proving again that the takedowns of proprietary coins do not necessarily affect the value of the decentralized tokens over the long term.

Keep in mind that this is happening despite the closure of crypto-friendly banking institutions that served as off-ramps from crypto to dollars. The investor base that is convinced of the value of Bitcoin regardless of the status of the conventional banks that serve it is more intact than ever.

Whatever quiet there seems to be today, it is temporary. The Fed has lost its way. Not even its stated policies operate as guardrails. It is purely reactive at this point.

This is not the world that Jerome Powell set out to create for himself 18 months ago. He now has two policies running at once, one hawkish and one dovish. What will he choose? For now, it’s both at once, which makes no sense. And that sums up the new world of money and banking in a post-lockdown world. The damage is deep and wide, and only begun to reveal itself in all its ugliness.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.