The Supreme Court voted 6–3 on June 30 to strike down President Joe Biden’s controversial plan to partially forgive student loans.

The six conservative justices voted to invalidate the program in the closely watched case, while the three liberal justices voted to uphold it.

Biden unveiled the plan in August 2022 in a move critics decried as a constitutionally dubious attempt to help Democrats in November 2022 congressional elections. The Congressional Budget Office said the plan could cost about $400 billion, but the Wharton School estimates the price tag could blow past $1 trillion.

On Feb. 28, the Supreme Court heard two related cases dealing with the program, Biden v. Nebraska (court file 22-506) and Department of Education v. Brown (court file 22-535), back to back.

The Biden v. Nebraska appeal springs from a lawsuit Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina brought against the federal government.

The other appeal arises from a lawsuit filed by two borrowers who say the department improperly denied them the opportunity to participate in the public commenting process and that they would have urged the agency to provide greater debt relief.

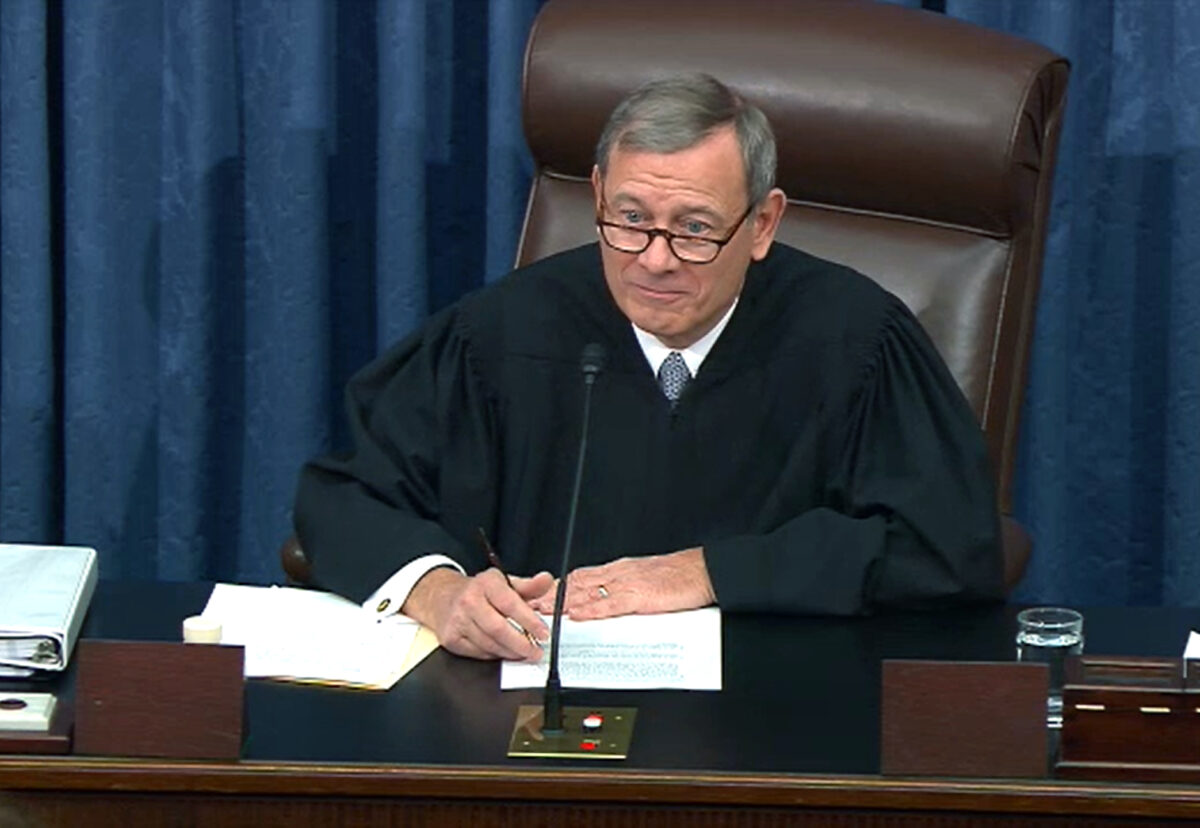

In Biden v. Nebraska, Chief Justice John Roberts wrote the court’s majority opinion (pdf).

“Last year, the Secretary of Education established the first comprehensive student loan forgiveness program, invoking the Higher Education Relief Opportunities for Students Act of 2003 (HEROES Act) for authority to do so.

“The Secretary’s plan canceled roughly $430 billion of federal student loan balances, completely erasing the debts of 20 million borrowers and lowering the median amount owed by the other 23 million from $29,400 to $13,600. … Six States sued, arguing that the HEROES Act does not authorize the loan cancellation plan. We agree.”

In the other case, Department of Education v. Brown, Justice Samuel Alito wrote the court’s unanimous decision (pdf) that threw out the two borrowers’ claim over a lack of legal standing.

The loan forgiveness program was justified by reference to the twin emergencies the Trump administration declared in March 2020 to combat the COVID-19 virus. The national emergency and the public health emergency enabled federal agencies to exercise expansive powers in managing the government’s pandemic response, but on May 11 Biden ended those emergencies.

The Biden administration separately put a pause on student loan payments and interest during the recent pandemic at an estimated cost of $100 billion but then claimed last year that the pandemic gave it emergency authority under the law to proceed with partial loan forgiveness.

About 26 million people reportedly applied under the program before courts blocked it last year. Of that total, 16 million are said to have been approved before the government stopped accepting applications.

The U.S. Department of Education claims that it has the authority under the Higher Education Relief Opportunities for Students Act of 2003 (HEROES Act) to move forward with debt relief on an emergency basis, which would cancel as much as $20,000 in loan principal for 40 million borrowers.

But lawmakers involved in the passage of the HEROES Act have said it was enacted after the 9/11 terror attacks to provide student loan relief to military service members and their families, not to cancel debts en masse.

The original version of the legislation in 2001 allowed the department to grant debt relief as a result of a “national emergency” related to a “terrorist attack,” but the 2003 version removed the “terrorist attack” qualifier.

This is a developing story. This article will be updated.