Commentary

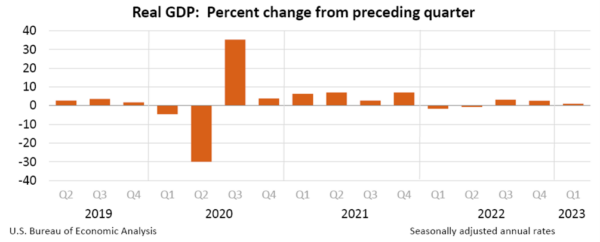

For reasons I cannot explain, there was widespread shock at the new GDP numbers for the first quarter. They revealed a 1.1 percent growth rate, which is a crawl and much lower than the experts anticipated. And the new data points to an inexorable reality.

Certainly the recession will be obvious by the summer and undeniable by the winter. It will be all anyone talks about starting in 2024 and following.

It’s possible to make a credible case that we are already in one. Indeed, you can backdate your analysis to observe that we never really left the lockdown depression of the spring of 2020. All the rest has been an illusion kept alive by paper money and government spending. This time, however, the dramatic slowdown traces to hardcore factors like factory orders, housing, and investment.

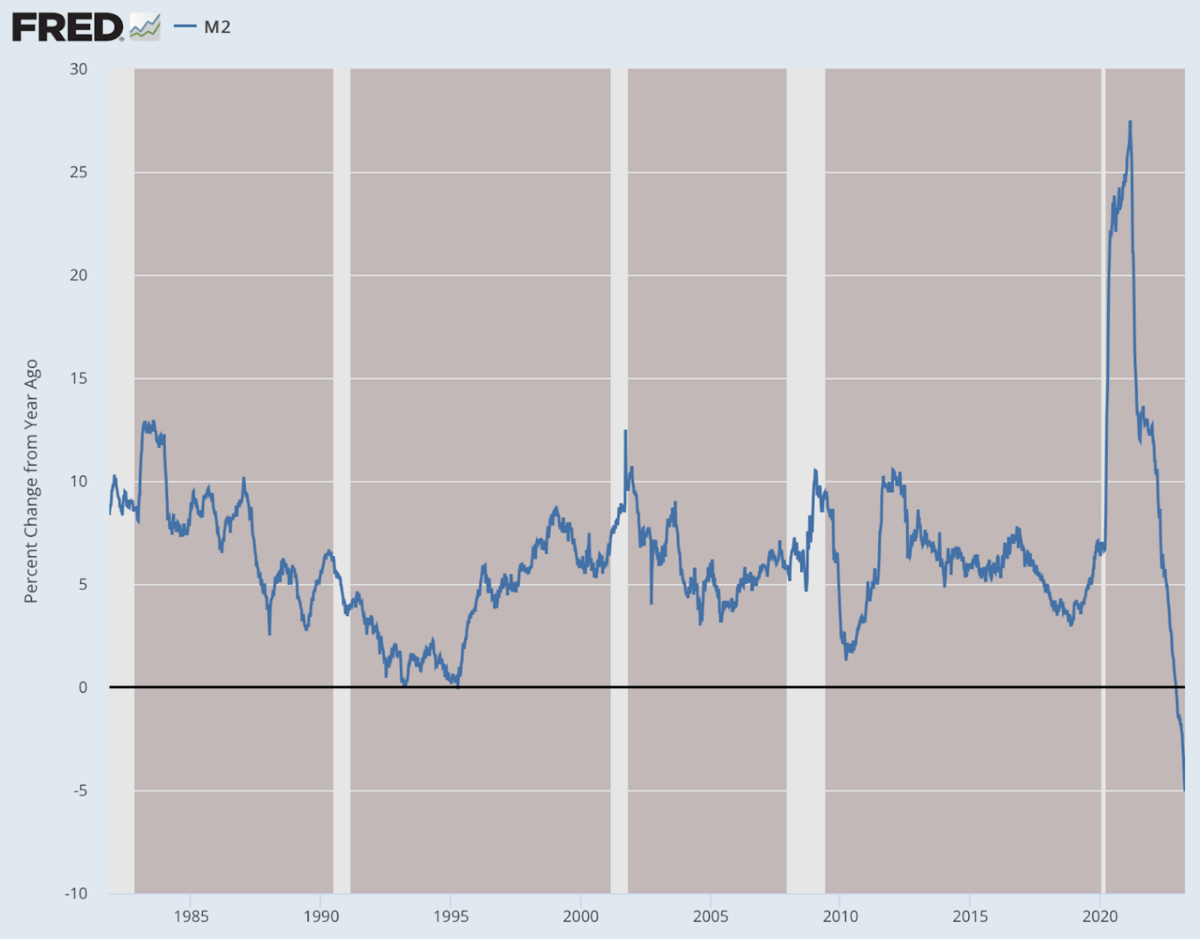

Our very expectations of economic progress are being dramatically downgraded. All of this was easy to see when one looks at monetary aggregates. The decline in the money supply from its peak is now 5 percent. That’s not 1930–32 levels of 15 percent but it is the largest fall in the money supply in the postwar period. We really don’t know what the effects will be but they cannot be good.

Mises wrote the core of this book from 1934 to 1940 while in exile in Geneva. (It wasn’t published in English until after the war.) Economic depression and war provided the historical backdrop. The mainline of intellectual opinion in those years was that democratic liberalism and capitalism had completely flopped and were rightly being replaced by the planned society.

That planning could take Soviet or Nazi forms but also the idea of the planned society had swept England and the United States. It had become a doctrine that capitalism had failed completely, which is why the whole of the industrialized world was dealing with high unemployment and low productivity.

Mises’s chapter on the trade cycle, inflation, and deflation provided a much different take on how the cycle happens. He explains that in the age of sound money, mass inflations were impossible because money consisted of a fixed or slowly growing amount of specie backing such as gold and silver.

The empirics bear him out. In the 1870s, with the United States on a gold standard, with domestic convertibility, the U.S. economy grew 6 percent and averaged 4–5 percent throughout the 1880s and 90s. We can only dream of such growth rates today.

Yes, there were always banking crises but they were localized and a normal part of the enterprising society in which all businesses face the need to assess risk. They did not result in huge macroeconomic cycles.

But with war as financed by central banks, that began to change. The unleashing of dramatic flows of new money and credit has distortionary effects on the structure of production that can result in large price increases but also in industrial instability. That is why he had warned against their creation in his 1912 book “The Theory of Money and Credit.”

It had become conventional to believe that the whole of monetary theory could be summed up in the quantity theory of money. This stated that the price level is a function of money supply and demand and that otherwise money was neutral to the market. It could be increased or decreased and prices would adapt without causing further damage. Mises argued that this was not the whole story. So long as new money is fed through the banking system, there are injection effects that flow from the crucial institution of interest rates.

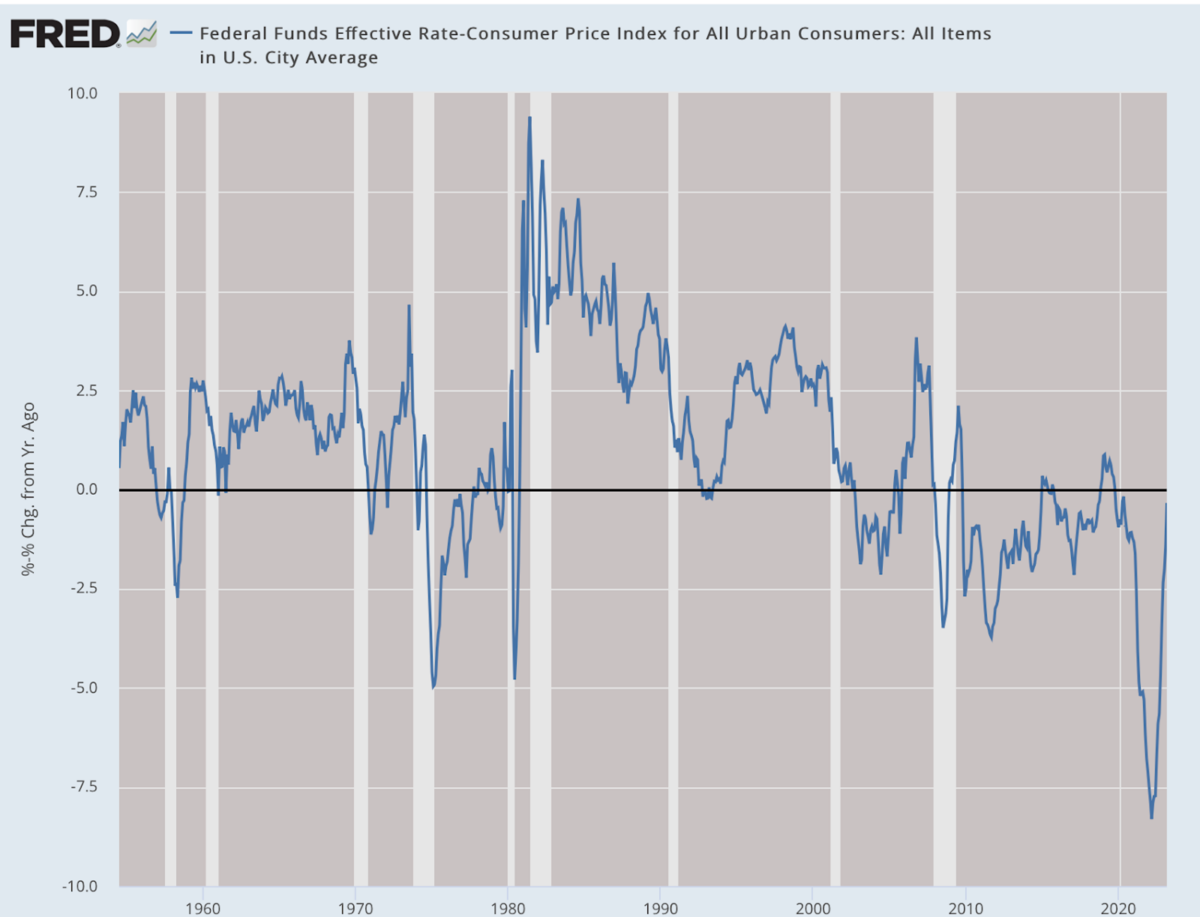

Central banks have a tendency to push rates ever lower because they can and that is always popular with the public, politicians, and business enterprises. But this comes at a huge cost. When interest rates are distorted, they create false signals to investors who end up loading up on longer-term projects that cannot be sustained with existing private resources. These unsustainable investments eventually must fold back in on themselves once underlying realities come to the fore.

How long does this take? Usually the trigger is a reversal in easy money policies toward more tighter ones, a policy switch that comes about when the central bank fears inflationary consequences. The result is a deflationary policy that drives down economic growth in close proximity to the magnitudes of growth achieved with looser monetary policies.

As I read Mises’s entire story here, I was overwhelmed at the prescience of his description and its application to today. The waves of easy money came in three parts: 2000–2002, 2008–2019, and 2020 to 2022. This longer than 20-year period saw huge increases in technology and prosperity but the wheat and chaff grew together. The day of reckoning would happen at some point.

We might have seen a soft landing after 2019, at least a softer one. But instead of crawling slowly out of zero interest rates, pandemic funding meant doubling down on the worst-possible policies. That made our current plight inevitable.

There is simply no choice now but to deal with the resulting recession/depression. Keep in mind that federal funds rates adjusted for inflation, which are roughly identical to the return on Treasury bills, are still in negative territory, -0.3 percent to be precise. The Fed must keep going with its campaign to offload its balance sheet and tighten money.

Mises writes:

“The boom [eventually] produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the necessary collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy against the evils which inflation and credit expansion have brought about.”

This paragraph beautifully describes our political and economic culture in January 2024, for by then it should be very obvious that the boom has fully turned to bust. With the Fed out of tools to foster a new boom, there will be no choice remaining but to let it take its course. People will be very angry.

I will confess my own frustration in living through our times while having 90-year old economic texts right at hand to map out exactly what is taking place. Whom to blame? It’s not the public. It’s the managerial elite who created this crisis in steps that unfolded over three years or really over 20 years. They attempted the oldest trick in the book for trying to avoid the consequences of their actions. But the coming months and years will once again underscore that this is simply not possible.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.