As revenues continue to fall, California may face a $7 billion higher budget deficit than the governor forecast in January, according to the state’s Legislative Analyst’s Office.

“Although the Governor’s budget revenue estimates are reasonable, they are likely a bit too high,” according to Legislative Analyst Gabriel Petek’s 2023–24 Multiyear Assessment report issued Feb. 15.

The office estimates revenues will be about $10 billion lower than Gov. Gavin Newsom’s budget proposal, which could raise the total expected deficit to about $29.5 billion.

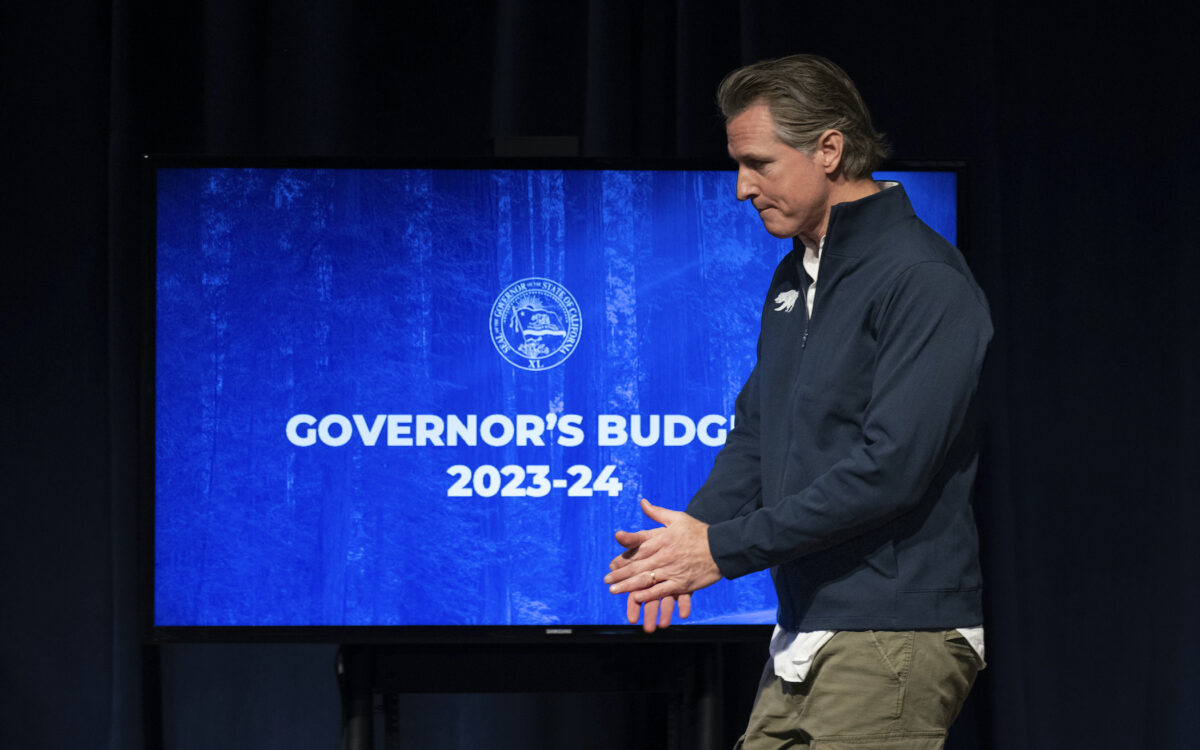

Newsom described the budget picture as “very volatile” when unveiling it Jan. 10, adding that he plans to revise it in May when “there’s more clarity.”

Many factors have contributed to the revenue drop, according to the Legislative Analyst’s Office.

Rising inflation spurred by federal pandemic stimulus money, large Federal Reserve interest rate increases, and a cooling economy have all played a part in the decreased income.

Revenue from personal income taxes and corporate taxes also declined, the office said.

With California’s progressive tax system, the very wealthiest pay nearly half of all personal income tax collected, California Department of Finance spokesman H.D. Palmer told Capital Radio, a public-service radio station in Sacramento, last year.

“If you look at all of the personal income tax returns that were filed in California in the year 2020, just 1 percent of the total number of income tax returns … were responsible for more than 49 percent of all of the personal income tax that was paid in that year,” Palmer said.

Many larger corporations, especially in the tech industry, have also reduced their labor forces and pared back spending, according to the Legislative Analyst’s Office.

The gloomy financial picture comes just a year after the state’s coffers overflowed with an extra $98 billion from the federal pandemic stimulus and surplus funds.

The extra cash allowed the governor to boost spending on education, homelessness, health care for immigrants, and other programs. It also triggered a law that required the state to return about $17 billion to residents in rebates.

California will also face operating shortfalls of $9 billion in 2024–25 and 2025–26, and $4 billion in 2026–27, according to the legislative analyst.

“Because of the state’s constitutional spending requirements, revenues would need to be higher by more than these amounts for the state to be able to afford the spending level currently proposed,” Petek, the legislative analyst, wrote in the latest analysis.

However, state officials have said they are not planning to dip into $37 billion in reserve funds to maintain spending levels. Newsom has, instead, proposed to delay certain investments and reduce other expenditures in water and drought programs and reduce climate initiatives by $6 billion in the next fiscal year.

He also proposed cuts in some housing programs, healthcare workforce investments, transportation, and other spending.

Instead, the state could spend its rainy-day funds, reduce more one-time and temporary spending, shift more costs to other areas, or increase revenues on a temporary basis, the analyst’s office suggested.

Even with revenues dropping, state spending remains at historic levels.

Since 2020, California’s surges in revenue have been record-breaking and are still above average, the analyst’s office reported.

Even after adjusting for inflation, anticipated revenues for 2023–24 remain about 20- percent higher than before the pandemic, the office said.

Once state legislators sign off on the final budget for 2023–24, it will take effect July 1.

Newsom’s office did not return a request for comment about the deficit by press time.