Recent spending proposals outlined in Gov. Gavin Newsom’s May budget revision outpace revenues, with the chance the state can afford its spending levels less than one-in-six across a five-year period, according to a report released May 23 by the state’s nonpartisan Legislative Analyst’s Office.

“If the Legislature adopts the Governor’s May Revision proposals, the state very likely will face more budget problems over the next few years,” the authors wrote.

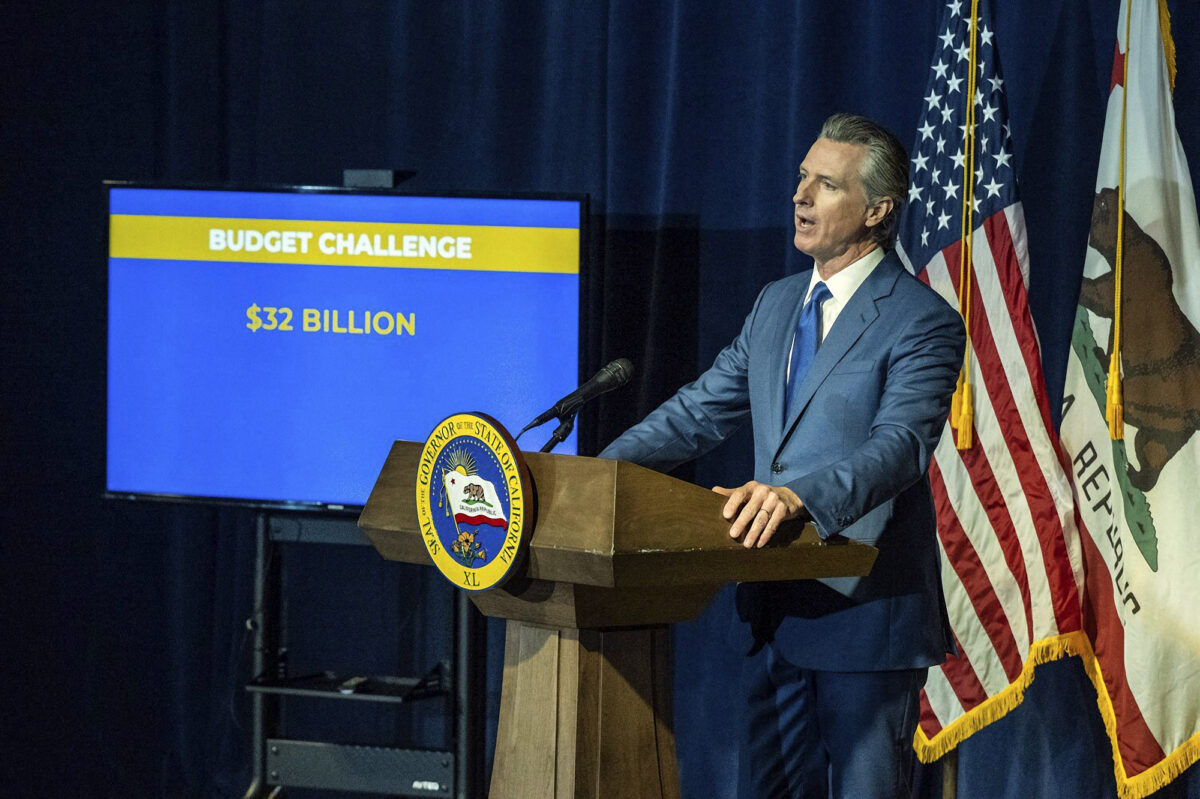

The governor laid out his revised budget plan during a press conference held May 12 where he announced an additional $9 billion shortfall, bringing the total deficit to nearly $32 billion.

Details regarding revenues and spending provided by the administration differ from those projected by the state’s analysts’ estimate of a $34.5 billion deficit this year.

Several discrepancies in budget calculations lead to the difference, including an $11 billion variation in revenues through 2023-2024 and an additional $10 billion in spending through 2026-2027.

Projections related to Health and Human Services spending are the bulk of the discrepancy, with analysts estimating costs to be $6 billion higher than budgeted.

Proposed solutions to the budget shortfall include expanded revenues and reduced spending.

Revenues would need to increase by $30 billion to cover anticipated operating deficits for the 2024-2025 fiscal year, analysts suggested in the report.

“It’s pretty unlikely to meet the May revision spending levels on an ongoing basis,” Ann Hollingshead, principal fiscal and policy analyst with the analyst’s office, told The Epoch Times. “If we’re hoping for revenue growth alone, that most likely won’t be sufficient.”

At issue are tens of billions of dollars in multi-year and one-time spending commitments made by the Legislature impacting the 2023-2024 budget—some that the governor has proposed delaying.

Postponing payment until later years is not economically feasible, according to the analysts, who suggest legislators prioritize funding projects in this year’s budget and reduce expectation of future expenditures.

Analysts point to the state’s significant reserves as a cushion that gives lawmakers time to resolve the dilemma, but the authors note that spending will have to be realigned with revenues.

Approximately half of the budget concerns could be alleviated by drawing down reserves, but the rest would have to come from spending cuts, revenue increases, and a shift in costs, according to the report.

“The state can cover the projected budget problems using reserves and by pulling back some of those temporary one-time spending augmentations without impacting core ongoing services in California,” Hollingshead said.

If efforts are not undertaken to address the growing budget deficit, analysts suggest the state will be forced to make difficult decisions including cuts to core programs.

In order to balance the budget, comprehensive measures should be taken to reduce spending on one‑time and temporary spending commitments from $11 billion to $4 billion, with future temporary payments eliminated, and a total reduction of $18 billion through 2026-2027, according to the report.

Taxes remain the primary source of revenue generation for California, and declines across the board are negatively impacting the state’s ability to fund its initiatives.

Personal income, corporate, and sales tax collections are expected to be 11 percent lower than last year, and the decline is adding to budgetary pressures, according to the analyst’s office’s May Revenue Outlook released May 13.

Data shows that withholding tax is down 5 percent compared to last year, with the report suggesting a 13 percent drop in total income tax revenue generated this year.

Core taxable sales have decline for two consecutive quarters—an occurrence only seen during the dot-com bust and the Great Recession prior to this year—and the authors suggest losses in the technology sector and across California businesses are contributing to the slide.

A drop in earnings among high-income individuals is a leading cause of revenue decline, and the possibility of an economic downturn is putting downward pressure on revenue projections, according to analysts.

“Revenue collections ultimately will depend on the future path of the economy, which is highly uncertain,” the authors observed in the May 13 report. “There is a good possibility that rising interest rates and tightening credit soon will push the economy into a broader slowdown, leading to further revenue declines.”

The report highlights the uncertainty surrounding the economic future of the nation and the state, noting the difficulty such creates in forecasting future revenues and expenditures.

Mixed signals regarding traditional economic indicators like unemployment numbers—which are very low, suggesting strength—combined with troubling housing and slowing manufacturing indices are complicating analyses, according to the report.

“Nonetheless, these indicators continue to signal a looming downturn,” the authors wrote. “Consistent with this, the consensus among economic forecasters has deteriorated recently.”

Signs that consumer expectations are decreasing with continued elevated inflation and the subsequent Federal Reserve response to raise interest rates, combined with recent banking failures, increases the risk of a downturn, according to experts.

“We’ve been saying for over a year that the state faces a heightened risk of recession,” Hollingshead told The Epoch Times. “That absolutely continues to be the case.”

Economists agree, with calls for prudence coming from across the state, and the governor urged as much repeatedly during his May 12 press conference.

With lawmakers in Washington, D.C. arguing over the debt ceiling, and financial markets stuttering as the June 1 deadline approaches, the economic situation is exceedingly perilous, according to experts, and the risk of impact to California is substantial, with potentially 840,000 jobs lost if a lengthy default occurs.

Though headwinds are strong and barriers to revenue growth are significant in the short-term, analysts are confident that California is well poised to weather the storm, if appropriate countermeasures are taken.

“The state has this risk, and it’s something we’re cautioning the Legislature about, but at the same time, the state does have a good level of preparedness to deal with this,” Hollingshead told The Epoch Times. “The Legislature has built up reserves for the state to handle exactly this type of situation.”