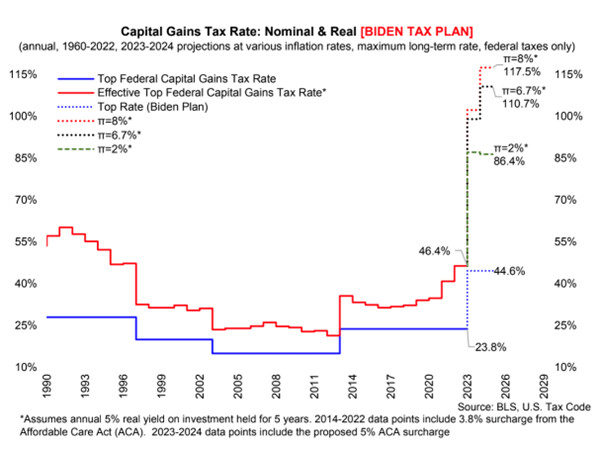

President Joe Biden’s proposed capital gains tax increase could result in an effective tax rate of over 100 percent after adjusting for inflation, according to recent calculations by Laffer Associates. The increase would more than double the tax investors pay on investments held longer than one year.

The proposal, outlined as part of Biden’s $6.8 trillion budget plan for 2024, seeks to increase the capital gains tax rate for individuals earning more than $1 million a year, to 39.6 percent, up from the current rate of 20 percent. In addition, it would increase the Affordable Care Act surcharge to 5.0 percent, bringing the total tax rate for high-income investors to 44.6 percent.

Assuming an investor earned an annual yield of 5.0 percent on an asset held for five years—higher than current yields for all U.S. Treasury bonds—and assuming inflation remains at its current level of 6.7 percent, the investor would pay a real capital gains tax rate above 110 percent.

If the Federal Reserve successfully tames inflation back to its preferred target rate of 2.0 percent, the effective rate for this hypothetical investor is still 86 percent.

“What’s the right and fair tax to levy on investments?” the Center to Unleash Prosperity (CTUP) asked in a statement. “Should the government take it all and then some?”

To illustrate how an investor might pay more money than he or she has earned, the CTUP offered another way of looking at it.

“If you buy a stock for $100 a share and then it rises to $120 per share five years later, but the accumulated inflation rate over that period was, say, 24 percent, then you lost money owning the stock after adjusting for inflation,” said the organization. “You would still owe Uncle Sam a 40 percent tax on the phantom ‘gain’ of $20 per share.”

“This is sheer idiocy.”

In addition, Biden’s plan would eliminate a tax loophole known as “step-up in basis,” which allows heirs to avoid paying capital gains taxes on assets that have appreciated during the previous owner’s life.

Many economists argue that excessive capital gains taxes discourage investment and hinder economic growth.

The Biden administration has defended the proposal as a way to fund critical investments in education, childcare, and other social programs. However, it remains to be seen whether the proposal will gain enough support in Congress to become law.

Regardless of its fate, the proposal has sparked a fierce debate about the appropriate level of taxation on investment income and its impact on the economy.