A team of Federal Reserve economists found that the cash surplus accumulated by American households over the past few years since the start of the pandemic has now largely evaporated.

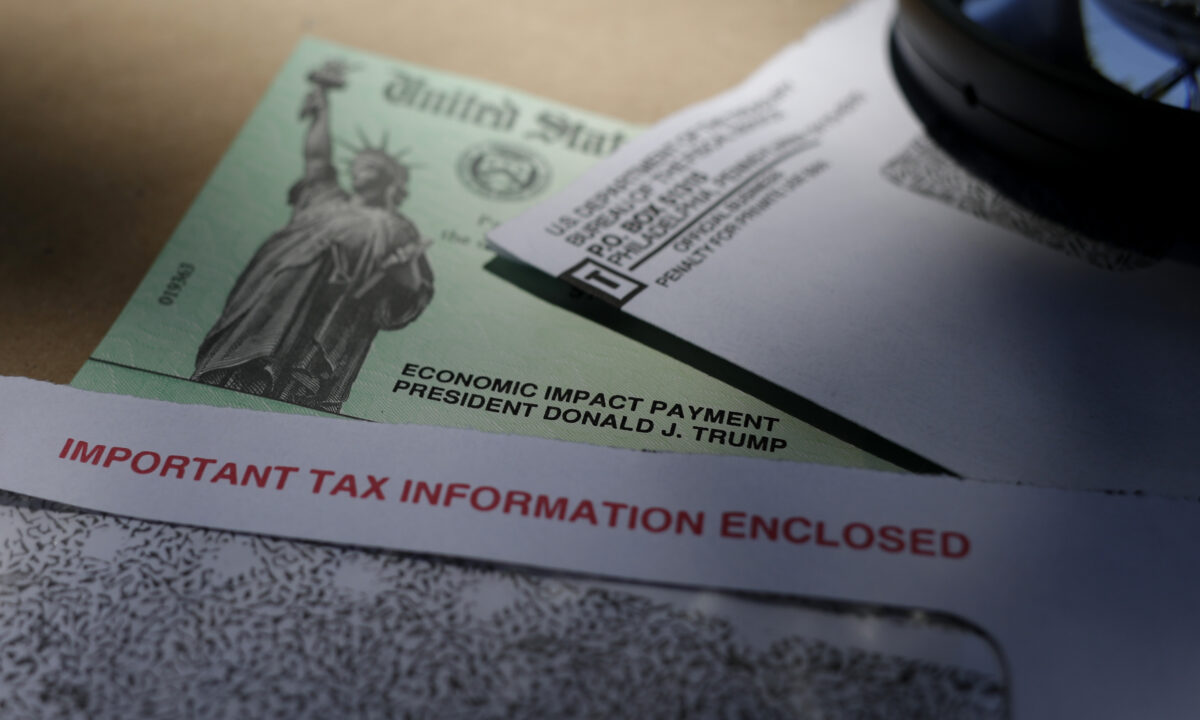

The expenditure of household excess savings by U.S. consumers partially came from government pandemic stimulus checks, which caused the spur in economic growth over the past year, despite high inflation.

Now, the excess savings are largely gone, as Americans gradually spent it all over the last two years, according to a recent research note by Fed economists Francois de Soyres, Dylan Moore, and Julio Ortiz.

The Fed researchers said the remainder was depleted in the first quarter of this year.

Congress approved two massive fiscal stimulus packages in the first year of the pandemic, in the form of direct payments to American households, in addition to other temporary measures like freezing student loan repayments and the expansion of child tax credits.

This led to cash piling up in household accounts while spending slackened over concerns about the virus, supply chain disruptions, and government-imposed lockdowns.

These factors meant that most U.S. consumers did not start spending their excess savings until late 2021, according to Fed data.

The three Fed economists defined excess savings as the amount of savings households maintain above the preceding savings trend.

“To mitigate the health and economic fallout from the pandemic, governments around the world engaged in large fiscal support programs, which increased the demand for consumption goods, but production of these goods did not adjust quickly enough to meet the sharp increase in demand,” the economists wrote.

They also noted how the excess savings partially contributed to the surge in inflation last year.

Americans Spent More Savings Than Others in Developed Economies

Other developed countries saw a similar trend in households gradually spending their excess savings accumulated during the pandemic, as governments around the world provided massive fiscal support which increased the demand for consumption goods.

However, those populations still have savings equivalent to about 3 to 5 percent of their nations’ GDP, compared to those in the United States, said the economists.

The Fed team wrote that the sharper decline in savings in the United States, suggests that stimulus money spending played a major role in propping up consumer demand since the beginning of 2022.

“Given the more rapid drawdown of excess savings, aggregate demand in the United States is likely to have been more than in other countries over the past year,” the researchers wrote.

They also found that when excess savings were accrued past downturns, such as the early 1980s and after 2008, the money saved by households was spent over a longer period of time compared to what happened post-pandemic.

Money saved up during the pandemic was depleted in about 10 quarters, far quicker compared to the two earlier recessions, when extra household savings remained after 19 quarters.

As households began to spend again, consumer prices increased dramatically by mid-2021, as rising U.S. inflation spun out of control.

Supply chain troubles and energy shortages, combined with a surge in spending, sent inflation rates leap from an annual 1.7 percent in February to 7 percent by December 2021.

Inflation hit a 40-year peak at 9.1 percent in June 2022, after which prices began to gradually ease.

The Fed responded with an aggressive interest rate hike strategy which raised its policy rate from near zero, up to 5.25 percent, after ten increases over fifteen months.

Prices have eased since the Fed made its move, standing at 4 percent in May, but the central bank’s target rate of 2 percent.

At the last Federal Open Market Committee (FOMC) meeting in June, the central bank decided to not go forward with another rate hike that month, to observe the results.

However, Fed officials suggested that more interest rate hikes could be coming later this year, according to FOMC meeting minutes.

“Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate,” they said.

“The economic forecast prepared by the staff for the June FOMC meeting continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year, followed by a moderately paced recovery.”

There is still concern that additional interest rate hikes could tip the American economy into a “mild recession,” which most Fed policymakers still expect by the end of the year.

Still, a minority of central bank economists are optimistic that the economy will continue to grow slowly and avoid a recession in 2023.