Commentary

Here’s a thing I like to do on the day of Labor Department data releases. I read the actual release and look at the data and trend lines, then look at the details and see what’s driving the trend. I make a general judgment and write an imaginary headline. Then I check in the top two mainstream newspapers and what they say about the same subject.

Without exception, the judgment is the opposite. It’s been this way for two years. Why? Well, when you look at the Labor Department’s press release, you find enough language in there to justify the headlines, even if the data underneath contradicts it. I conclude from this that these data bureaus have been captured just like everything else in public culture these days.

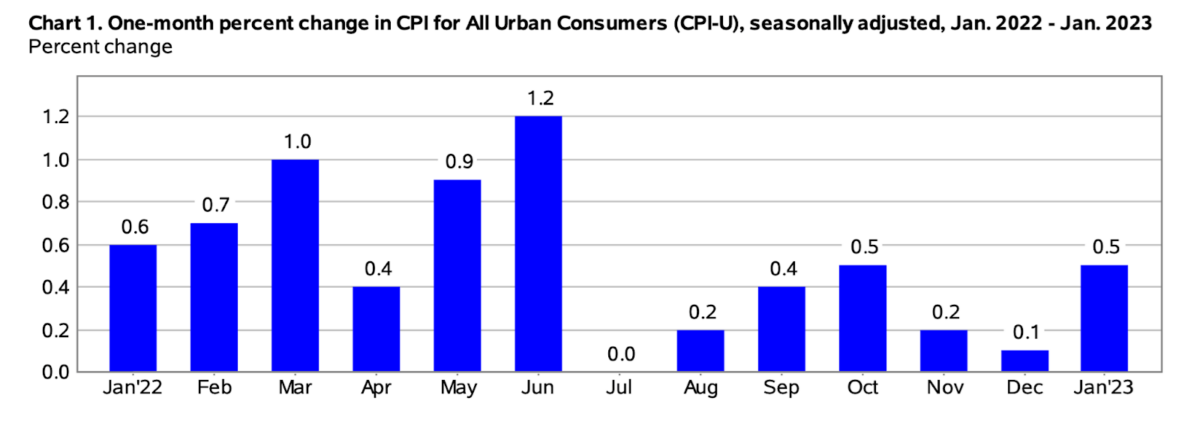

So of course I repeated this ritual today upon the time release of consumer price index (CPI) data. Economists expected it to have risen overall in January by 0.4 percent, which would have been striking after two successive months of actual decline. Instead, the overall pace of increase came in at 0.5 percent, which wipes out two months of decline in the rate of increase (following data adjustments) and takes us back to October’s high rate of increase.

This is not good news. It’s actually very bad news. You might think it was the headline. But nope. These news venues are so hip to getting a story out within seconds of the release that they accept whatever the buzz has been for the two previous days. Call me cynical but I strongly suspect that certain people within the agencies are dictating this buzz. As a result, the initial announcement turns out to be pure propaganda.

New York Times: “Pace of U.S. Inflation Eases Slightly Again, Data Shows.”

Wall Street Journal: “January CPI Report Shows Annual Inflation Cooled.”

Yep, that will make one’s head spin. But of course if you look more carefully at the articles, they eventually admit the truth. NYT: “Consumer Price Index data released on Tuesday showed that price increases picked up briskly on a monthly basis last month.” The WSJ offers this wacky word salad: “Annual inflation cooled for the seventh straight month to 6.4 percent in January, but the pace of easing is starting to level off.”

Huh? In the 90 minutes after the CPI release, we read in all the authoritative venues that prices have cooled, firmed, eased, increased, leveled, and moderated!

It’s no wonder that everyone gets confused. Readers only want to know if their hell is going away or getting worse. To believe the press around the initial release, it turns out that bad times are always ending, even when the bad turns to worse! Simply put, you can’t believe a word of this.

Also, with no press at all, the numbers from December and November were just revised from falling to… rising! Oh, so when we thought things were getting better they were actually getting worse, and now we find that things are getting really bad at a much faster pace, but the news media reports this as “easing” and “cooling” and “leveling.”

And even the timing of the revised numbers is suspicious. You see, if inflation was actually slightly worse than believed in December in November, that makes January’s high rate of increase not as much of a shift in the data!

See how this works?

Let’s say you weighed 200 in October, then 199 and 198 in November and December but in January you weigh 210. You might think that is terrible news but if you retrospectively “revise” your November and December weight to 205 and 208, then, hey, 210 is a falling rate of increase. You are kind of losing weight!

It’s all nuts really. But that is more-or-less what the Labor Department has done. Mainstream media dutifully plays along!

Let’s take a broader look at the CPI over two years and come to terms with what has happened to us. In the rawest of terms, the two-year stack comes in at 15.4 percent. Which is to say: if you had a dollar in December 2020 and held it for two years in your hand and opened your hand today, you would have three quarters and a dime.

You might scream out that a ghost seems to have stolen your money. You are right. But then a news-media expert shows up and points out that actually this is not true. You are exactly experiencing a cooling and an easing in the pace at which your money is depleting, based on revisions in data, as well as recent trendlines, so there is nothing to worry about.

“But I have less money!”

“Are you denying the science?”

So on it goes. But at this point, I doubt that most people pay attention to the experts in economics or any other topic. The general attitude is incredulity. For two years now, we’ve heard that inflation is transitory, declining, improving, cooling, easing, abating, and otherwise getting better. And yet we turn around and observe actually that everything has gone up widely in price. Who are you going to believe, the experts or your own eyes?

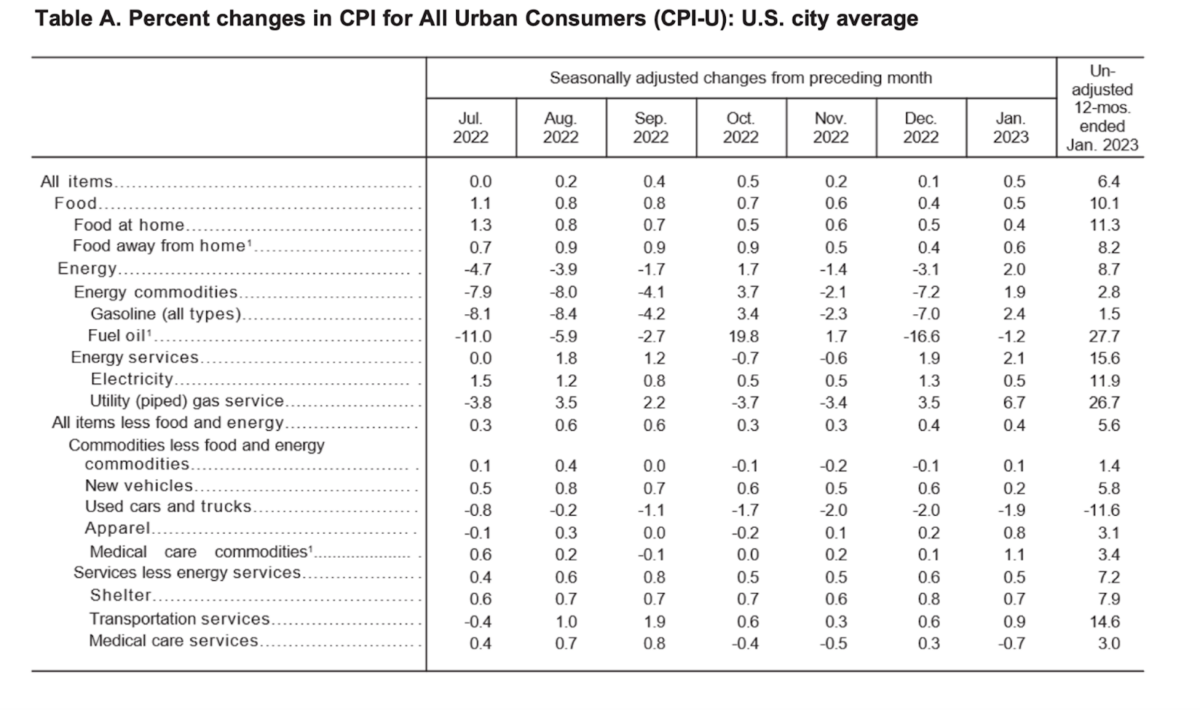

Let’s just put this on the record so that we know exactly what is going on here. Bottom line is that you are currently paying far more for groceries, meals out, and utility bills than you were paying a quarter ago, to say nothing of last year or two years ago. You can toss that “good news” blather in the trash because it is utterly worthless.

And keep in mind that this trend is now two years old! That’s getting to be a very long inflation.

And can we PLEASE get some clarity on what we mean here by inflation? It means the value of the dollars in terms of the goods and services you want to buy. It does NOT mean the value of the dollar in terms of other foreign currencies you purchase. The dollar on international currency exchanges is indeed strong, which is why you can travel most of the world and live better than the locals. But come home and try to buy a cocktail and you will be pillaged.

The crucial takeaway from today’s CPI release is that this is not getting better. It is getting worse. The Fed’s policy is so far a flop just like so many other policies. How much longer will this go on? Already the 1913 dollar is worth about 3 cents. Are we seeking to drive that to 1 cent or less?

At some point, these ridiculous headlines just don’t matter. American consumers know the truth. This is a great pillaging to go with the great reset.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.