Commentary

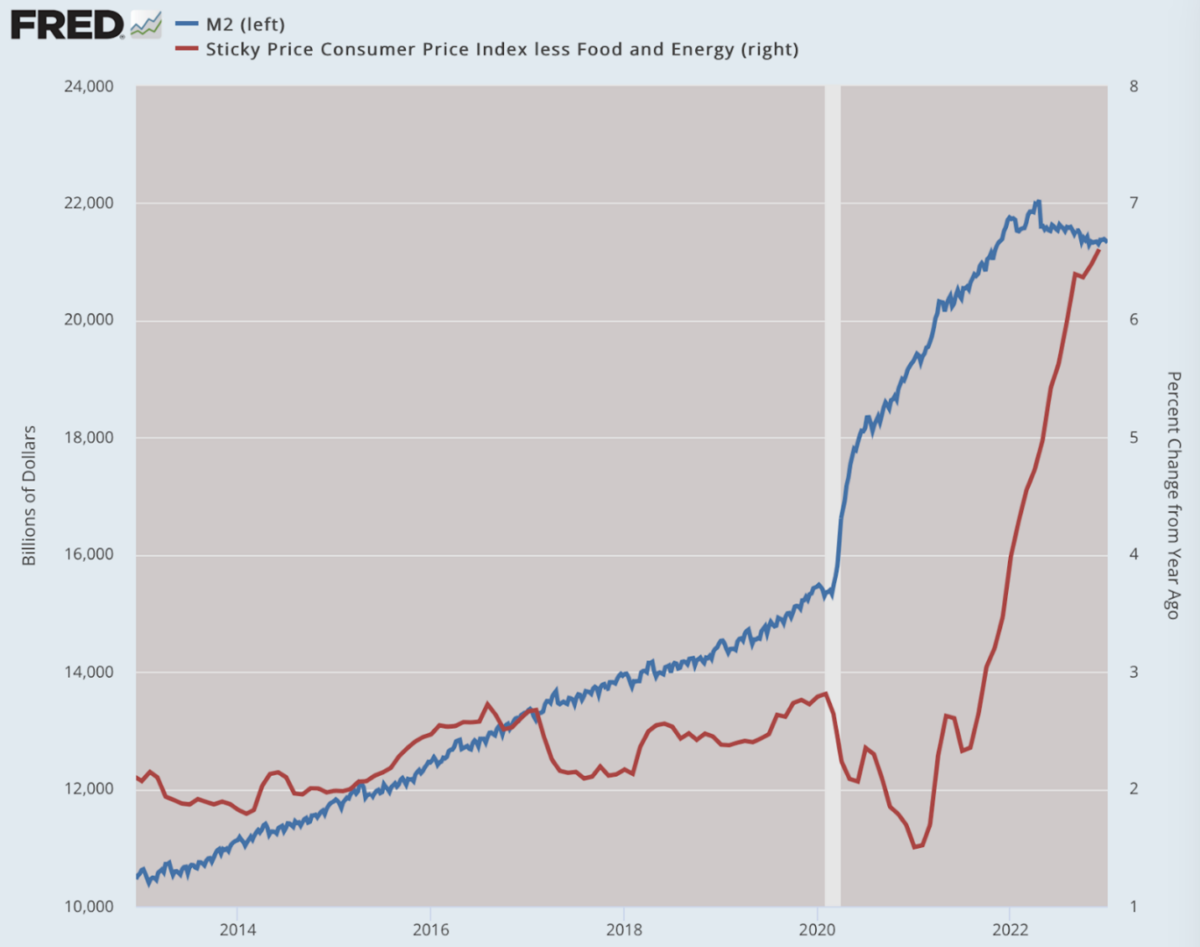

There are many ways to measure the amount of dollars that exist today but let’s choose M2 because it seems most reliable for now. There are now 21.3 trillion dollars extant. That’s $6 trillion more than existed just three years ago.

For perspective, the entire USD money stock just ten years ago was $6 trillion. That means that in just three years, the Fed has enabled the creation of 40 percent of the whole of the existing dollar-based money stock. That’s how much the economic landscape has shifted thanks entirely to Congress’s dangerous and crazed spending frenzy and the Fed’s willingness to accommodate it.

The rate of creation right now is currently flat, which is good as far as it goes. This is due to the shift in monetary policy in an attempt to tame inflation. But there is nothing to be done about the floods that already exist. Those $6 trillion have to become part of our daily economic reality, which is to say that prices absolutely must adjust upward. They have and they will continue to do so.

One way to measure price increases is to delete the most volatile sectors of food and energy and examine that which more clearly reveals the extent to which upward pressure is embedded. Looked at this way—through the lens of the so-called sticky rate of inflation—we see no evidence of taming. The sticky rate in December was higher than ever before.

The direct causation of the Fed’s money pumping is undeniable. There is no reason to blame Putin or climate change or greedy corporations. The underlying cause is as plain as day. The prices chase the money. There is still tremendous potential for rising prices. The Fed knows this. For this reason, there will likely be no pullback in the quantitative tightening for a long time.

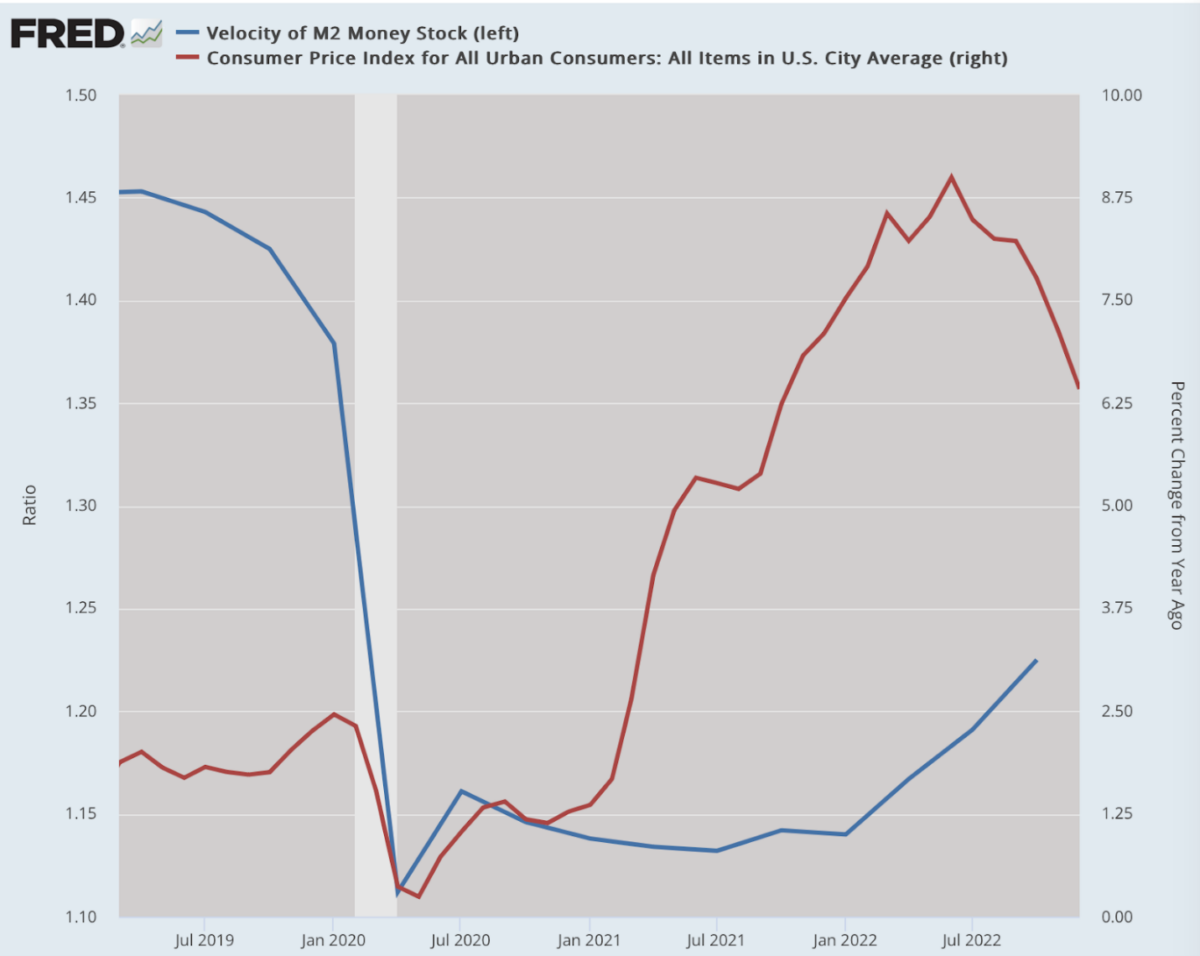

Velocity has been mercifully low since the lockdowns. That has kept a lid on prices. If we had the same amount of velocity today that we had in 2000, prices would be moving dramatically up at a much faster pace. Nonetheless, the potential is still there. Velocity has been rising slowly over the last two years but we are nowhere near where we were in normal times. Should that change, look out! Faster velocity feeds inflation.

However, given the prevailing disaster of corporate and household balance sheets, it will likely stay quite low. By historical standards dating back to 1960, existing money velocity is running at about half of its long-term average.

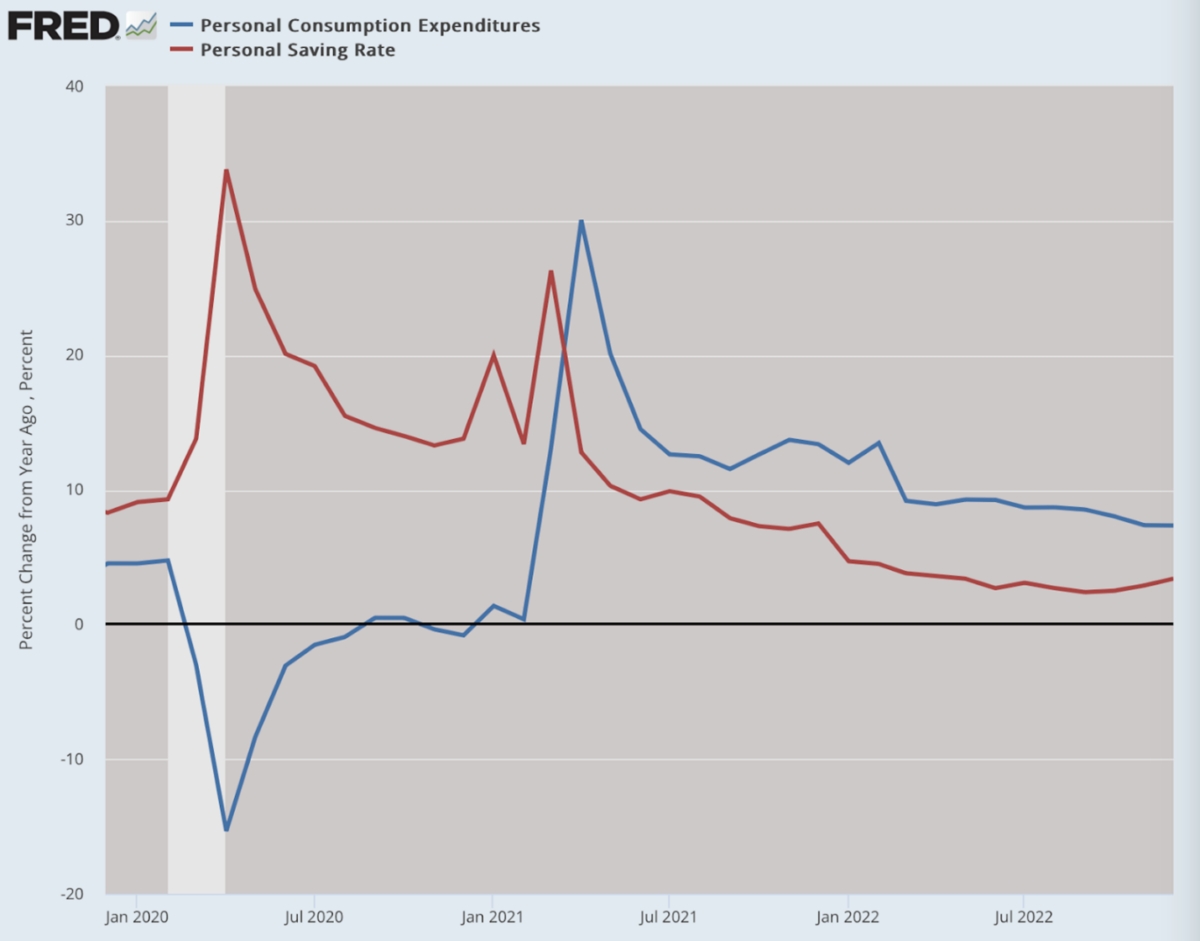

We face a remarkable situation right now. Consumer spending is weakening. Usually that happens because people have decided to save more of their income. But savings have never been lower. What possibly can this mean? To put it plainly, it means that most people in the middle and working classes are getting poorer by the day, with no end in sight. The financial candle is burning at both ends.

Finally, the Wall Street Journal is starting to get it, running an article with the implausible title “The US Consumer is Starting to Freak Out.”

“It’s a stark turnaround from the second half of 2020, when Americans lifted the economy out of a pandemic downturn, helping the U.S. avoid what many economists worried would be a prolonged slump. Consumers snapped up exercise bikes, televisions and laptop computers for schoolchildren during lockdowns. When restrictions were lifted, they rushed back to their favorite restaurants and travel destinations.”

“And they kept spending, helped by government stimulus, flush savings accounts and cheap credit, even as inflation picked up. Faced with four-decade-high inflation last year, Americans outspent it. Through most of 2022, consumer spending growth exceeded price increases by about 2 percentage points.”

All that has changed and quite dramatically. Adding to that are new fears among professional classes that job opportunities are drying up. Indeed they are. The change in the yield curve, with rising short-term rates, has shifted the attention of big capital away from long-term speculation and toward more immediate payoffs. This means that there are plenty of jobs available in hospitality and food service but ever fewer in the jobs that credentialled people actually want: getting paid the big bucks to do nothing.

As an example, the openings for remote work have pretty much dried up. The salad days of 2020 and 2021 are likely gone forever.

The feeling of being economically trapped is sweeping over vast numbers of people. Tragically, most people have no idea who to blame or what to do about it in any case. The entire system feels rigged these days, with far-distant elites running the world and utterly uninterested in what average citizens are going through. This is not only true in the United States but all over the world.

We have lived through a great pillaging, not only of our prosperity but also of basic rights to freedom itself. These days we see a few victories in the courts here and there but it is not nearly enough to compensate much less disempower the bloodless elites who have done this to us. There is a path toward restoration but it means doing exactly what the ruling class fears the most: restore the Constitution and take away all power from the globalized bureaucratic elites who have so mismanaged the world.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.