Commentary

The saving grace of the U.S. economy for most of 2022 had been employment, which had printed positively each month. Employment even seems to have ameliorated the two consecutive quarters of declining GDP that occurred in the first half of the year that we identified as a recession. Unfortunately, we don’t think 2023 will be so auspicious.

Consider that:

Our view is that all this points to declining economy, a pullback on rate hikes by the Federal reserve, and, likely, recession.

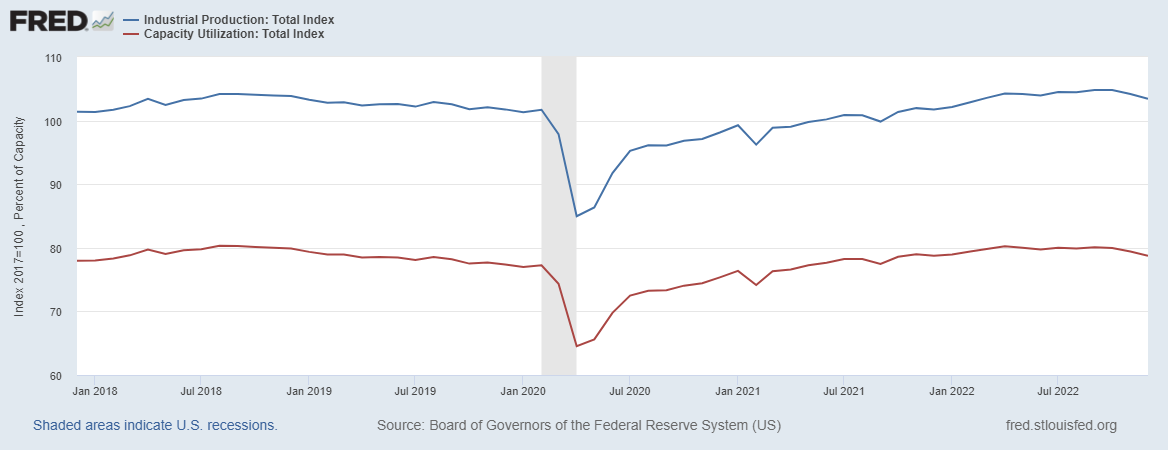

The Industrial Production Index dropped from its all-time September high, falling by more than 130 basis points by December. Capacity utilization also tipped down more than 120 basis points since September.

Fourth-quarter 2022 earnings for most of the tech sector started yesterday and are due over the next two weeks. It’s disconcerting that the tech sector layoffs were announced before earnings releases; it likely signals earnings misses. It also signals that the go-go growth days of tech are either in pause or over, absent some clear new innovation, such as artificial intelligence. Moreover, given the weighting of the tech companies in the various indexes, it likely signals a flat market for the next few quarters. (As an example, Microsoft’s earnings printed above expectations, but forward guidance was negative.)

Japan and China are both coming out of the pandemic, but their own consumer economies are moribund, and both hope to restore growth through their exports. But real consumer spending on goods in the United States is in decline, falling 0.6 percent in November and 0.2 percent in December. We expect, then, a glut in inventories from imported goods in the next few months and a decline in prices in most manufactured goods, particularly consumer durables. But we also expect this will increase unemployment in domestic (U.S.) durable goods manufacturing, which tend to be—like the tech sector—higher wage and, often, union jobs. Finally, the glut of goods will cause margin pressures on retailers as price-cutting to clear excess inventories will affect consumer markets for several months.

The Institute for Supply Management’s Purchasing Manager’s Index has shown decline consistently over the last seven months and has been since November below 50, signaling contraction. The latest figures are for December.

All these data point to reflect a slowing, or even contracting, economy, likely in the the later quarters of this year. Other data, such as housing starts, point to a similar slowing.

That tends to indicate that the Fed might slow its pace or percentage rate of its ongoing interest-rate increases. Fourth-quarter 2022 GDP printed at 2.9 percent; it’s a key indicator of the Fed’s future actions. But it seems clear from the Fed’s own projections interest rates for most of 2023 will be 50 basis points—0.50 percent—or less going forward and, perhaps, even pause in an attempt to achieve a “soft landing”—that is, avoid a recession and substantially higher unemployment—leading into the 2024 election year.

But such a soft landing will be incredibly difficult, given a long-standing inverted yield curve, where investors can earn higher earnings from funds in shorter-term investments than longer-term bonds. An inverted yield curve tends to indicate investors are pulling their money from riskier investments (like new businesses) in favor of safe, risk-free, investments. Add to this already volatile mix the dispute over the debt ceiling and it spells a rocky few months—and maybe quarters—for the U.S. economy.

We think the odds of recession in 2023 are about 70 percent, led by the manufacturing sector, most likely starting in the third quarter.

DISCLOSURE: The views expressed, including the outcome of future events, are the opinions of The Stuyvesant Square Consultancy and its management only as of January 25, 2022, and will not be revised for events after this document is submitted to The Epoch Times editors for publication. Statements herein do not represent, and should not be considered to be, investment advice. You should not use this article for that purpose. This article includes forward looking statements as to future events that may or may not develop as the writer opines. Before making any investment decision you should consult your own investment, business, legal, tax, and financial advisers. We associate with principals of TechnoMetrica on survey work in some elements of our business.

Note: Our economic and business commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.