by HERBERT COGGINS

DURING the war many people speculated whether Stalin, Churchill, or Roosevelt would emerge as the dominant figure of the post-war world. We all know now that the ultimate and victorious survivor is the tax collector. War, defense, and diplomacy may carry on for years, but the nation’s eternal future rests with the Collector of Internal Revenue.

lie will have a profound effect upon our race. Already neuropsychiatrists are reporting cases of tax shock, a new disease more to be feared than the strain of battle, and one that shows little response to sulfa derivatives. Its victims, who once faced enemy shell stoically, grow hysterical at the mention of shelling out. The malady often leaves the patient paralyzed in the check-writing fingers, and unable to raise a hand up to the small-change pocket.

There is but one way to face the inevitable: condition ourselves to it. Orientals can nap on a bed of spikes, South Sea Islanders tread barefoot on glowing coals, and some of our most stable people have learned to swallow raw oysters and olives. A widespread taste for taxes, however, promises to be of slower growth.

We shall have to start in the nursery. The growing infant fortunately has to accept the world as he finds it. So far as he knows, war, disease, and poverty are normal and desirable. Since he learns of them gradually, they are not disturbing. He can just as readily accept the problem of government revenue. When the child’s first questioning indicates a serious interest in the facts of national life and he asks, “ Where do taxes come from? ” we must answer frankly and leave no trace of guilt or embarrassment.

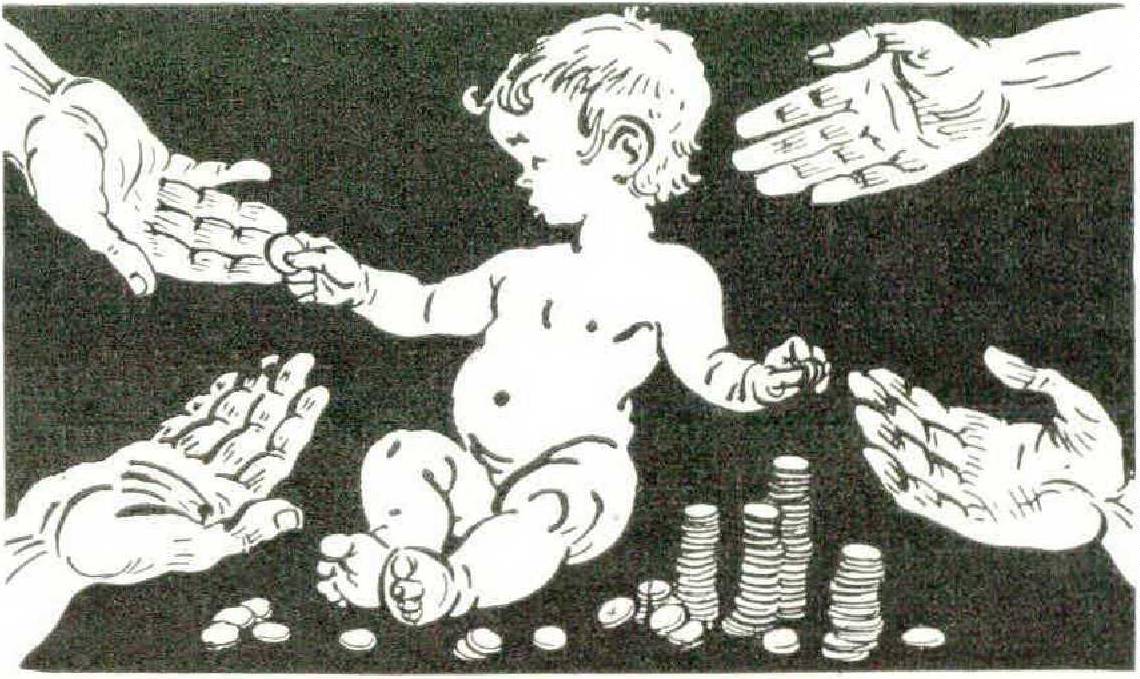

As a first step in building a nation of smiling taxpayers we must have the mint strike off millions of new small coins of trifling value. These are to be supplied to the parent for education and training and must become so commonplace to the child that he will not object to parting with them. He should be taught to play with the coinlets even in the cradle, and the parents should take part as if with ball and marbles. Then very gently, at the proper time, a coin or two should be taken from the child. The gesture should be repeated at intervals until he shows no resistance or outcry.

The purpose is several fold — to save the child from the ultimate peril of excess purchasing power and to teach him that, in future, ownership will be fleeting at best. At the same time it prepares him to accept the function of tax collector and greatly softens the impact when, in later years, he meets the genuine official.

As a safety measure very young children should wear muzzles to prevent the swallowing of coins. This is more than a surface precaution, for it is now recognized that accidents of like nature have a psychological effect, and can mark a person for life. Otherwise later, as an adult, the victim may be unable to part with the smallest token without symptoms of retching and distress.

It is now generally believed that many of our unpopular money-changers owe their allergy to taxes to coins swallowed in infancy.

As soon as the child shows no hostile reaction to parting with money, he should be given a small well-filled purse. Thereafter coins should be taken from him only on planned occasions, related in his mind with something pleasant. It would be particularly constructive to relieve him of a coin while handing him his milk bottle or when he plays with his favorite toy. A subtle trading with cookies or lollipops might implant within the child the feeling that he is getting something for his taxes — an attitude hard to acquire in later life.

During the speech-forming period the infant should be taught to spell and pronounce the word tax, learning it lightly and musically in happy moments. This will dispel in advance the disturbing reactions of the future adult. Introducing the term into nursery rhymes and bedtime stories will add an aura of good feeling. In the tales such characters as ogres and robbers might significantly be identified with tax evaders.

Throughout the training, one precaution is imperative. The child must never be left emptyhanded. The relation between property owner and tax taker, already severely strained, should never be definitely broken. We must not overdevelop the giving-up impulse and destroy the constructive urge to become a large taxpayer.

Already there is a popular school of economic thought which blames all our national ills on taxation. They point with reason to the enormous cost of tax collection. This they would correct by having no taxes to collect. They propose that we all take our belongings, move into publicly owned buildings, and do government chores for food, board, and pocket money. With the money thus saved they propose to retire the national debt.