No foreign power will ever be allowed to buy a UK newspaper or magazine: that’s the upshot of this week’s debate in Parliament. The new law, due in a few weeks, is also expected to rule out minority stakes. So what next for us — and the Telegraph? It has been said that the Emiratis may have been our best bet because no one else wants to invest in newspapers and magazines. The opposite is true. It’s a point that needs to be more widely understood, so I’d like to say something about the auction we came so close to completing last December.

Neither The Spectator nor the Telegraph need a penny of anyone else’s money

Some twenty-two bidders had contacted Goldman Sachs to say they were interested in The Spectator, the Telegraph, or both. It was an amazing list, including some of the most respected names in British and European publishing. There were also some names who had no publishing or political interests but who loved the magazine and wished to continue its traditions. When I saw the twenty-two, I thought I’d have been happy with nineteen of them and delighted with ten. Editors don’t choose proprietors (it works the other way around), but with the stellar list that Goldman had assembled there was a very high chance of a good ending. In the end, we had whittled the list down to a final four.

And investment? Crucially, neither The Spectator nor the Telegraph need a penny of anyone else’s money. We’re both profitable. We don’t need a sheikh or a sugar daddy. All we need is an owner who will let us invest a bit more of our readers’ money in journalism. So: accept lower but still-respectable profit margins and let us invest the rest. That would give us all the cash we’d need to double our subscriptions yet again.

I believe that anyone who ended up with The Spectator would agree to this fairly modest proposal (albeit with radical effects for us). So resuming the auction process would most likely mean a good owner — and getting the investment in journalism that we need. The risk for us now is that being kept in purgatory, as a long list of people wonder what to do with us.

An auction reconvened now would see the original bidders back, their files still fresh. Leave this until after the summer and the whole timeline could be longer, more expensive and with harmful consequences. One of the reasons that Parliament acted now, rather than wait for the end of the Ofcom process, was that it knew the damage that such delays can do to publications in a fast-changing industry. As Lord Moore said in the parliamentary debate:

The delay involved has been very difficult for newspapers in general, and particularly for my own and for The Spectator, because while you do not know what will happen you cannot really get on with doing your journalism. That tends to erode things if you are not careful, so it is very important that we have got to the heart of it.

A new auction can be done quickly, as the work was done. It doesn’t need to be a protracted process. We can get them all booked into the Hope & Champion in Beaconsfield for a few days (a Wetherspoons staycation venue, Katy Balls loves it) and whittle it down quickly.

Perhaps RedBird doesn’t need a new bidder: it could find a new (non-government) funding partner and proceed. The issue isn’t the US-based RedBird or Jeff Zucker (whom I found to be professional and respectful of The Spectator’s traditions). The issue was with RedBird’s partner, Sheikh Mansour’s IMI, which was providing most of the funding. Mansour is the deputy PM of the UAE, which is why Parliament thought his bid would have been incompatible with protecting press freedom.

This RedBird IMI deal, in the end, was not to be. But the biggest favor RedBird could do the two publications at the center of this storm is to waste no time in restarting the auction. The list of bidders is still there. RedBird should be able to improve on the £600 million ($760 million) book value for the two titles which themselves are looking forward to starting the next chapter. All that’s needed is for someone to turn the page.

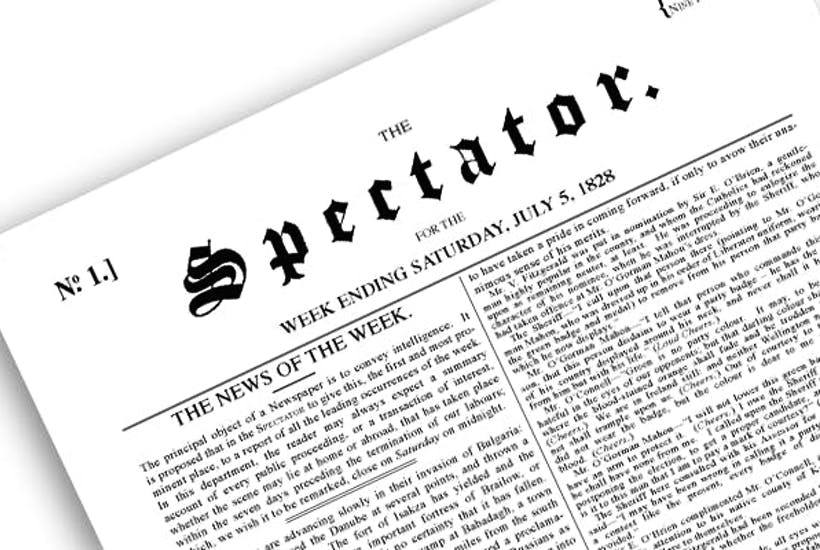

This article was originally published on The Spectator’s UK website.