With the increasing frequency of cybersecurity incidents and data breaches across government agencies, protecting your financial information has never been more critical.

But for many experts and consumer data protection advocates, the scope and number of these data breaches in recent months is a new development that everyone should take seriously.

On Tuesday, U.S. District Judge Tanya Chutkan denied a request from 14 Democrat-led states to block Elon Musk and the Department of Government Efficiency (DOGE), a temporary contracted organization the Trump administration has recruited, from accessing data systems and making personnel changes at seven federal agencies.

Increasingly, DOGE’s activities in recent weeks, as well as the safety of their own website, have raised concerns about the safety of consumer data.

"The concern right now is certainly unique, with DOGE accessing personal financial data across the government — that is certainly unprecedented in the access and scope,” says Persis Yu, deputy executive director and managing counsel at Student Borrower Protection Center. "It's not entirely clear what their relationship is to the government and what their obligations are."

Yu notes that lack of firewalls for sensitive personal information within the federal government and how they plan to use this data are all causes for concern.

Bruce McClary, senior vice president of communications at the National Foundation for Credit Counseling, which is one of the oldest non-profits offering credit counseling services in the U.S., also says data breaches are increasingly common.

"So much of our data has been breached and stolen that everyone should assume they're vulnerable to identity theft."

"The more dependent we are on technology, the more we use these interconnected payment systems and data storage of account information with big retailers and banks, the more likely it is that there is going to be some vulnerability, and there may be a data breach where some of your information may be exposed,” he notes.

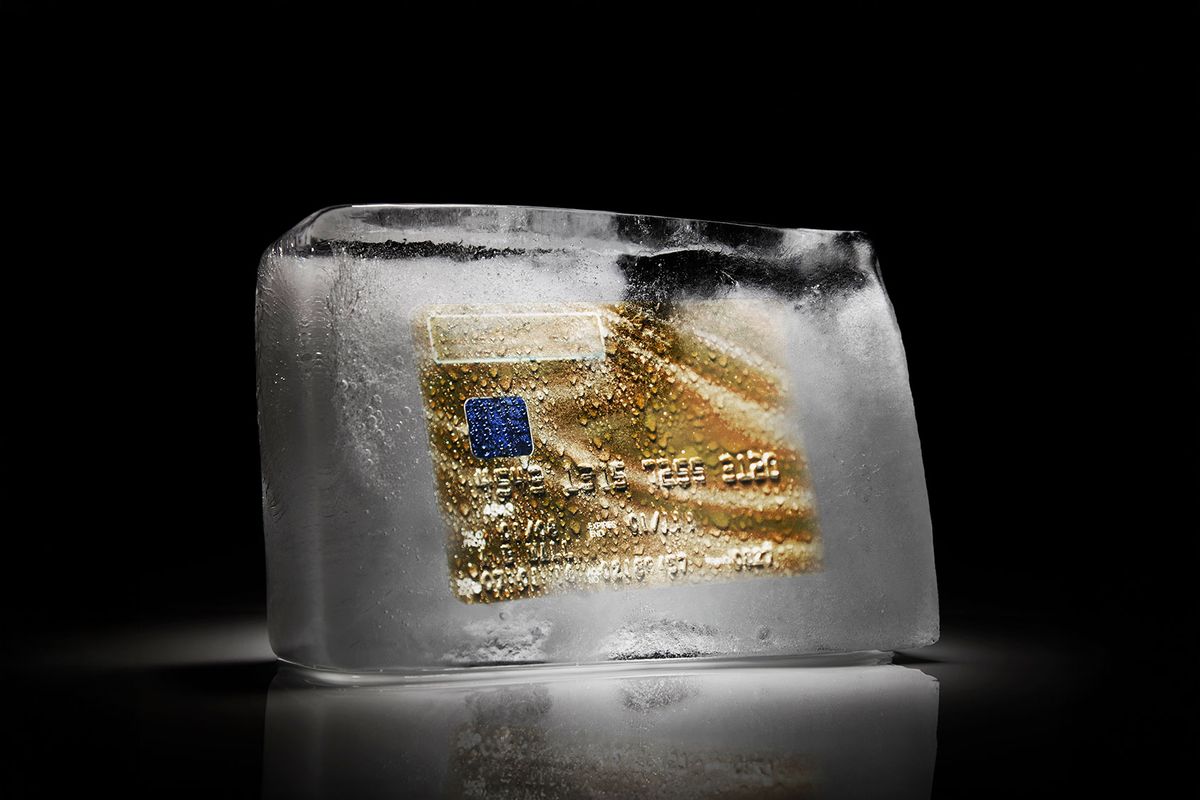

Many financial experts like McClary are encouraging consumers to consider freezing their credit as a proactive measure against identity theft, especially if you’re planning any big purchases or moves in the immediate future.

For most consumers, a credit freeze can be a powerful tool that restricts access to your credit report, making it significantly more difficult for fraudsters to open new accounts in your name.

This added layer of security is particularly valuable in an era where personal information is frequently compromised in large-scale data breaches.

Liz Weston, author of “10 Commandments of Money,” also says credit freeze can be a good idea.

"So much of our data has been breached and stolen that everyone should assume they're vulnerable to identity theft,” Weston notes. “Freezes are relatively easy to set up and to temporarily suspend if you want to apply for credit.”

One of the most compelling reasons to freeze your credit is that it's now free to do so. In 2018, a new law mandated that the three major credit bureaus — Experian, Equifax and TransUnion — allow consumers to freeze and unfreeze their credit at no cost. This development has made credit freezes an accessible option for everyone concerned about their financial security.

To freeze your credit, you'll need to contact each of the three major credit bureaus individually. Once your credit is frozen, you can temporarily lift the freeze when you need to apply for credit, and then reinstate it afterward.

We need your help to stay independent

It's important to note that a credit freeze doesn't affect your ability to use existing credit cards or loans — it only prevents new accounts from being opened in your name. Also freezing your credit has no impact on one’s credit score.

While a credit freeze is a robust protective measure, it should be part of a broader strategy to safeguard your financial information. Regularly monitoring your credit reports for suspicious activity and maintaining strong, unique passwords for your financial accounts are also crucial steps in protecting yourself from identity theft.

And credit freezing alone is not a panacea to all your financial and digital security worries, according to Bruce McClary of the National Foundation for Credit Counseling.

"It's more important than ever to monitor your credit activity as closely as possible, and to keep an eye on all of your account activity,” he says.

Read more

about personal finance