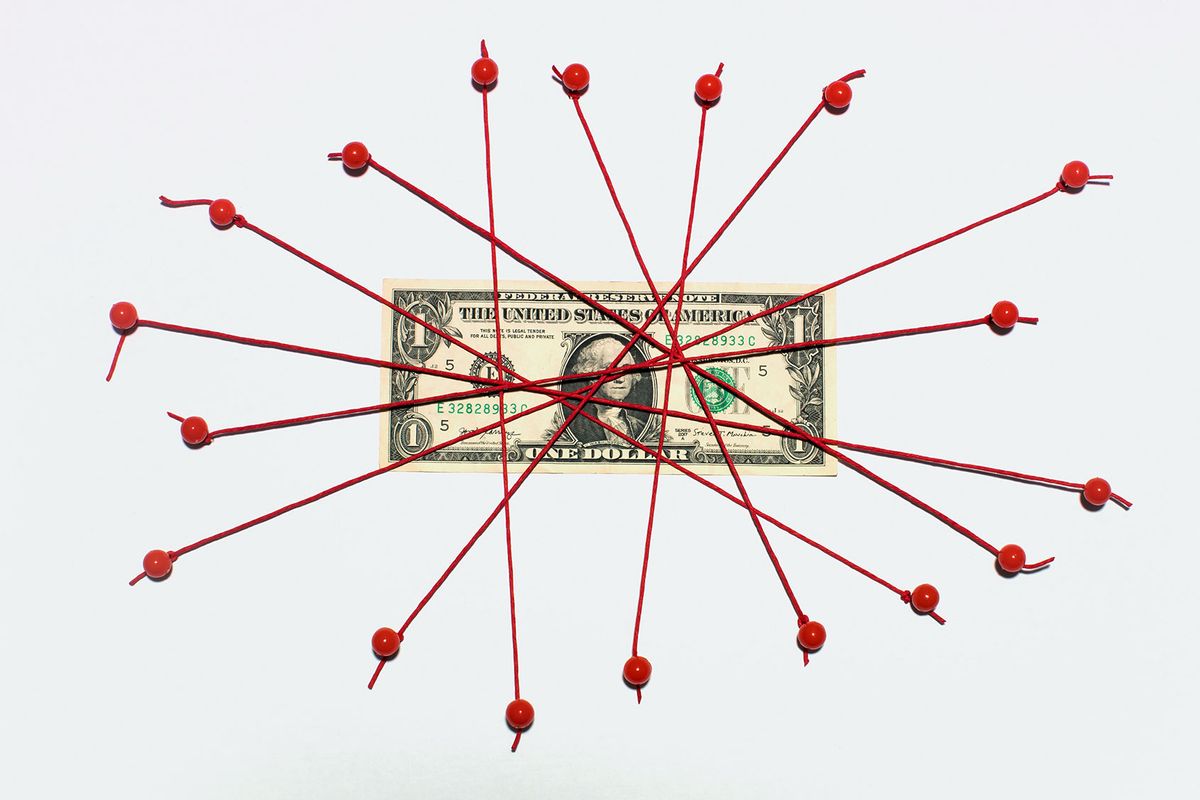

Americans are looking to tame their spending habits in response to overconsumption, ongoing inflation and a potential recession, recent analytics and social media data suggest.

While many people make bold resolutions at the beginning of the year that evaporate before the end of January, this "no-spend" trend feels different, according to industry experts.

"Typically, people will freeze their spending for a month or two, but lately we’ve been seeing content creators on TikTok going to the extreme, with some talking about doing this trend for the entire year," Rianka Dorsainvil, Chime's consumer certified financial planner, told Salon.

This shift to curb overspending picked up steam at the end of last year. The hashtags #NoBuy and #NoBuy2025 jumped 90% on X, Reddit and Pinterest between Dec. 1 and Jan. 1, according to research conducted by Chime using Meltwater, a social analytics tool.

On TikTok, the no-spend trend is even more popular, according to Chime analysts. The hashtag #NoSpendChallenge reached over 25,000 posts as of January, with hundreds of content creators posting about their plans to have a “no-spend” or “low-spend” year in 2025, according to publicly available data on TikTok.

We need your help to stay independent

TikTok's's power and influence continue even as it faces a ban in the U.S. Many Americans use it for financial education: According to research compiled by Chime, one in four Americans used FinTok — the financial side of the app — to search for savings tips in 2024. Over 50 percent plan to use FinTok more in 2025, with 37% saying they'll use it to get out of debt.

"While this concept isn’t new, its current popularity reflects a growing desire among consumers to reassess their spending habits and financial priorities. Anti-consumerism has definitely skyrocketed over the past year," Dorsainvil said.

Holiday shopping might be one reason our wallets are tightening. Roughly 36% of Americans took on new credit card debt during the 2024 holiday season, accruing an average of $1,181, according to a survey conducted by LendingTree.

But political and economic stressors are another reason for shifting consumer sentiment.

Recent Bankrate data shows many Americans feeling significant financial pressure, with more than two-thirds saving less due inflation and 69% concerned about covering immediate living expenses if they lose their primary source of income.

An Alix Partners poll conducted last September and October showed U.S. consumers planned to spend 16% less in 2025. A survey conducted after the presidential election showed they planned to spend a bit more, however.

"I recommend adopting a 'low-buy' approach. This method encourages a significant reduction in non-essential spending rather than eliminating it entirely."

Consumers say they're planning to cut back on discretionary expenses — eating out, entertainment and shopping.

While limiting spending is a solid strategy for many, taking this type of challenge to the extreme is not necessarily a viable financial plan or the path to a healthy relationship with money, Dorsainvil warned.

"As a certified financial planner, I have some reservations about this strategy," she said. "While temporarily refraining from non-essential purchases can effectively reset spending habits and enhance savings, it may not be sustainable or beneficial for everyone in the long term. Instead, if consumers are interested in this strategy, I recommend adopting a 'low-buy' approach. This method encourages a significant reduction in non-essential spending rather than eliminating it entirely."

Read more

about personal finance