THE AMERICA ONE NEWS

Oct 8, 2025 |

0

| Remer,MNSponsor: QWIKET

Sponsor: QWIKET

Sponsor: QWIKET: Sports Knowledge

Sponsor: QWIKET: Elevate your fantasy game! Interactive Sports Knowledge.

Sponsor: QWIKET: Elevate your fantasy game! Interactive Sports Knowledge and Reasoning Support for Fantasy Sports and Betting Enthusiasts.

topic

National Post

24 Feb 2025

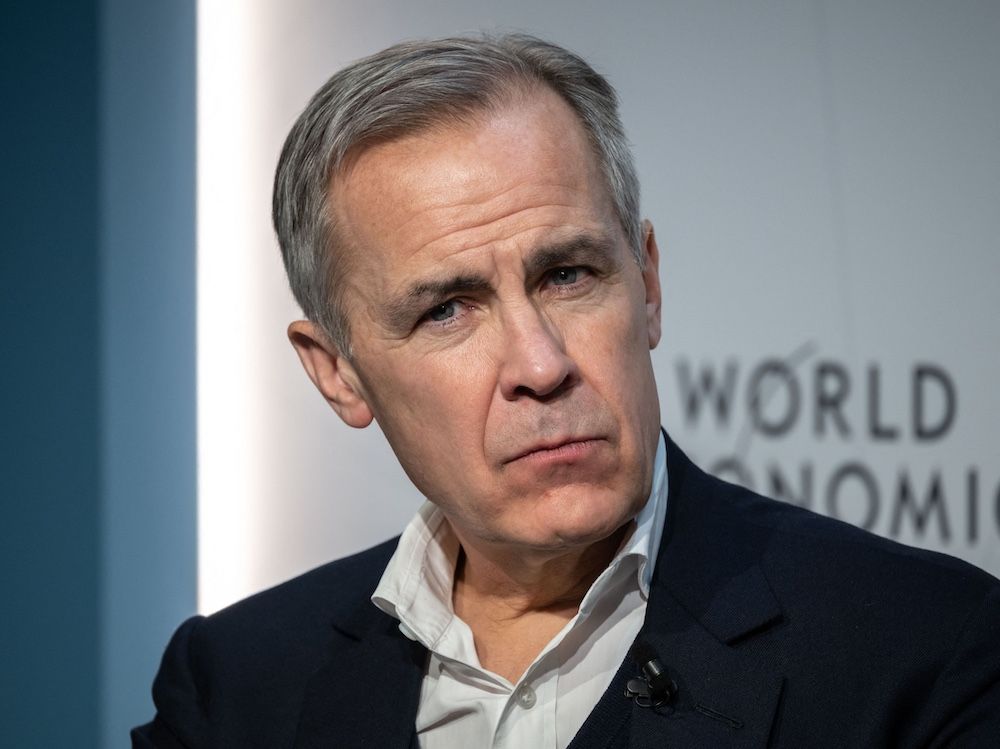

Recently, Mark Carney sat back and failed to negate the claim that he deserved credit for having saved Canadian banks from the misadventures of our American neighbours during the 2008 financial crisis. Carney can claim no such credit. In actuality, there are historical reasons for Canada’s lack of vulnerability to such financial upsets, including a divergent institutional pathway and regulatory changes recommended by Canadian Supreme Court Judge Willard Estey that safe-guarded Canada’s banking system from the financial crisis.