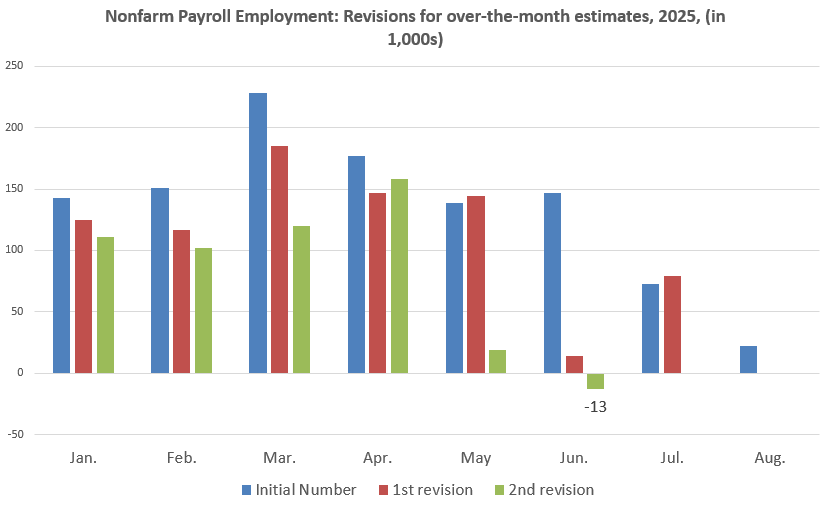

If you’ve been paying attention to how jobs data is reported in this country, you know how the scam has worked over the past two years: first, release a very positive jobs numbers—often labeled a “blowout” jobs number. When this number comes out, the usual media “journalists” and finance pundits tell us all how totally amazing the US jobs market is. Then, after the initial reports have died down, and the general public is no longer paying attention, the federal government then quietly releases revised numbers that show the jobs situation for that month was actually considerably less impressive than initially reported. This has happened nearly every month in 2025, with revised numbers repeatedly coming in below—often well below—the initial reported numbers.

In March, for example, we were told that jobs went up by 228,000 in that month. Then, by the third revision, the number was reduced by more 100,000 jobs, with the final number being only 120,000. In May, this revision process has reached almost absurd proportions. For example, in May, the initial report was that the US economy saw 139,000 new jobs during the month. After the final revision, that number was reduced to mere 19,000 jobs. Things were even worse for June, with the initial total of 147,000 jobs revised down to negative 13,000 in the final revision. (We have yet to see the final revision for July.)

[Read More: “The Jobs Economy Worsens as Full-Time Work and Manufacturing Jobs Disappear“ by Ryan McMaken]

The job market has become so bad that July’s initial jobs total was only 73,000, and August’s initial number is 22,000.

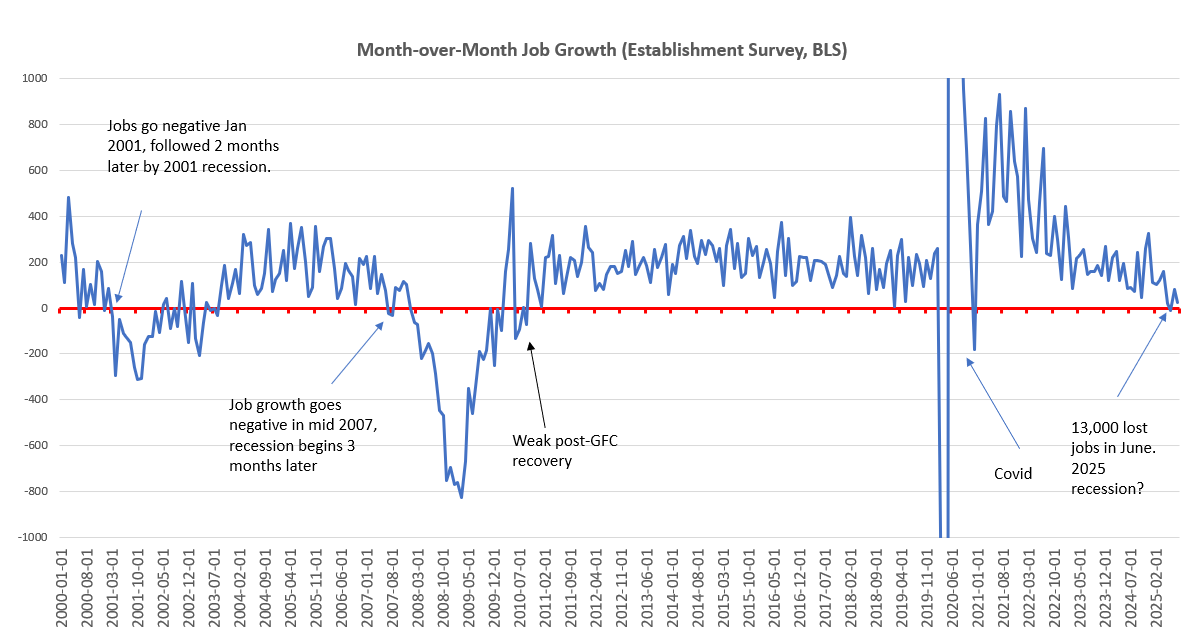

But June’s number really sticks out like a sore thumb right now because it shows actual month-over-month job losses in June. This is notable because the BLS almost never reports month-over-month job losses in any month unless that month occurs during a recession or in the early months of recovery after a recession.

When was the last time we saw a month-to-month decline in jobs? We have to go back to December 2020 to see that—back when the economy was in a terrible state thanks to covid lockdowns and the general covid panic. Before that, we find month-over-month jobs losses during March and April 2020, during the depths of the covid recession. To find a month of negative job growth before that, we have to go all the way back to 2010, when the jobs market was still digging itself out of the Great Recession.

In other words, for decades, a month of job losses is a sign of an extremely weak or recessionary situation. We also find month-over-month job losses during 2008, in the midst of the 2007-2008 recession itself. And, of course, we saw many months of job losses in the wake of the dot-com bust, from 2001 through much of 2003.

There’s really no way to portray this jobs report—and the included revisions—as anything we might call a “solid” jobs situation. With an average of only 29,000 jobs added per month over the past three months—and with most of those jobs being part time jobs—the jobs situation is essentially flatlining in the United States.

Indeed, the jobs report was so bad that Donald Trump—who is usually full of blowhard bluster about how magnificent the US economy is—had virtually nothing to say about it, except to have his appointees blame the federal statisticians who compile the data. Trump sent his underling Kevin Hassett, director of the National Economic Council, to go on Fox News and declare that the jobs numbers are actually much better than the numbers reflect. How much better? Hassett doesn’t know, of course, he only “knows” that the present estimates must be wrong. The numbers are great in Hassett’s imagination, though.

Oddly enough, the Trump administration didn’t complain about the statisticians when the BLS was publishing “blowout” positive numbers—like the initial reports for March and April—when numbers favored the administration. Apparently, the statisticians were doing a great job in April. But now that the numbers look bad for Trump, the statisticians are suddenly doing a bad job.

Trump blamed the massive downward revisions for May and June on the statisticians who trump claims are trying to make Trump look bad. The truth is that the federal number crunchers haven’t really changed their song and dance in more than 18 months. During early 2024, it became apparent that the BLS was repeatedly putting out very good initial numbers, only to be followed by big downward revisions. This did not stop with Trump’s inauguration, and continues to this day. If the job numbers are now starting to look worse, it’s likely because the employment situation is considerably worse now, compared to 2024. But who can be surprised by this? Credit-fueled expansions don’t last forever, and as sticky price inflation refused to go away in 2024, the Fed couldn’t simply keep the easy-money flowing to create the impression of a strong job market. That may have worked in 2021 and 2022, but then price inflation hit a 40-year high and the Fed had to scale back its runaway monetary inflation to keep price inflation from getting totally out of hand. But, after two years of rampant money printing to the tune of five trillion dollars, it took nearly two years for the job market to reflect how the Fed had let up on the monetary accelerator.

That’s what we’re now seeing. The easy-money fueled job growth of the post-covid inflationary bonanza is finally showing its unpleasant downside. This is made worse by trump’s huge tax increases in the form of tariffs, but the origins of the current slowdown lie in the monetary boom that came before. The only way to avoid a continued stagnation—or outright bust—in the jobs economy is to step on the monetary accelerator. That however, would continue to impoverish ordinary Americans who suffer from the price inflation of the Trump-Biden years. The choice now is between a jobs bust, renewed aggressive price inflation, or Japan-style stagnation. Trump can blame the statisticians all he wants, but the grim reality is getting harder to hide.