The BLS has reported a slight uptick of the CPI inflation rate, to 3.1 percent. Reporters who dislike Donald Trump are assuming that this uptick in price inflation must be due to President Trump’s tariffs. This is really no different than when people who disliked Joe Biden falsely blamed inflation on his fiscal deficits.

If tariffs had caused a slowdown in GDP growth, relative to M2 money supply growth, this may have caused an uptick in price inflation. GDP growth in 2025 has been pretty good, and is projected to be good for the remainder of the year.

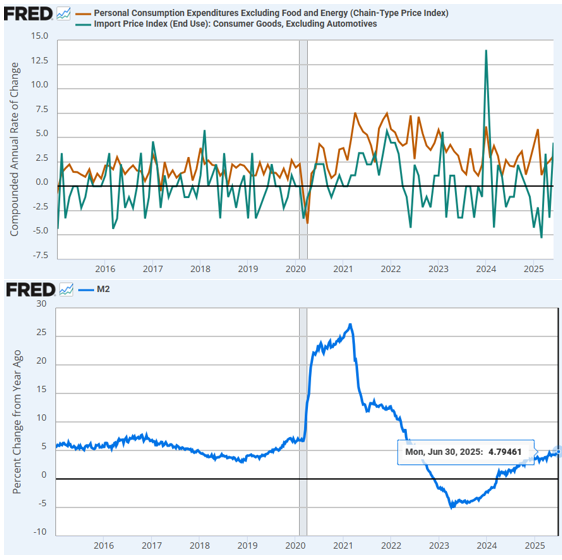

A quick look at the data indicates that import prices have not been rising faster than prices generally, so far this year. The import-export sector of the US economy is a small part of US GDP anyway.

Why is the CPI inflation rate up? The rate of money supply growth has been picking up, and is approaching 5% (see the graphs below). The US had very low CPI inflation back in 2018 and 2019 when M2 money supply growth was slowing down and fell below 5 percent. We should also note that the recent wave of price inflation in 2021 came without tariff increases- but with large M2 money supply increases.

People dislike inflation, and with good cause. However, we should not use price inflation as a cudgel to beat up our political opponents by merely assuming that whatever policies political opponents have implemented must be the cause of inflation.

Tariffs distort international trade and reduce efficiency. Tariffs do not cause sustained increases in price inflation rates, and Fed officials know this. Central banks cause price inflation by cutting short term rates and increasing the money supply. Perhaps the Fed Chair should reconsider his plans to cut short term rates during the second half of 2025.