Well, it was tariff D-day — again. President Donald Trump’s sweeping reciprocal tariffs on almost 70 US trading partners went into effect at midnight on Aug. 7. The financial markets shrugged off the event, with investors ostensibly taking the president’s advice of not being a “panican.” Now that higher import duties have been officially implemented, it is time to play the waiting game.

All eyes were on Aug. 1 when country-specific tariffs were supposed to take effect. However, the administration postponed it to Aug. 7 to allow the authorities to adapt to the new tariff regime. Whatever the case, the president’s latest executive order officially codifies a key tenet of Trumponomics 2.0.

While Trade Representative Jamieson Greer told CBS News’ Face the Nation that the tariff rates “are pretty much set” and will unlikely be lowered in the coming days, Trump and Treasury Secretary Scott Bessent have stated that it is not the end of the world. In other words, countries can also phone the White House and ask to negotiate better terms.

As of now, the current average effective tariff rate, according to the Yale Budget Lab, is slightly more than 18%, a 90-year high. And, according to the president, more is to come.

In a lengthy and humorous interview with CNBC’s Squawk Box, President Trump announced that he will soon unveil the details of a new tariff scheme for semiconductors and chips. This follows through on previous threats and could be announced before the end of August.

Trump confirmed that he will also release details of tariffs on pharmaceutical imports. Comparable to a previous proposal, the president said he would first introduce a “small tariff” on foreign drugs before slapping a “maximum” import duty of as much as 250%.

The objective for these levies? According to Trump, the administration wants to manufacture semiconductors, chips, and pharmaceuticals domestically.

Good friends, better enemies? President Trump has previously referred to Indian Prime Minister Narendra Modi as a “friend.” Despite his positive feelings for the leader, Trump imposed an additional 25% tariff on India, bringing the total rate to 50%.

According to an Aug. 6 executive order, New Delhi is “currently directly or indirectly importing Russian Federation oil.” The directive added: “Accordingly, and as consistent with applicable law, articles of India imported into the customs territory of the United States shall be subject to an additional ad valorem rate of duty of 25 percent.”

In the past, the president has pointed to a diverse array of grievances, whether the sizable trade imbalance or the country’s membership in the BRICS. However, the latest edict focuses solely on India buying large amounts of Russian crude oil. It is no secret that Modi has increased his country’s purchases of Moscow’s petroleum products, making India the second-largest customer, with annual purchases of $53 billion.

India’s government was not pleased by the action, calling the decision “unfair” as it needed to provide a population of more than 1 billion people with affordable energy. “It is therefore extremely unfortunate that the US should choose to impose additional tariffs on India for actions that several other countries are also taking in their own national interest,” the Ministry of External Affairs said in a statement. “We reiterate that these actions are unfair, unjustified and unreasonable. India will take all actions necessary to protect its national interests.”

The Kremlin took exception to Trump’s announcement, stating that sovereign nations should be allowed to decide with whom they can trade. “We hear many statements that are in fact threats, attempts to force countries to cut trade relations with Russia. We do not consider such statements to be legal,” said Dmitry Peskov, spokesperson for the Kremlin.

Will it be enough to pressure Russia to end the war? The clock keeps ticking. All eyes on the upcoming Alaska summit involving the leaders of Russia and the United States.

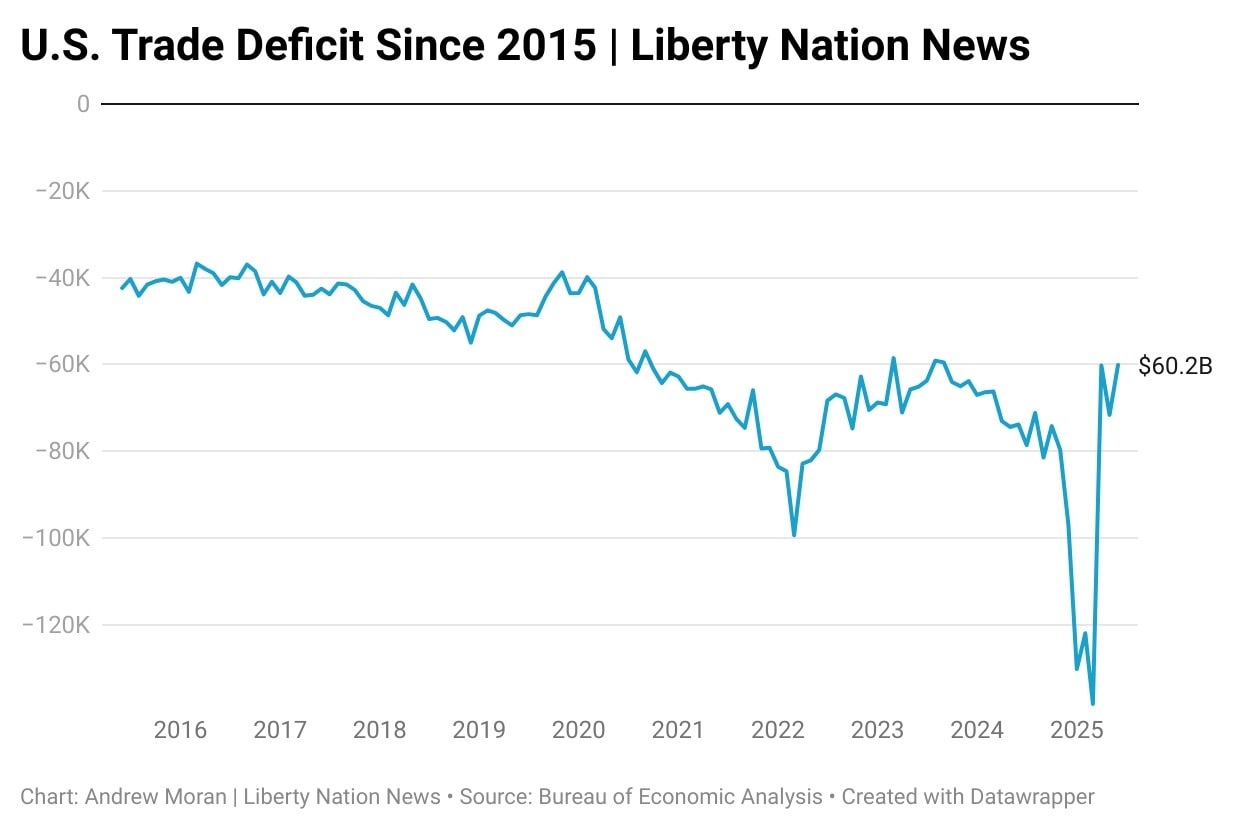

According to the Bureau of Economic Analysis, the US trade deficit narrowed by 16% to $60.2 billion in June, the lowest since September 2023. This is down from a revised $71.7 billion gap and close to the consensus estimate of $61.6 billion.

Imports fell by close to 4% to a 15-month low of $337.5 billion, while exports dipped 0.5% to $277.3 billion, the lowest since January. Most notably, the trade deficit with China and the European Union declined substantially to $9.4 billion and $9.5 billion, respectively. However, gaps widened with Vietnam and India, climbing to $16.2 billion and $5.3 billion, respectively.

This comes shortly after the Department of Commerce’s Census Bureau reported that the goods trade deficit fell by $11.4 billion to $84.85 billion in June, the smallest gap in nearly two years. Imports tumbled 4.6% to $262.9 billion, and exports slid 0.7% to $178.1 billion.

The United States and the rest of the world have moved on from the peak uncertainty observed in April. Everything has been priced in, and now American businesses and consumers wait. Either they will endure a massive bout of price inflation, or they will become wealthy from the trillions of dollars in domestic and foreign investment expected to flood the country in the coming years. Whatever the case, somebody will have to pay the tariff bill. Who will it be?