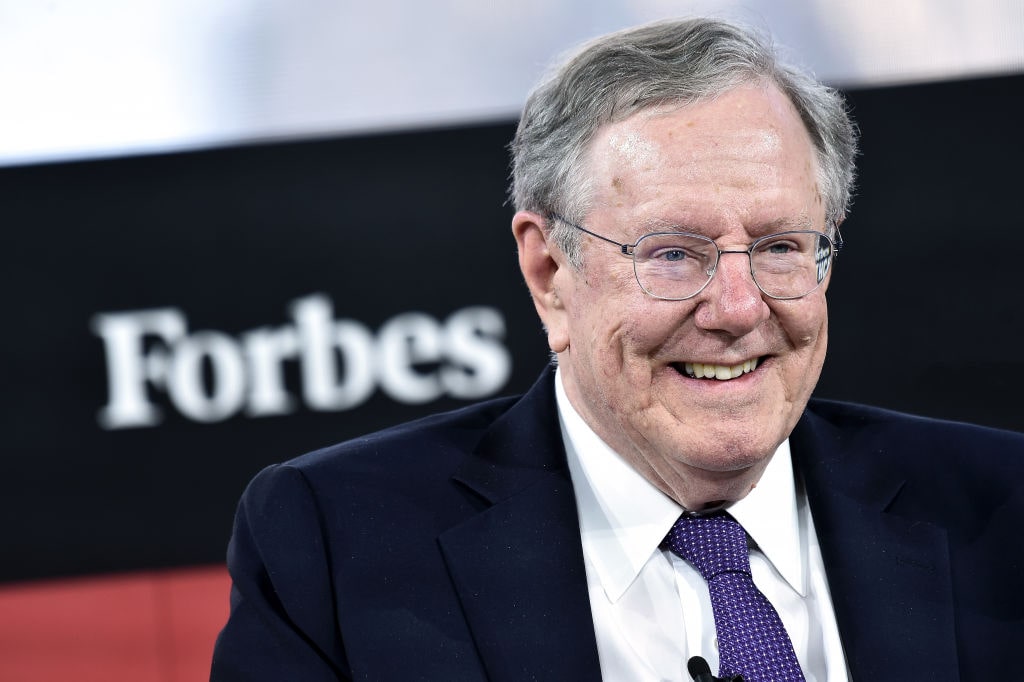

Heading into the November presidential election, the mantra of the Republican Party was “drill, baby, drill.” One month into the new administration, President Donald Trump’s catchphrase could be “cut, baby, cut.” So far, the White House is attempting to gut various aspects of the federal government. Over on Capitol Hill, lawmakers are already working on the GOP tax bill, a legislative initiative that aims to slash taxes. Steve Forbes, the famous publisher of Forbes magazine and former presidential candidate, has some suggestions.

In the coming weeks, the Republican Party will hold internal debates about whether to pass one big, beautiful reconciliation bill or two. Whatever path officials take, Forbes discussed the urgency of addressing tax policy before the year’s end to avoid substantial tax hikes in 2026. At the same time, according to Forbes, this is an opportunity to ensure the GOP tax bill touches upon other issues, particularly the capital gains tax.

The capital gains tax – a penalty on the profit realized from the sale of stocks, bonds, real estate, and other investments – has captured the public policy spotlight in recent years. The tax rates for short- and long-term capital gains vary, ranging between 10% to 37%, though single and joint filers with specific taxable income thresholds can pay 0%. Under the previous administration, progressive lawmakers proposed a tax on unrealized capital gains targeting affluent households. The subject sparked a fierce economic and legal debate, though it died unceremoniously, which made sense. A 2021 study found that most people rejected former President Joe Biden’s idea of taxing unsold assets.

The capital gains tax – a penalty on the profit realized from the sale of stocks, bonds, real estate, and other investments – has captured the public policy spotlight in recent years. The tax rates for short- and long-term capital gains vary, ranging between 10% to 37%, though single and joint filers with specific taxable income thresholds can pay 0%. Under the previous administration, progressive lawmakers proposed a tax on unrealized capital gains targeting affluent households. The subject sparked a fierce economic and legal debate, though it died unceremoniously, which made sense. A 2021 study found that most people rejected former President Joe Biden’s idea of taxing unsold assets.

This year, Forbes says the GOP tax bill should concentrate capital gains tax cuts, which are instant revenue raisers for the US government. Despite the potential political backlash, Forbes identified the positive economic impacts of reducing the capital gains tax, particularly for retirement accounts and pension funds, as it will bolster domestic investment.

“People who hold assets that a capital gain now realize that capital gain, because instead of 24%, they’ll be paying 15,” Forbes said in a recent interview. “You get more realization of capital gains, and then you can redeploy the money to other investments. So, there is an instant way to raise money and give a boost to the economy.”

But while there are advantages to this pursuit, Forbes avers that Republicans do not seem much interested in touching this subject.

But while there are advantages to this pursuit, Forbes avers that Republicans do not seem much interested in touching this subject.

A chief reason could be public perception. With polls suggesting that many Americans across party lines support taxing the rich, the president’s opponents can easily craft the narrative that cutting the capital gains tax is a gift to the ultra-wealthy that will be paid for by taking an ax to entitlement and welfare programs. If households struggle to pay the rent, put food on the table, and fill up their automobiles with gasoline, why would they desire reductions to the capital gains tax?

Forbes suggests that one way to overcome this is to change the rates across the board, whether on federal income or standard deductions, as part of a broader legislative package. As a matter of political tactics, the Republicans will need to get over the Democrats’ game plan of accusing the other side of trimming the capital gains tax for the rich.

Cutting tax rates will not be the only mechanism available to the Republican trifecta ahead of the midterm elections.

In one month, the Department of Government Efficiency (DOGE) has identified billions of dollars in waste. The US Debt Clock estimates $120 billion, and Treasury Secretary Scott Bessent projected that DOGE has saved taxpayers about $50 billion. Whatever the final tally may be, the “Muskivites” will find enormous amounts of waste in a wide array of federal programs, including Medicare and Medicaid.

According to Forbes, should the new administration and Elon Musk’s group of fiscal sleuths target regulations, they would greatly benefit the national economy. He slammed former President Biden for approving and instituting thousands of different rules and regulations that cost the US economy $2 trillion annually. The editor-in-chief noted that abolishing the regulatory regime might not be “glamorous,” but it would also serve as a tax cut for the country.

“Getting rid of these kinds of crazy rules, I think, will be a huge contribution,” Forbes said.

Extending the 2017 Tax Cuts and Jobs Act (TCJA) will be a sizable skirmish in Washington. One side will say that leaving the TCJA intact will add $5 trillion to the deficit, while the other party will declare that allowing it to expire will serve as a $5 trillion tax hike. Economists will pen their research papers, and pundits will debate the Trump-era tax policy on the nightly news. Whatever occurs, the discussion will require popping of popcorn – or drowning in Pepto Bismol.