July was the month when tariff inflation was supposed to rear its ugly head. Instead, the latest Consumer Price Index (CPI) report indicated that President Donald Trump’s sweeping global tariffs have yet to have a material impact on consumer prices. This has critics pointing to the August numbers as perhaps the starting point for tarifflation.

The current administration was saved by another month of decent inflation data. According to the Bureau of Labor Statistics (BLS) – yes, that turbulent agency! – the headline annual inflation rate was unchanged at 2.7% for the second consecutive month in July, below the consensus estimate of 2.8%. On a monthly basis, the CPI rose 0.2%, matching economists’ expectations. Core inflation, which eliminates noisy signals from energy and food prices, climbed to 3.1% year over year, from 2.9%. It was also higher than the market estimate of 3%.

Within the inflation report, the energy index declined by 1.1%, primarily due to a 2.2% drop in gasoline prices. Electricity costs slipped 0.1%. Food prices remained unchanged, with supermarket prices decreasing by 0.1%. The index for food away from home, such as restaurants and fast-food joints, rose 0.3%. Eggflation has been all but eradicated as egg prices fell again by 3.9%.

A closer examination of the figures revealed that services, rather than goods, accounted for much of the increase. Shelter, in particular, represented most of the CPI boost last month. Additionally, transportation and medical care services each advanced 0.8%. Monetary policymakers typically place more weight on the services side of the monthly inflation report because it can present a better outlook for long-term trends.

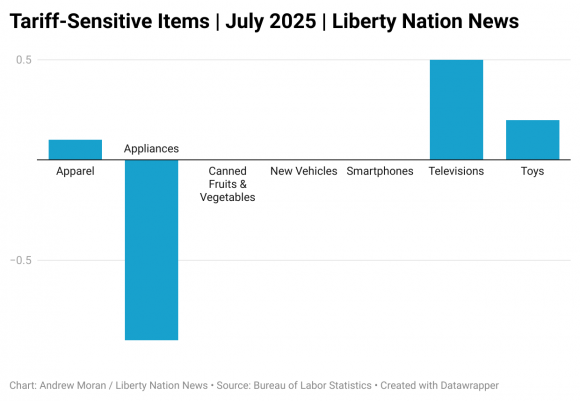

Of course, everyone was searching for clues as to whether tariff inflation was forming. Did it? Not quite. An inspection of tariff-sensitive items suggested that higher import duties did not result in higher prices for shoppers. Now, whether it was because businesses are delaying price hikes or foreigners are eating the tariffs is a debate for another day.

Of course, everyone was searching for clues as to whether tariff inflation was forming. Did it? Not quite. An inspection of tariff-sensitive items suggested that higher import duties did not result in higher prices for shoppers. Now, whether it was because businesses are delaying price hikes or foreigners are eating the tariffs is a debate for another day.

Here is a breakdown of key tariff-related goods:

President Trump and his team could take another victory lap later in the week as the Bureau of Labor Statistics releases wholesale inflation data and trade prices. Early forecasts suggest goose eggs for the July Producer Price Index (PPI) and little changes to import prices.

Did the economists get it so wrong? To be fair to the pocket protector-wearing, calculator-crunching bean counters, the president’s trade pursuits have dramatically changed since Liberation Day on April 2. Over the past four months, there have been on-again, off-again tariffs, trade agreements, pauses, and delays – it is surprising that the country is not wearing a neck brace from the whiplash.

That said, August should be a compelling month for the possibility of tariff inflation. Almost 70 countries were slapped with higher levies, ranging from 10% to 41% – India’s 50% levy will take effect in late August. Economic models suggest the next set of readings could reveal higher prices.

That said, the best government statistic the nation currently has to read the tariff inflation tea leaves is the PPI. This is a pipeline inflation indicator that measures prices paid for goods and services by businesses and is typically passed on to customers. Goldman Sachs recently stated that companies have absorbed approximately two-thirds of tariff-related costs. Can this go on forever? Corporations might be able to hang on and sacrifice profit margins, but it will be a monumental endeavor for the small business community.

The joke on Wall Street is that the current month’s inflation data is the most important … until the following month. However, while the clarion calls of tariff inflation are becoming a running gag, it is crucial to remember that trade policy operates with a lag, meaning that the effects may not be apparent for several more months.

Liberty Nation depends on the support of our readers. Donate now!

At the same time, even if tariffs lead to higher business and consumer costs, they could be offset by the administration’s deregulatory and tax-cut initiatives. Additionally, the Federal Reserve may possess sufficient ammunition to restart its easing cycle and lower interest rates at the September Federal Open Market Committee policy meeting. It is a waiting game, but families might be better off playing Hungry Hungry Hippos to pass the time.