US stock markets fell sharply at the opening bell after China announced retaliatory tariffs to Donald Trump's "liberation day" import taxes.

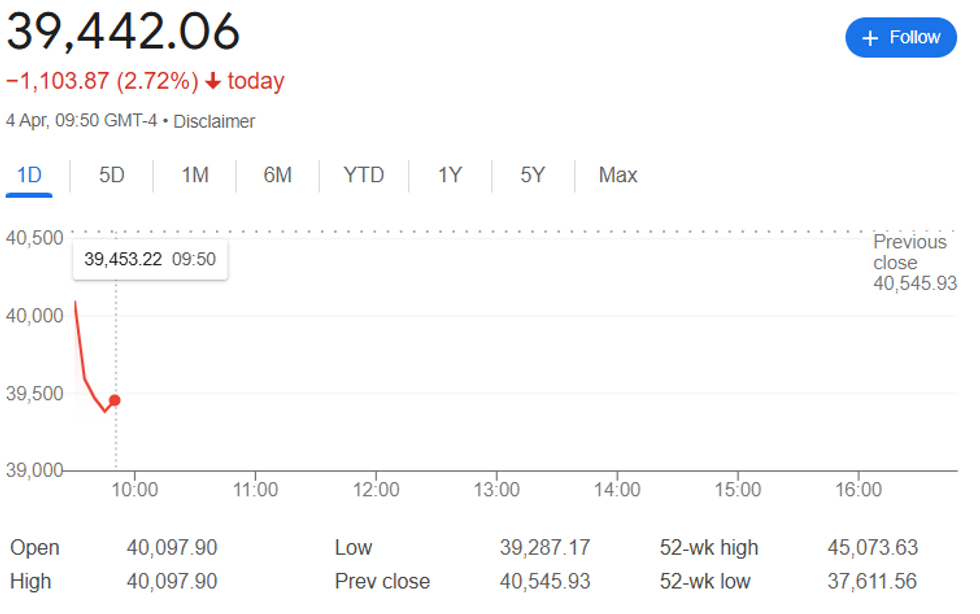

The Dow Jones Industrial Average fell 2.4 per cent to 39,562.23, continuing its downward trend.

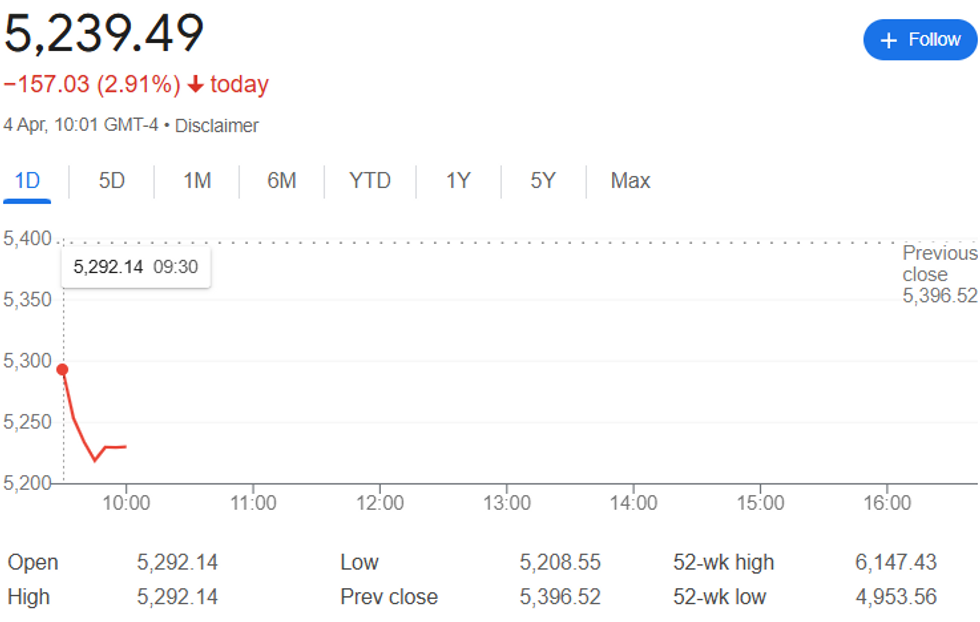

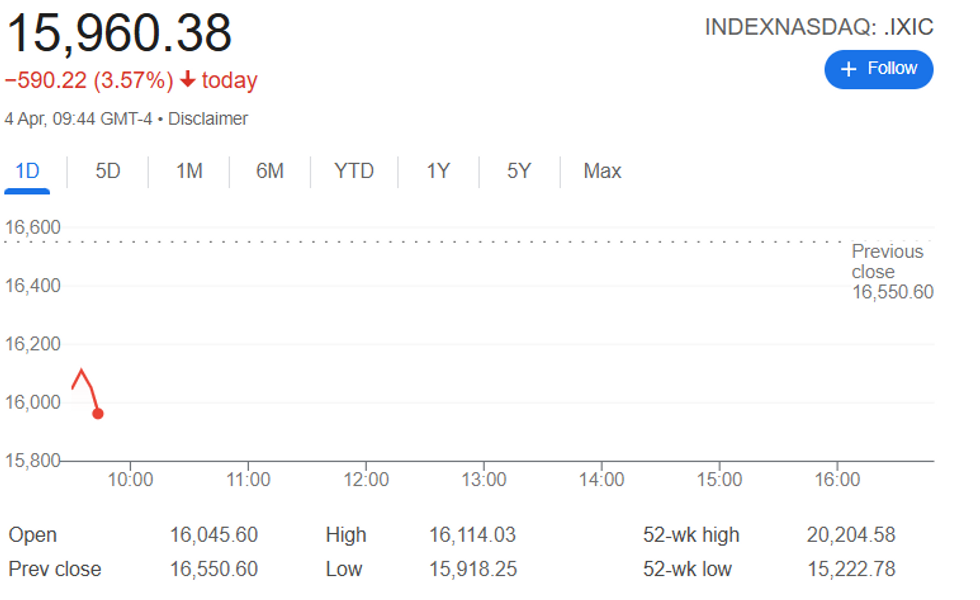

The S&P sank 2.5 per cent to 5,264.52, whilst the tech-heavy Nasdaq Composite dropped 2.8 per cent to 16,65.73.

This marks the second consecutive day of significant losses for US markets, the worst day for the market since March 2020.

Global stock markets have gone into free fall after China announced tariffs of 34 per cent on US goods this morning.

The S&P 500, a broad measure of the US stock market, has dipped by 2.9 per cent after the benchmark shed 4.84 per cent yesterday.

Technology stocks suffered significant losses on Friday, as part of a downward trend.

Apple shares slumped more than 3 per cent, falling by 10 per cent decline for the week.

Artificial intelligence company Nvidia pulled back 5 per cent during Friday trading.

Tesla also saw its shared plunge, down by 6 per cent on the same day.

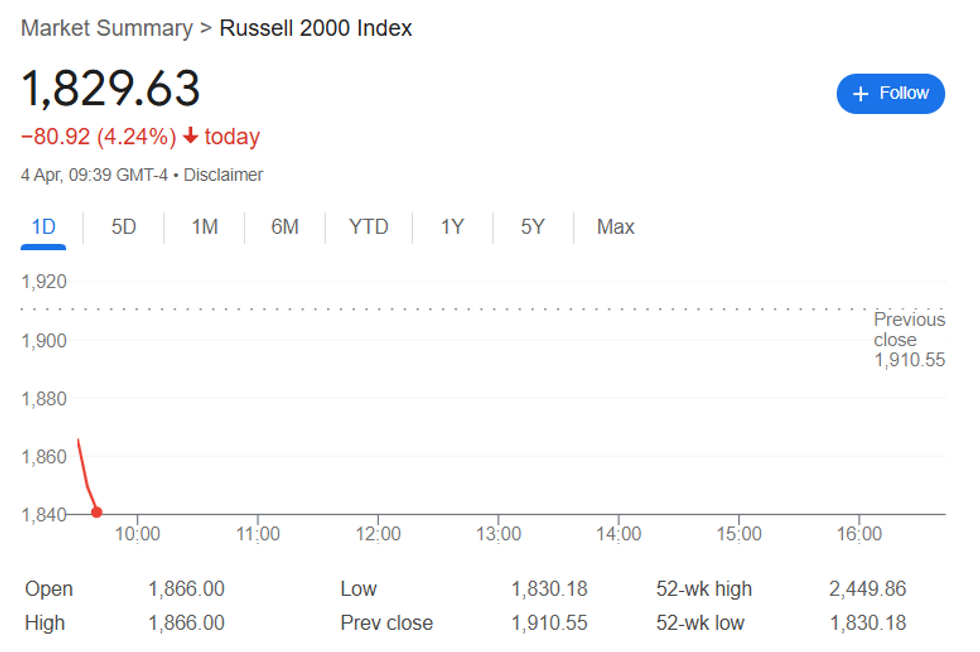

The Russell 2000 index of small US company stocks has slumped 4.2 per cent in early trading, to its lowest since December 2023.

The Dow Jones industrial average has plunged by 982 points at the open, falling 2.4 per cent to 39,563 points.

This significant drop means the Dow is now in 'correction territory', having fallen 10 per cent from its recent record high.

The Nasdaq Composite is heading into a bear market.

The tech-heavy Nasdaq .IXIC dropped more than 20 per cent from its all-time closing high touched in December, putting it on course to confirm a bear market.

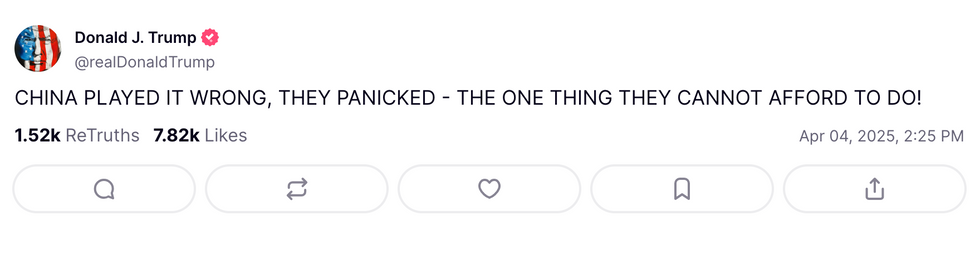

Donald Trump has reacted online to China's retaliatory tariff announcement, stating that the Chinese "panicked".

China announced tariffs of 34 per cent on US goods this morning, after the US unveiled its "Liberation Day" tariffs on Wednesday.

Posting on Truth Social, he said: "CHINA PLAYED IT WRONG, THEY PANICKED - THE ONE THING THEY CANNOT AFFORD TO DO""

The US Stock Exchange opens for the first time since China's tariff retaliation.

All eyes will be pointed towards the US stock market when it opens in just 15 minutes.

On Thursday, Wall Street saw a historically bad day with the Dow Jones having a point drop that ranked in the top 5 worst of all time.

The US economy added 228,000 jobs in March, significantly outpacing analyst expectations of 140,000, official figures show.

The strong performance comes despite February's figures being revised down to 117,000.

Meanwhile, unemployment ticked up slightly from 4.1 per cent to 4.2 per cent, according to the Labor Department.

This robust jobs report complicates the economic picture for the Federal Reserve.

Traders have been increasingly betting on interest rate cuts in response to Donald Trump's tariff war.

However, such strong employment figures could mean that cutting rates risks stoking inflation in the world's largest economy.

Xi Jinping

GETTYChina said it had opened a formal complaint against the new US. tariffs with the World Trade Organisation (WTO).

It said that saying the measures violate WTO rules and requesting consultations.

"China has filed the WTO complaint with respect to the United States' measures," the Permanent Mission of China to the World Trade Organization said in a statement.

British and Dutch gas prices have plunged to their lowest in over six months in line with sharp declines in oil and stock markets.

It comes after China announced retaliatory tariffs on US goods of 34 per cent, sparking global recession fears.

The British front-month contract TRGBNBPMc1 was down 8.26 pence at 87.51 pence per therm.

The Dutch front-month contract TRNLTTFMc1 was down 3.62 euros, or 9 per cent at 35.86 euros per megawatt hour (MWh) or $11.63/mmBtu, by 1158 GMT, LSEG data showed.

Prices were already down in the morning but the fall accelerated after China announced additional tariffs.

Rachel Reeves said the UK was 'determined to get the best deal we can' with the US

PA

Chancellor Rachel Reeves has said that the UK Government is "determined to get the best deal we can" with the US in order to help protect Britain from the tariffs imposed by America.

It is thought a UK-US trade deal was nearly signed by the White House and Downing Street last week, before Donald Trump decided not to put pen-to-paper.

No10 has refused so far to retaliate to the 10 per cent tariffs imposed by Washington and is instead focused on securing a trade deal.

“Well, of course, we don’t want to see tariffs on UK exports, and we’re working hard as a government in discussion with our counterparts in the US to represent the British national interest and support British jobs and British industry,” the Chancellor said on Friday.

“Those conversations are ongoing at the moment, but we’re determined to get the best deal we can for our country.”

She would not give a timeframe for when she expected the discussions to bear fruit.

“I’m not going to give a running commentary on those discussions. They’ve been ongoing since our Prime Minister Keir Starmer had a successful visit to the White House to meet President Trump just a few weeks ago.

“Those conversations are ongoing. We want to do everything in our power, and we’ll continue to do everything in our power to get the best possible deal for British industry, working closely with them to protect prosperity and jobs here in the UK.”

The CBOE Volatility Index, which is used to gauge the level of fear among Wall Street traders, has risen to its highest level since August 2024.

Measuring future expectations of volatility on S&P 500 stock, it has risen since points to far today to 39.60.

Oil prices have hit their lowest prices in more than four years.

Brent North Sea crude, which is often used as a benchmark for international prices, dropped by more than 6 per cent to below $66 per barrel.

It marks its lowest price since 2021.

It comes after eight OPEC+ countries agreed yesterday to increase oil production by 411,000 barrels per day in May.

OPEC had previously planned to produce 135,000 barrels a day next month.

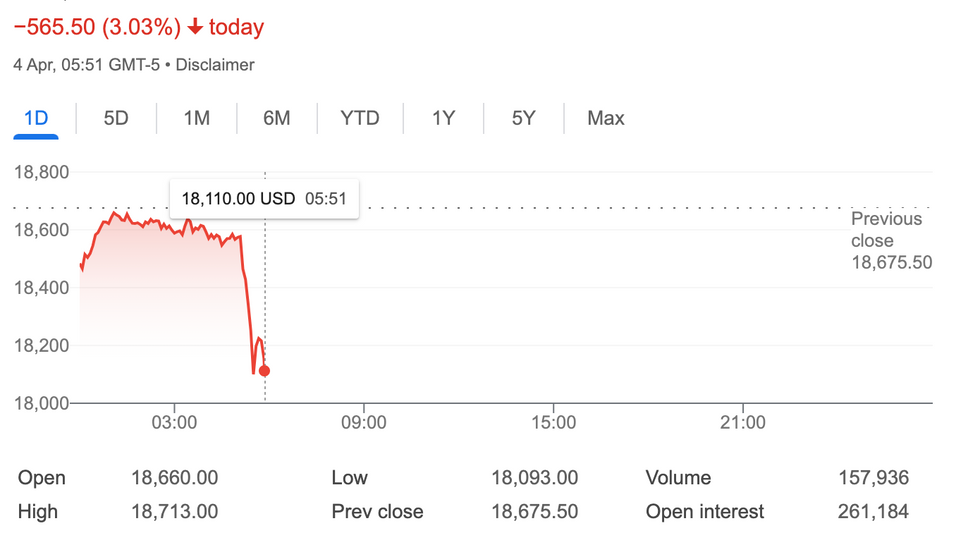

Nasdaq 100 future market dips after China's announcement

The Nasdaq 100 futures have dropped by 3 per cent due to the significant exposure many tech companies have in China.

The index has fallen 20 per cent from its all-time highs.

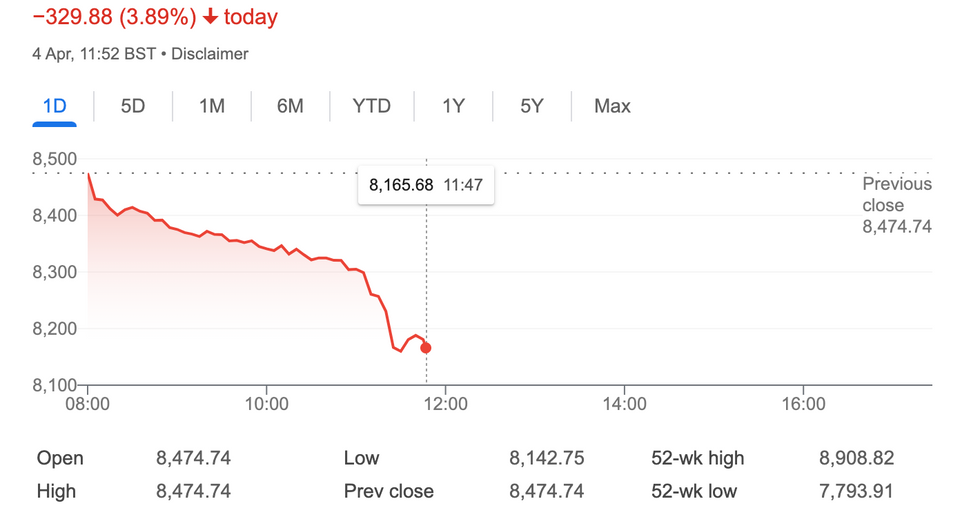

The Ftse100 has dropped significantly throughout today

The Ftse 100 has been tumbling ever since trading began at 8.30am this morning.

However, the announcement from China that it would respond to the White House's tariffs with retaliatory measures of its own led to an immediate significant drop.

The UK's best-known stock market index dropped by about 4 per cent shortly after the announcement, losing around 150 points in the space of an hour and hitting the lowest level since December.

European indexes were also suffering steep falls with Germany’s Dax tumbling around 4.5 per cent and the Cac 40 down 4 per cent.

China has confirmed it will impose additional tariffs of 34 per cent on all U.S. goods from April 10.

Beijing's Commerce Ministry said in a statement: "The purpose of the Chinese government's implementation of export controls on relevant items in accordance with the law is to better safeguard national security and interests, and to fulfil international obligations such as non-proliferation."

It also added 11 entities to the "unreliable entity" list, which allows Beijing to take punitive actions against foreign entities.