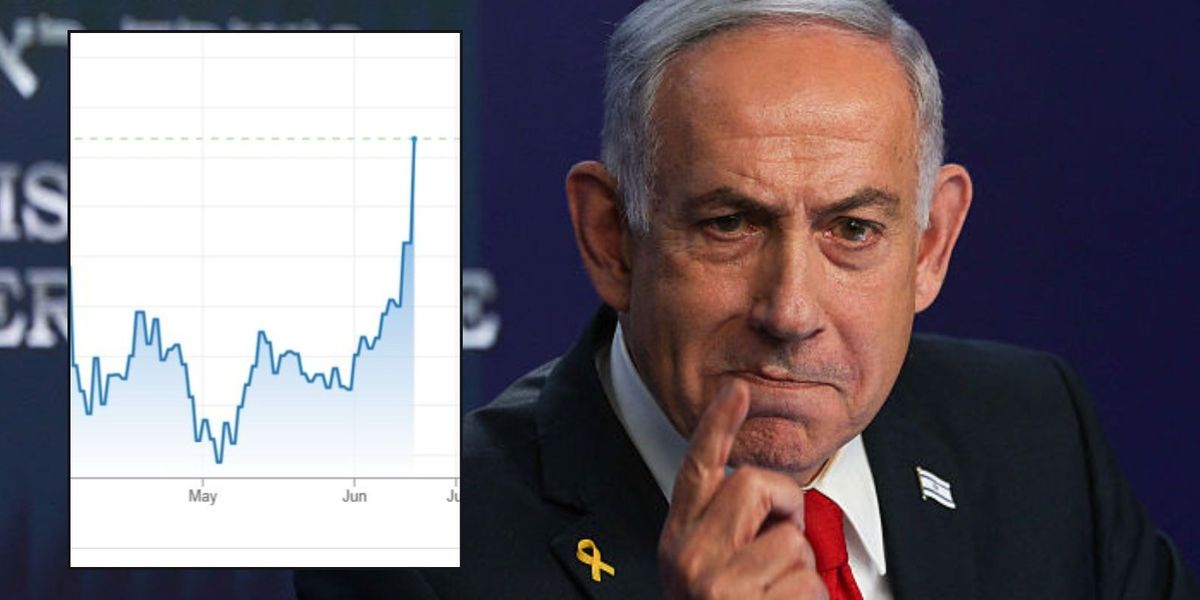

Global oil prices have skyrocketed in response to escalating geopolitical tensions between Israel and Iran, which could exacerbate inflationary pressures in the West.

Overnight, Israel confirmed it launched a "major strike" on Iranian nuclear and military sites, resulting in benchmark oil contracts jumping by more than 10 per cent.

In response to the news, the Dow futures slipped 600 points, while the S&P 500 and Nasdaq fell 100 points and 400 points, respectively.

Analysts are sounding the alarm that the cost of living could rise globally due to the conflict, mirroring the hike in energy prices following Russia's invasion of Ukraine in 2022.

Oil prices are surging in response to the Iran-Israel conflict

GETTY / BLOOMBERG

Katrina Ell, Moody’s Analytics head of Asia Pacific economics, told Bloomberg Television that a spike in oil prices are likely to be inflationary when combined with US President Donald Trump's sweeping tariffs on trading partners.

She explained: "It comes really at an unfortunate time for the global economy given the already heightened uncertainty and chaotic nature we are dealing with coming out of the US protectionist stance."

When oil prices rise, the cost of production also goes up. This is eventually passed onto consumers, especially on goods which are energy-intensive.

Oil-importing countries, including the UK, could experience slower economic growth on top of inflation if the conflict continues for the foreseeable future.

If inflationary pressures are prolonged, analysts warn that central banks may be forced to raise interest rates which will increase the cost of borrowing.

The Bank of England has recently slashed the UK's base rate to 4.25 per cent, however the US Federal Reserve has held off cutting rates in the wake of Trump's tariffs.

Bloomberg Economics analysts Jennifer Welch, Adam Farrar and economist Tom Orlik broke down why the central bank's chair, Jerome Powell, may be forced to take action in response to this development.

They explained: "Coming hard on the heels of the post-pandemic surge in inflation, and with concern that inflation expectations are not firmly anchored, that would be difficult for Fed Chair Jerome Powell & Co. to look through."

President Donald Trump has warned there is a "chance of a massive conflict"

ReutersBritish and European stock markets were on track to open lower at the beginning of trading later after Israel's attack on Iran.

The FTSE 100 was projected to drop by 0.5 per cent, however this is likely to be less than the estimated drop in European markets.

Oil companies Shell and BP are among the biggest companies in the UK's flagship stock market and are set to benefit from the price of crude oil rising.

Analysts predict the Cac 40 in France and the Dax in Germany were on course to open more than one per cent lower.