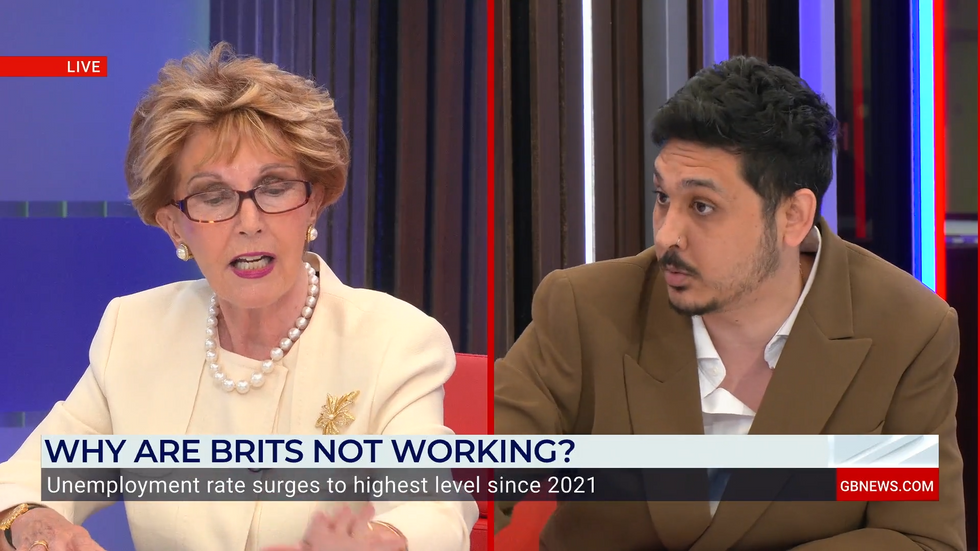

GB News fan-favourite Michelle Dewberry threatened to remove both guests from her programme after a heated exchange erupted over Britain's rising unemployment figures.

The confrontation occurred between left-wing political commentator Curtis Daly and Baroness Jacqueline Foster during a discussion about the latest jobless data.

The row intensified as the pair clashed over wealth inequality and welfare reform, with both guests repeatedly interrupting each other. Michelle was forced to intervene, warning: "No one's going to be answering any questions in a moment because I will kick you both off."

She told viewers the exchange was "not an enjoyable experience" for those watching at home or listening in their cars.

Michelle threatened to kick both guests off the show

GB NEWS

The People's Channel star issued a final warning to both guests, telling them to "pack it in" after they continued shouting over one another.

Britain's unemployment rate has climbed to 4.6 per cent in the three months to the end of April, marking the highest level since July 2021, according to the Office for National Statistics. The figure represents an increase from 4.5 per cent in the first quarter of this year.

ONS director of economic statistics Liz McKeown said: "There continues to be weakening in the labour market, with the number of people on payroll falling notably."

She added that feedback from their vacancies survey "suggests some firms may be holding back from recruiting new workers or replacing people when they move on."

Rachel Reeves is grappling with dwindling employment rates

PAThe latest data reflects a cooling labour market, with businesses facing increased employment costs and economic uncertainty. Wage growth has also shown signs of slowing alongside the rise in joblessness.

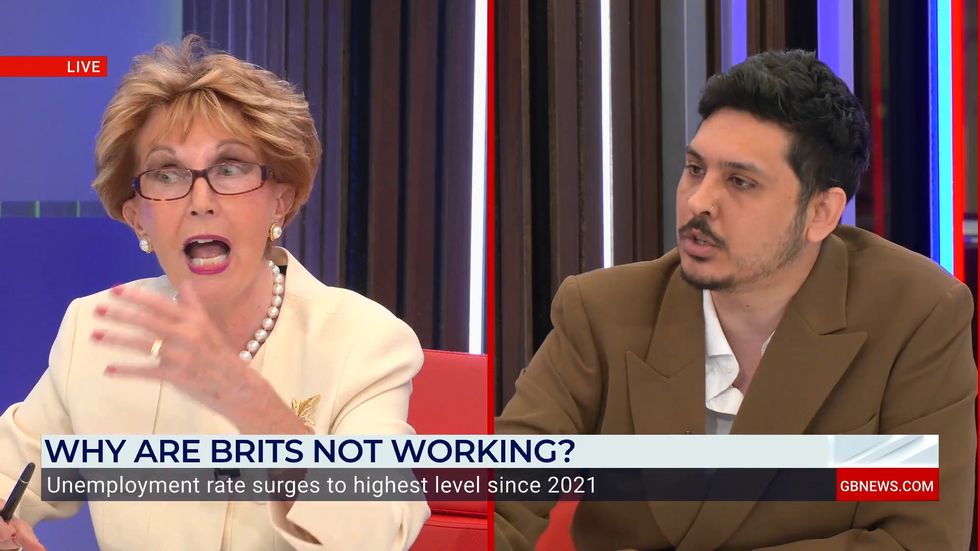

The dispute began when Daly argued for a wealth tax on "the billionaire class and corporations" to address growing inequality. He cited Denmark's higher labour participation rate of 75 per cent compared to Britain's 53 per cent, despite having "a far more generous welfare state".

Baroness Foster rejected the comparison, stating: "You can't make a comparison there just because you see something. These systems are completely different." She defended wealthy individuals who "generate wealth in this country" and "pay a lot more tax than you would think".

When Daly insisted on discussing wealth taxes rather than income tax, Foster responded: "It's like talking to a wall." She accused the left of being "great at spending other people's money" and having "no concept on what people have done in this country".

The pair fundamentally disagreed on how the economy should operate

GB NEWS

The confrontation escalated when Foster questioned Daly's personal work experience, asking "what work have you done". Daly accused her of trying to "evade the point", whilst both continued to interrupt each other.

As the pair accused one another of not answering questions, Michelle intervened forcefully. "You two, listen," she said, before issuing her ultimatum about removing them from the programme.

The presenter reminded them of their audience, saying: "You've got people in cars listening. You've got people relaxing on their sofas at home listening. They can't hear you if you're both shouting over each other."

She concluded with a stern warning: "You're on your final warning now, so pack it in. Right?"

Foster suggested Daly lacked life experience

GB NEWS

The unemployment figures cover the start of a business tax increase outlined in Labour's inaugural budget last October. April also marked the beginning of a baseline 10 per cent tariff imposed on the UK and other countries by US president Donald Trump.

Ruth Gregory, deputy chief UK economist at Capital Economics, said the data leaves them "more confident in our view that the Bank of England will cut interest rates further than investors expect, to 3.50 per cent next year".

The Bank of England last reduced borrowing costs in May, cutting rates by a quarter point to 4.25 per cent. Analysts suggest the weakening labour market data, combined with easing wage growth, will likely prompt further rate cuts into 2026.