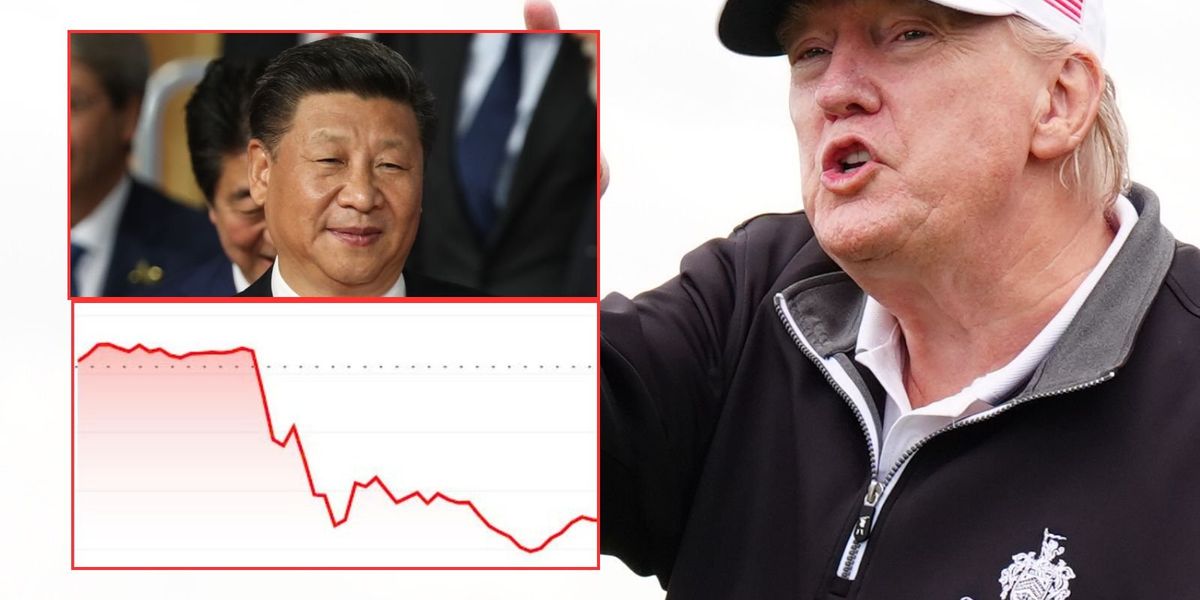

The global economy is at heightened risk of being plunged into crisis as the stock market fell into the red after President Donald Trump declared imports from China will face an extra 100 per cent tariff from November 1, 2025.

This represents a significant escalation in the trade war between the US and Beijing with the White House citing China's decision to limit exports of rare earth elements as justification for the dramatic increase.

Mr Trump characterised China's restrictions on these crucial materials as "extraordinarily aggressive" actions. The President stated that additional American export restrictions targeting "any and all critical software" would be implemented alongside the import duties.

"It is impossible to believe that China would have taken such an action, but they have, and the rest is History," the Republican Party leader posted on Truth Social.

The stock market is in the red as US-China trade talks break down

|GETTY / PA / GOOGLE

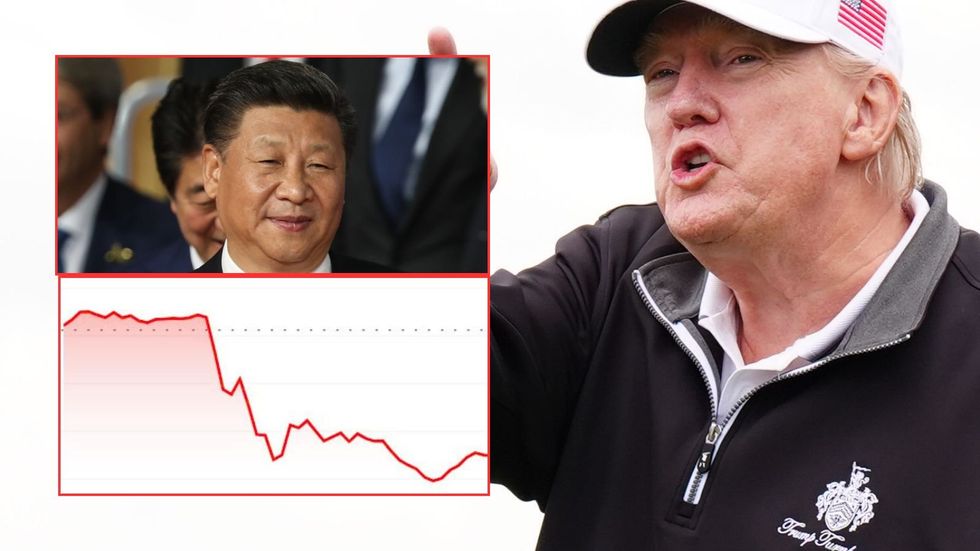

Financial markets tumbled following the announcement, with technology shares bearing the brunt of investor concerns. The Nasdaq composite index plummeted 3.6 per cent whilst the broader S&P 500 index shed 2.7 per cent.

The sharp sell-off reflected mounting anxiety about renewed commercial hostilities between the world's two biggest economies. Investors fled risk assets as the prospect of intensified trade barriers threatened to disrupt global supply chains and corporate earnings.

Mr Trump cast doubt on his scheduled encounter with Chinese leader Xi Jinping at the upcoming Asia-Pacific Economic Cooperation gathering in South Korea.

"I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so," Trump declared on Truth Social.

The 'Magnificent 7 stocks' —Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla— are the primary drivers of the Nasdaq's value | GETTY

The 'Magnificent 7 stocks' —Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla— are the primary drivers of the Nasdaq's value | GETTY

Furthermore, Donald Trump alleged that Beijing had been "lying in wait" and expressed bewilderment at China's timing. "Some very strange things are happening in China! They are becoming very hostile," he remarked.

The president insisted that Washington would "not allow China to hold the world captive" through its dominance of rare earth element production.

Beijing currently imposes 10 per cent duties on American products in response to Washington's existing 30 per cent levies on Chinese merchandise.

Initially, Mr Trump introduced these measures citing alleged unfair commercial practices and Beijing's purported role in facilitating fentanyl trafficking.

The dispute has expanded beyond tariffs, with China announcing "special port fees" for vessels constructed in and operated by the United States.

This move followed Washington's April decision to impose charges on Chinese-affiliated shipping.

Rare earth elements remain central to the conflict, as these materials prove essential for manufacturing smartphones, electric vehicles, military equipment and renewable energy systems.

Beijing maintains overwhelming control over global production and processing of these strategic resources.

The stock market has been volatile since Trump returned to office | Reuters

The stock market has been volatile since Trump returned to office | Reuters

Concerns have been raised about the stock market potentially being in a "bubble", due to the overvaluation of artificial intelligence (AI) by investors.

Richard Flax, the chief investment officer at Moneyfarm, said: "There’s been a lot of discussion about the huge investments that the big tech companies are making in data centres for AI.

"Some analysts estimate capital spending by so-called hyperscalers could reach $1.2trillion by 2029. This has raised questions about what sort of return on investment we could expect to see.

"The concern is that these businesses will over-invest, building capacity that will take longer to fill than they hope. This has been a feature of previous technology shifts - notably the booms in railroad investment in the 19th century and the rapid build-out in telecom fibre in the late 1990s."