Is Britain on the brink of a financial crisis? Every Labour Government this country has ever had has led Britain into a financial crisis. You remember as well as I do.

So let’s look at what Rachel Reeves is contending with ahead of the Autumn Budget. The deficit currently stands at £152 billion for 2024/25, which is over 5 per cent of GDP, while the national debt is about 100 per cent of GDP.

Inflation has risen to nearly double the Bank of England’s target, reaching 3.8 per cent in July compared with the 2 per cent target.

It was 2.2 per cent when Labour took office just 13 months ago, so it has almost doubled.

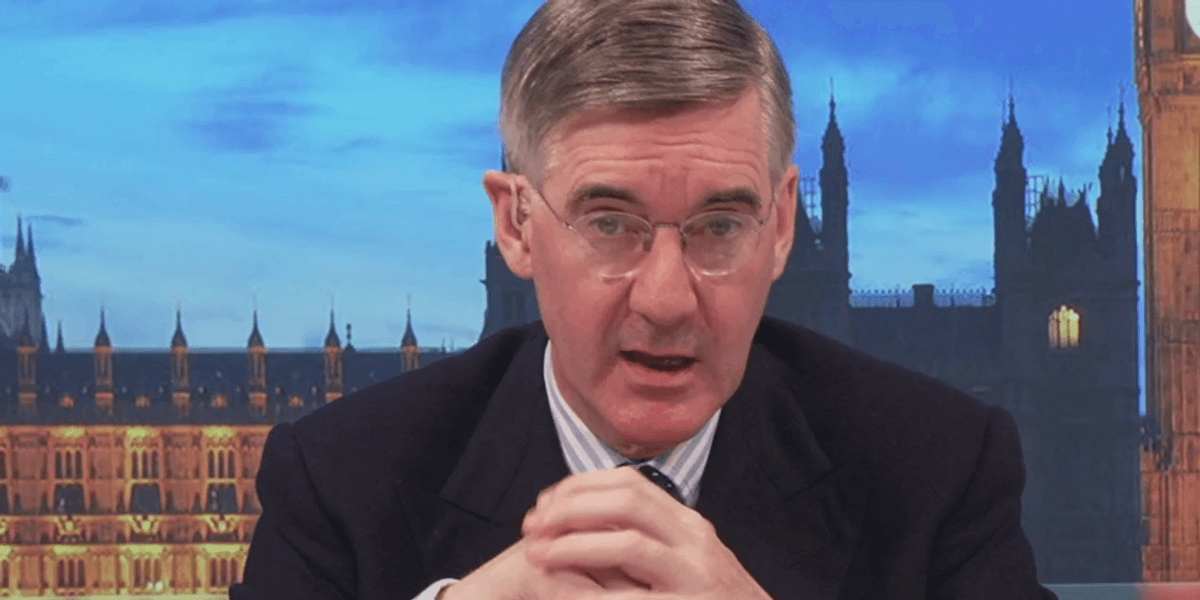

'Inflation has risen to nearly double the Bank of England’s target'

|GB NEWS

Borrowing costs are another major concern, as these feed directly into the deficit and must be paid annually. The 30-year gilt hit 5.6 per cent this week, a 27-year high.

That’s before we even get to the £50billion black hole predicted in the public finances that Chancellor Rachel Reeves must confront.

Rumours suggest she is considering imposing capital gains tax on home sales or even a mansion tax, a last-ditch effort to plug the gap that would inevitably hit growth.

Warning signs are flashing.

The National Institute for Economic and Social Research predicts sluggish growth, a weak jobs market, rising welfare costs, and debt interest payments exceeding £111billion.

To put that into context: £111billion is more than the defence budget, more than the education budget, and almost the same as the annual state pension bill, spent just on interest.

That means tax hikes or spending cuts are inevitable.

To meet her fiscal rules, Rachel Reeves may need an additional £51.1billion, equivalent to a 5 per cent income tax rise across the board.

Meanwhile, though interest rates were cut to 4 per cent on August 7, rising inflation may make further cuts impossible this year.

That puts pressure on the pound.

Rachel Reeves is preparing for her Autumn Budget statement | PA

Rachel Reeves is preparing for her Autumn Budget statement | PA

It has risen slightly in 2025, but its stability depends on whether international markets remain willing to finance Britain’s debt.

The conclusion is stark: with spending out of control, taxes set to rise further, and investment confidence dwindling as people leave the country, Britain does indeed seem to be on the edge of financial meltdown.

Another socialist financial crisis looms.