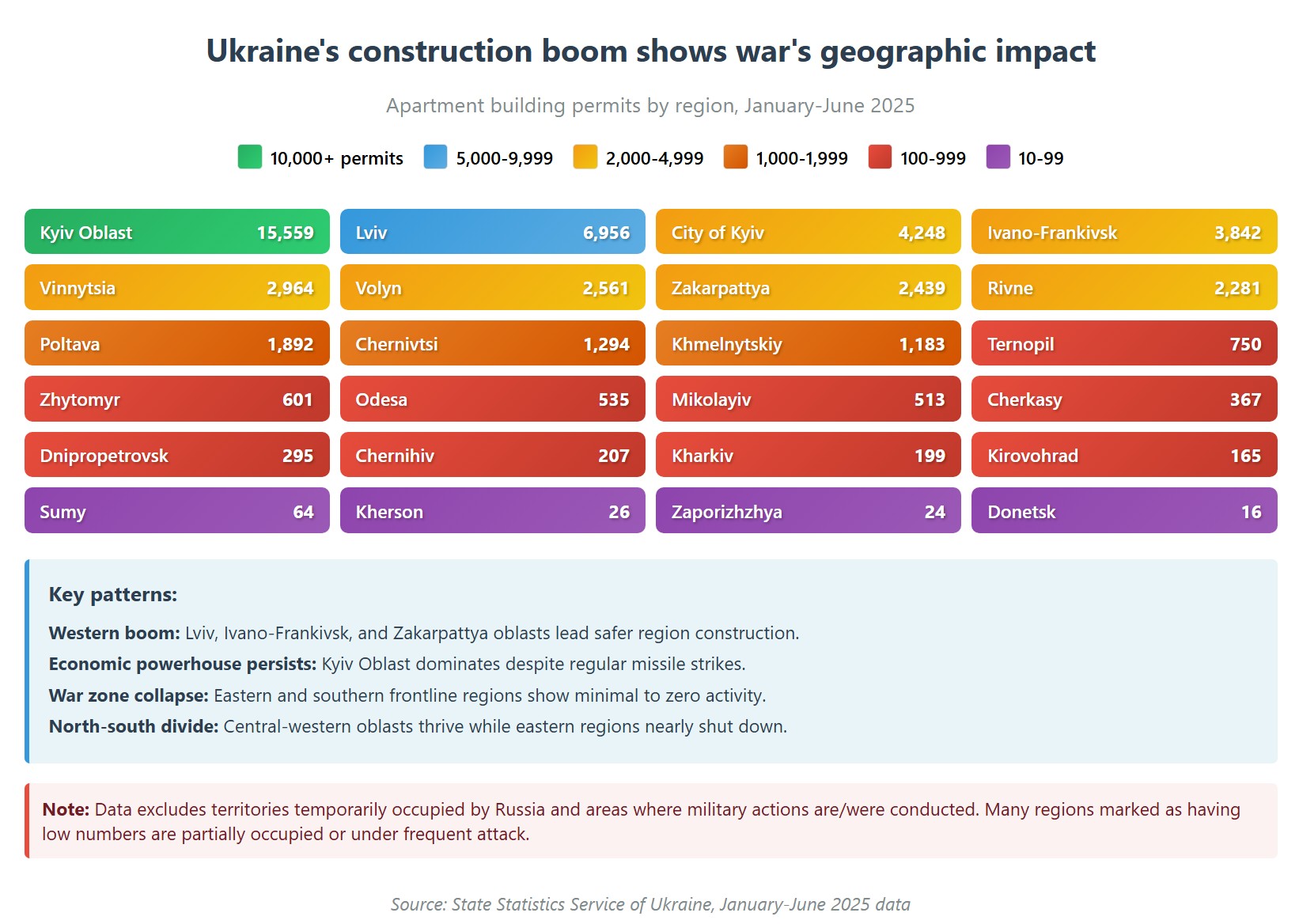

A 45% jump from last year defies wartime expectations across Ukraine’s economic heartland and western regions. Kyiv Oblast dominated with 15,559 apartment permits despite regular missile strikes.

At the same time, western strongholds Lviv (6,956) and Ivano-Frankivsk (3,842) attracted developers betting on safer locations, according to State Statistics Service data released on 18 September.

Western regions fuel wartime construction wave

This construction revival comes despite the industry operating at roughly half of pre-war capacity. Before Russia’s invasion, Ukraine approved construction for 12.7 million square meters of housing in 2021. The war crashed that figure to 6.67 million in 2022, then 4.2 million in 2023.

The 2025 recovery follows the geographic logic of wartime Ukraine.

Kyiv Oblast’s 15,559 apartments represent a 130% increase from 2024, while Lviv Oblast’s 6,956 units reflect the region’s role as Ukraine’s migration hub. Meanwhile, frontline regions tell a different story: Donetsk managed just 16 apartment permits.

“Western Ukraine has now become a big construction site,” noted an analyst tracking western regions’ industrial real estate boom.

Business confidence drives long-term bets

The apartment surge reflects deeper economic confidence despite ongoing strikes on Ukrainian cities. Construction companies have maintained optimism for four consecutive months, with their business confidence index hitting 54.0 in August—the only major economic sector firmly in positive territory.

This optimism translates into serious investment commitments.

Starting apartment construction requires long-term planning, secure financing, and confidence in demand, suggesting Ukraine’s business community sees stability ahead despite daily missile attacks.

The housing market has adapted to wartime realities, with mortgage lending surging by 62% in 2024. This growth is concentrated in government programs supporting key societal groups.

International investors see opportunity

The 45% surge in construction permits coincides with foreign portfolio investors returning to Ukrainian real estate for the first time since the invasion began. Developers report institutional investors from countries spanning the UAE to Canada are now purchasing residential units in bulk, with some projects seeing foreign sales exceed domestic purchases.

“In our projects, the number of deals with foreigners sometimes exceeds the number of deals with Ukrainians,” said Irina Mikhaleva from Alliance Novobud, speaking to Interfax-Ukraine.

This suggests the construction recovery isn’t just domestic resilience—it’s attracting global capital, betting on Ukraine’s economic future.

Foreign investors from Spain, Japan, Türkiye, and other countries view Ukrainian real estate as promising assets. Some developers now guarantee 10% annual returns in foreign currency to attract international capital.

The return of portfolio investors represents a significant shift from 2022-2024, when the market focused mainly on end buyers.

International institutional money moving into Ukrainian real estate signals early positioning for the country’s eventual reconstruction phase, potentially indicating broader confidence in Ukraine’s long-term economic trajectory.

Recovery from a low baseline shows adaptation

While the 45% growth sounds dramatic, it starts from a collapsed baseline. The 2.97 million square meters of new construction permits in early 2025 remain far below the 12.7 million approved in pre-war 2021. Ukraine’s construction sector still operates at roughly half its peacetime capacity.

Yet the geographic concentration reveals strategic adaptation. Safer western regions now absorb construction investment that once flowed to industrial eastern cities.

This represents a probable permanent demographic and economic shift that will outlast the war.

The World Bank estimates Ukraine needs $524 billion for reconstruction over the next decade, with housing suffering the most damage.

The current construction boom suggests Ukraine isn’t waiting for war’s end to begin rebuilding—it’s adapting and growing within wartime constraints while attracting international capital that sees opportunity in the country’s resilience.