Bloomberg’s detailed shipping analysis shows record Russian crude exports. However, complementary financial data suggests this surge reflects economic pressure rather than strength as Moscow shifts from profitable refining to commodity sales.

According to Bloomberg’s vessel-tracking analysis, crude oil exports from Russia reached their highest levels in 16 months during September. The financial news service documented how 3.62 million barrels per day of Russian crude moved through international shipping routes.

Despite Western sanctions, this significant increase demonstrates Moscow’s continued ability to find buyers.

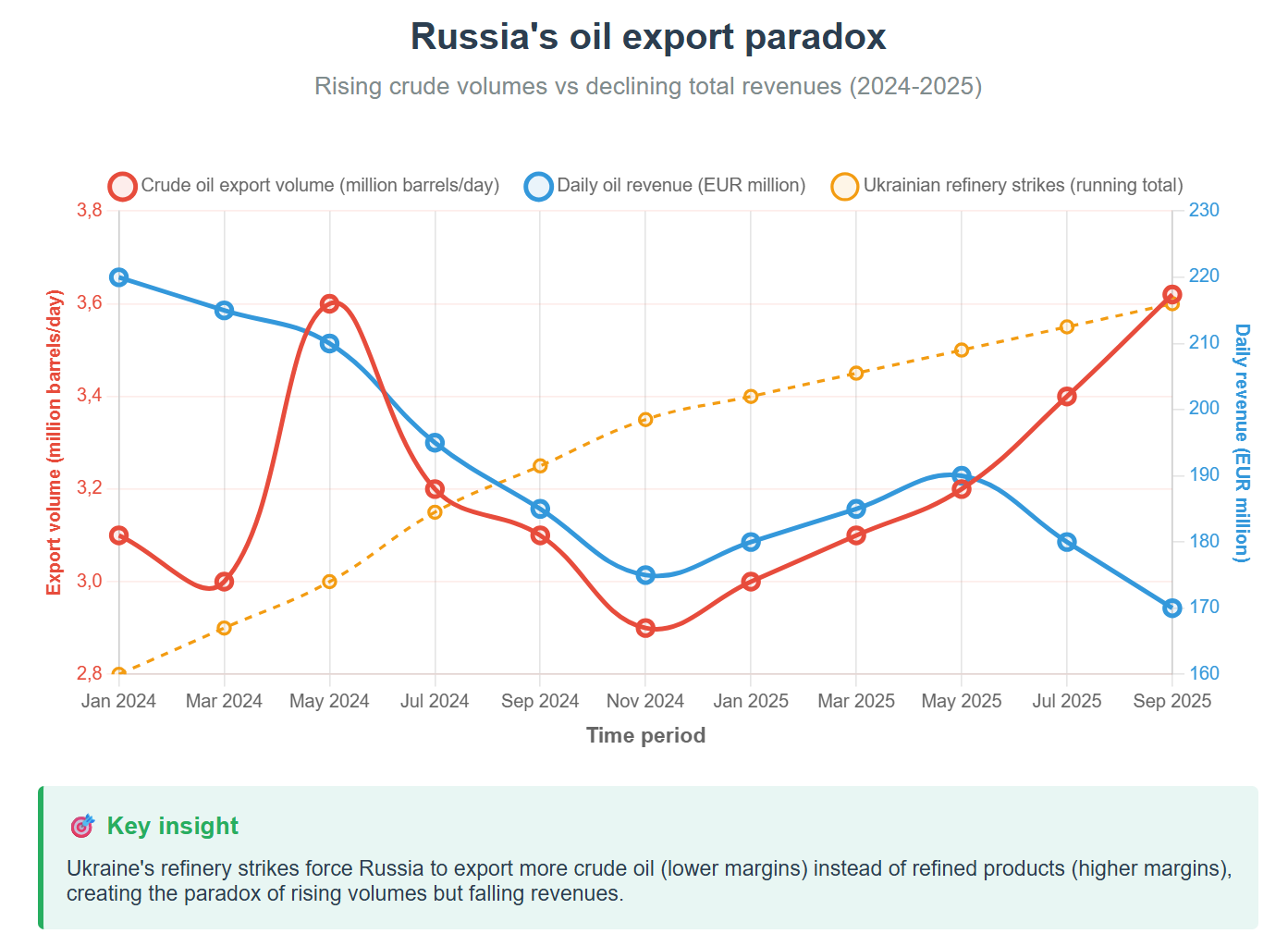

This shipping data indicates one dimension of Russia’s energy trade adaptation. Yet, the export deluge looks different when examined alongside revenue figures and refining industry analysis. It shows us how Ukrainian drone strikes reshape Russia’s energy economics in ways that ultimately benefit Kyiv’s strategic objectives.

The key is to understand the difference between crude oil and refined petroleum products and why that distinction matters for Russia’s war funding.

The economics of oil refining

Russia operates both crude oil exports and domestic refining businesses. While both generate profits, refined products typically command higher margins. Oil refineries generally earn $12-19 per barrel in gross margins by transforming crude into gasoline, diesel, jet fuel, and other higher-value products.

Ukrainian forces have systematically targeted this more profitable component of Russia’s energy infrastructure.

Since the campaign intensified, Ukraine has struck 16 of Russia’s 38 refineries, disrupting over 1 million barrels per day of processing capacity. The attacks have reached as far as 1,400 kilometers into Russian territory, hitting everything from Moscow’s largest refinery to facilities deep in Bashkortostan.

Volume growth, revenue decline

This systematic refinery campaign creates the economic backdrop for Bloomberg’s shipping data. When refineries cannot process crude oil, that crude must find alternative outlets. And it does, typically via export terminals, joining global commodity markets.

Although Russian crude export volumes have hit a 16-month high, the picture is not that simple.

The financial analysis from the Centre for Research on Energy and Clean Air (CREA) shows that Russian seaborne crude oil revenues dropped 12% month-on-month to EUR 170 million per day in August, even as volumes increased.

The disconnect makes sense. As Bloomberg notes: “The drone strikes on the country’s refineries appear to be forcing companies to divert crude to export terminals, adding even more barrels to the flow.”

At the same time, Russian refined product exports—the higher-margin business—showed minimal growth. Data published by CREA indicate refined product revenues rose 2.5% month-on-month to EUR 147 million per day, with volumes growing only 2%.

This suggests Russia is losing access to its most profitable export streams and compensating with higher volumes of lower-margin crude sales.

The shadow fleet’s limitations

Bloomberg’s analysis also helps to explain how Russia’s expanding shadow fleet enables these higher crude export volumes.

Russia now operates approximately 940 aging vessels to circumvent Western sanctions, a remarkable logistical achievement that allows Moscow to maintain oil flows despite international pressure.

However, shadow fleet vessels are typically better suited for crude transport than refined products, which require specialized handling and storage systems.

The fleet’s expansion has effectively facilitated Russia’s forced shift toward crude exports while being less capable of replacing lost refined product capacity. The shadow fleet can move more oil, but cannot restore the $12-19 per barrel margins that domestic refining would provide.

CREA analysis shows how, despite record crude export volumes, Russia’s fossil fuel revenues declined for the third consecutive month.

Strategic implications of tactical success

The combination of Bloomberg’s shipping data and complementary revenue analysis suggests Ukrainian refinery strikes are achieving their intended economic effect.

By systematically disrupting Russia’s refining capacity, Ukraine has forced Moscow to rely more heavily on lower-margin crude exports when the country needs maximum revenues.

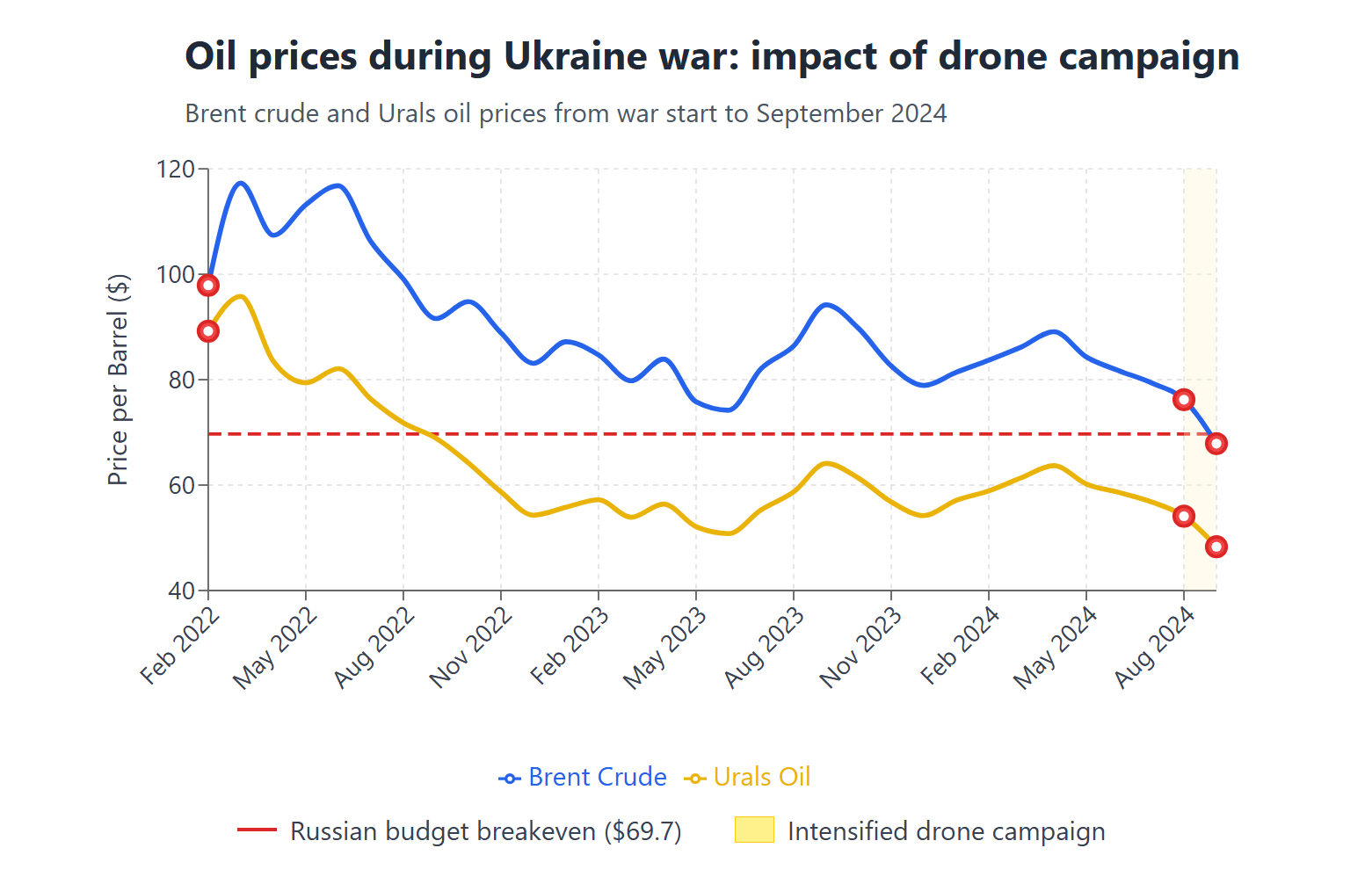

According to previous analysis, Russia requires approximately $69.7 per barrel to fund its 2025 federal budget. With refining margins destroyed and Brent crude trading below $68, Moscow faces revenue pressures despite being able to maintain export volumes through its shadow fleet operations.

As the shipping data shows, Russia can maintain export volumes. However, the revenue information suggests that Ukraine’s refinery campaign has successfully pressured Moscow’s energy economics.