Ukraine completed the sale of state-owned construction company Ukrbud for 805 million UAH ($19.48 million) on 2 October, concluding a troubled three-month process that reveals both progress and persistent gaps in wartime privatization transparency.

As Kommersant Ukrainian reported, the auction successfully disqualified Georgian businessman David Bezhuashvili’s company for ties to sanctioned persons—proof that reform mechanisms can catch violations.

Yet the eventual buyer, Tekhno-Onlain LLC, raises questions about financial capacity and due diligence that the State Property Fund has not publicly addressed.

The sale matters beyond budget revenue: Ukraine’s construction sector is critical for immediate war repairs and eventual reconstruction, making transparent asset sales strategically important for EU integration and investor confidence.

Auction catches one problem, questions remain about another

The 18 June electronic auction attracted five bidders who drove the price from 262.6 million UAH ($6.35 million) to 805 million UAH ($19.48 million)—more than triple the starting value. Bezhuashvili’s Petro Oil and Chemicals won with the highest bid, but the company was disqualified on 30 June for connections to sanctioned individuals.

The disqualification proved that the Prozorro.Sale electronic auctions framework together with sanctions screening can work.

This is exactly what transparency advocates demand—rigorous oversight that prevents problematic buyers from acquiring strategic assets.

Yet the runner-up, Tekhno-Onlain LLC, won with a bid exactly one hryvnia less—a minimal difference that raises questions about bidder coordination. However, no evidence supporting this has emerged.

Financial capacity questions

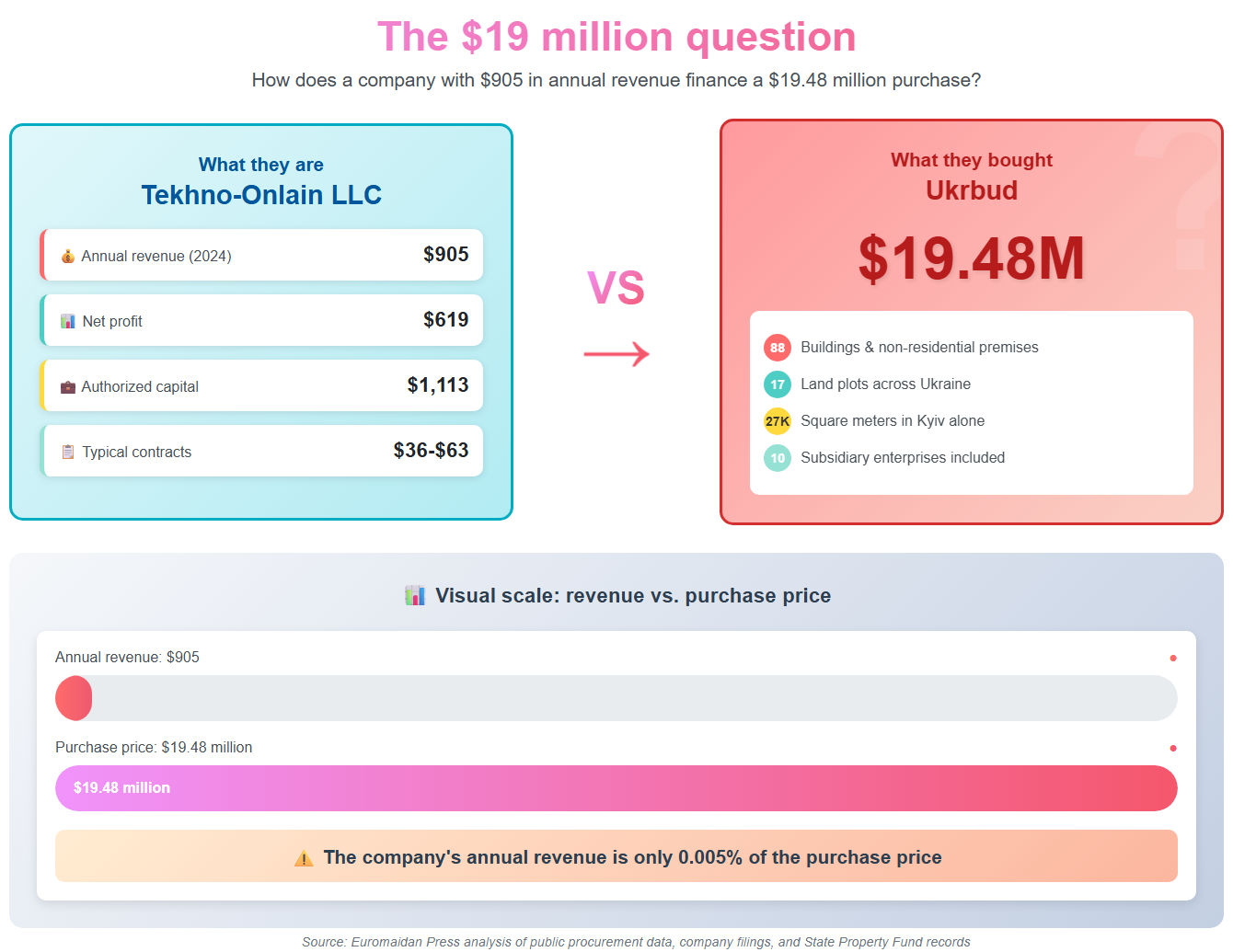

Tekhno-Onlain’s financial profile raises fundamental questions. The Sumy-based plumbing and heating equipment wholesaler reported just 46,000 UAH ($1,113) in authorized capital, 37,400 UAH ($905) in 2024 revenue, and 25,600 UAH ($619) in net profit, according to Non-Stop Ukraine, an anti-corruption NGO focused on pro-Russian connections.

The company’s participation in public procurement has been limited to small toner cartridge maintenance contracts worth 1,500-2,600 UAH ($36-$63).

How does such a company finance an 805 million UAH ($19.48 million) bid?

Between auction and contract signing, Tekhno-Onlain’s ownership changed: brothers Vasyl and Yevhen Astiony acquired 66% through their firm Bilart on 5 August, with 34% remaining with Maryna Ayab, according to Kommersant Ukrainian.

This ownership restructuring suggests the Astiony brothers provided the financial backing that Tekhno-Onlain lacked, but their construction sector expertise remains unclear. The State Property Fund has not publicly addressed how it verified financial capacity.

Alleged problematic connections

Questions also emerge about possible connections. Non-Stop Ukraine alleges that Tekhno-Onlain has ties to Russia through a lawyer, who represents the wife of former Ukrbud president Maksym Mykytas and connects through a chain of companies to Russian businessman Sergey Kiyashko, former head of St. Petersburg’s rolling stock producer Vagonmash.

Blogger Volodymyr Bondarenko alleged similar connections between Tekhno-Onlain representatives and Mykytas’ associates, though these claims remain unverified.

The Mykytas connection matters because of his controversial history with the company. Former MP Mykytas built a private development business during his 2010-2016 tenure as state Ukrbud president, “using the state company’s brand,” as Kommersant Ukrainian reported.

State-owned Ukrbud—the company just sold—is separate from Mykytas’s private construction corporation, which continues using the Ukrbud name. The sale involves only the mothballed state company, not Mykytas’s active private operations.

If Bezhuashvili was disqualified for sanctioned ties, why wouldn’t alleged Russian connections through other channels trigger similar scrutiny?

The three-month gap between auction and contract signing provided time for ownership restructuring—but what due diligence occurred during this period?

What was sold and what happens next

According to Kommersant Ukrainian, Ukrbud specializes in industrial and civil construction design, construction work, and workforce training through 10 subsidiary enterprises, including project institutes and training centers.

The asset includes 88 buildings and non-residential premises, 17 land plots, and significant Kyiv properties—19 objects totaling over 27,000 square meters—plus assets in Lviv, Kharkiv, Odesa, and Dnipro. The company has remained largely dormant in recent years, primarily leasing its real estate.

The company carries complicated baggage: thousands of investors who purchased apartments through construction projects remain without housing, Non-Stop Ukraine reports.

The sales contract and Kommersant Ukrainian show that new owners must preserve core construction activities, repay wage and budget debts within six months, and maintain employment levels. But the terms don’t explicitly require completing stalled housing projects or compensating investors—the new owners could profit from leasing real estate while ignoring obligations to thousands of Ukrainians.

Mixed signals for wartime reform

Ukraine has accelerated asset sales throughout 2024-2025, generating over $216 million through transparent auctions and approving the privatization of previously problematic facilities like the Odesa Port Plant.

The European Commission has recommended that Ukraine “intensify its privatization efforts” as part of the accession requirements. Ukraine must prove that it operates as a “functioning market economy” capable of integrating into the EU single market. Transparent, corruption-free asset sales demonstrate this capability to Brussels.

The Ukrbud sale shows reform mechanisms can catch violations: the auction successfully disqualified one problematic bidder.

However, a company with annual revenue under $1,000 somehow financed a purchase worth nearly $20 million, yet the State Property Fund has publicly not addressed these issues.

This raises questions about whether transparency reforms prevent well-connected actors from acquiring strategic assets through technically legal but questionable transactions in the future. This remains unanswered as Ukraine continues wartime privatizations meant to demonstrate market economy credentials to Western allies.