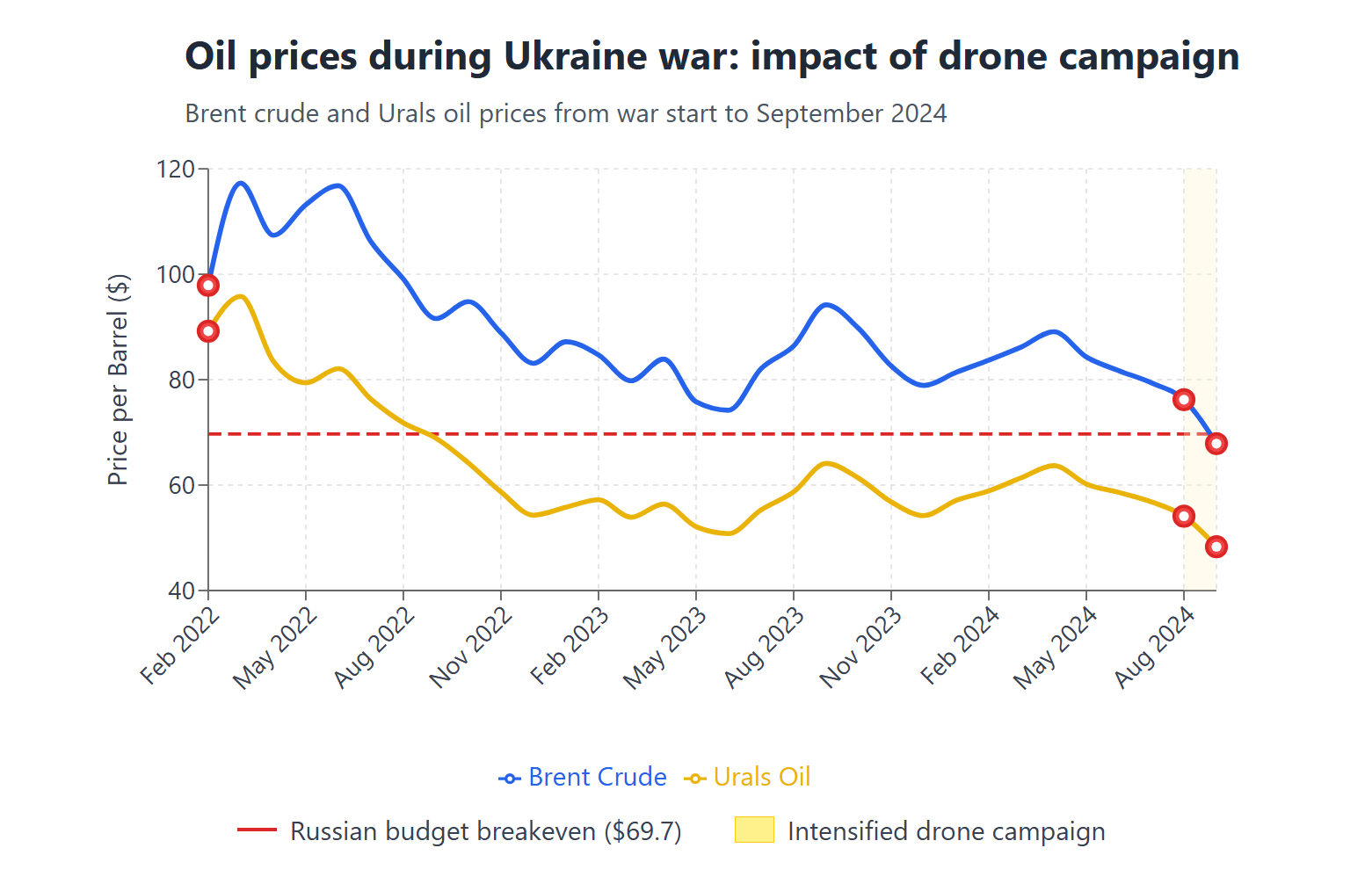

The campaign hits Moscow when oil prices have fallen below the $69.7 Russia needs to fund its war, turning tactical strikes into measurable economic pressure while the Russian economy shows signs of overheating.

Russia launched its war expecting energy price spikes to fund military operations, but instead faces oil oversupply just as Ukrainian drone strikes dismantle its refining capacity—turning tactical military success into measurable strategic economic pressure.

Sustained attacks

Since August, Ukrainian forces have struck 16 of Russia’s 38 refineries, disrupting more than 1 million barrels per day of processing capacity, according to the Financial Times. The methodical campaign has pushed diesel exports toward their lowest monthly total since 2020, while gasoline shortages spread across Russian regions.

“You have a refinery going down, but it might take three weeks between that refinery producing and that diesel getting to the port,” explained Amrita Sen of Energy Aspects, a global energy research consultancy, highlighting how Ukraine’s strikes create cascading disruptions that ripple through Russia’s entire energy supply chain over time.

The Reuters analysis reveals the crisis hits unevenly: private fuel stations—comprising 40% of Russia’s retail network—struggle most with supply disruptions and high borrowing costs, while state-owned facilities maintain better reserve access.

This disparity hints at emerging social tensions as ordinary Russians face fuel shortages while state enterprises continue operations.

Why now matters

Is the timing of the strikes coincidental or calculated? Perhaps both. Global oil markets face a significant oversupply, naturally depressing prices just as Russia needs maximum revenue for military spending. Ukrainian planners are pursuing a dual strategy—hitting both refineries that produce domestic fuel and export terminals that generate revenue.

Ukrainian drones reach major war-funding oil refinery 1300+km deep inside Russia second time in a week

Recent strikes have shut down Russia’s key Baltic oil terminal at Primorsk near the Finnish border for the first time and forced the Ust-Luga port near Estonia to halve operations, creating both domestic shortages and export disruptions.

The strategy reflects lessons learned from months of organized targeting.

“These cascading effects, which erode Russia’s economic resilience, increase operational costs and expose vulnerabilities in its energy-dependent war economy,” noted Olena Lapenko of Kyiv’s DiXi Group think tank in May, as Ukraine’s refinery campaign intensified.

Economic pressure

The strikes hit Russia when its economy shows early symptoms of stagflation—low growth combined with inflation approaching 25% by some estimates, far above official figures, according to Ukrainian economic analysis published by Ukrainian Pravda.

Military spending has reached unsustainable levels, consuming nearly half the federal budget.

At the same time, oil revenues dropped 37% year-on-year to 680 billion rubles in July. Brent crude settled at $67.87 per barrel as of writing this article—below the $69.7 that Russia’s budget requires—and each percentage point of refining capacity Ukraine eliminates compounds Moscow’s fiscal pressure.

Global implications

The disruption creates ripple effects beyond Russia’s borders. Türkiye has turned to India and Saudi Arabia for alternative diesel supplies, while premiums have risen to $25-30 per barrel over Brent crude—the highest since summer tensions with Iran, according to the Financial Times.

These supply chain adjustments could outlast the conflict, potentially reshaping energy trade patterns across Europe and the Middle East.

They immediately demonstrate Ukraine’s ability to affect global energy markets by targeting critical infrastructure.

Proving a point

President Volodymyr Zelenskyy has called drone strikes “the most effective sanctions—the ones that work the fastest.” This comment reflects growing Ukrainian frustration with the pace of Western restrictions while highlighting the immediate impact of direct action.

Where international sanctions operate through complex financial mechanisms, taking months or years to deliver visible results, Ukrainian strikes create measurable economic damage within weeks.

Recent attacks represent an escalating campaign demonstrating how tactical military success translates into strategic economic pressure.

As global oversupply continues to pressurize energy prices while Ukrainian strikes degrade Russian refining capacity, Moscow faces an economic squeeze that no military spending can entirely offset.

Will the Russian economy crack before Ukraine exhausts its capacity to maintain this unprecedented campaign of economic warfare through precision strikes?