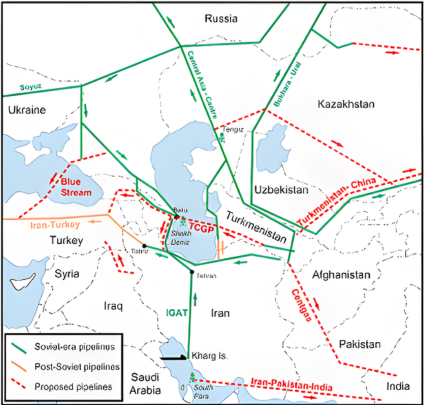

For decades, Russia’s power in Central Asia rested on pipelines. Moscow built these oil and gas networks to tie Kazakhstan, Turkmenistan, and Uzbekistan northward, making Russia both a market and a gatekeeper to global exports.

For years, that system delivered revenue to Russian companies and leverage to the Kremlin.

But today, those ties are becoming a lifeline for a country waging war in Ukraine—and a liability for investors betting on Moscow’s staying power.

The pipelines Moscow still controls

Kazakhstan’s crude still flows mainly through the Caspian Pipeline Consortium (CPC) to Novorossiysk on Russia’s Black Sea coast. Uzbekistan and Kyrgyzstan import Russian fuels and rely on Moscow for short-term gas contracts.

Even Turkmenistan, which now sells almost all its gas to China, must factor Russia into its export decisions.

Russia has repeatedly used its control over transit to pressure Astana, and Gazprom’s gas deals with Tashkent carry as much political weight as economic benefit. For smaller Central Asian states, Moscow remains a supplier of last resort.

How they feed the war

When Europe cut imports after the 2022 invasion of Ukraine, these regional ties softened the impact. Moscow collects transit fees and can veto Kazakhstan’s largest export route. Gazprom has expanded gas sales to Uzbekistan from just over one billion cubic meters in 2023 to more than five billion in 2024—a revenue stream and a reminder of dependence.

Türkiye and Iran have widened the gaps. Türkiye continues to buy Russian gas through TurkStream and Blue Stream while also handling Kazakh oil that transits Russia.

Through swap deals, Iran provides Russia with another way to mask or redirect energy flows. These arrangements blunt sanctions and keep revenue flowing to the Kremlin’s war chest.

Cracks in Moscow’s grip

But the system is breaking down.

China has replaced Russia as the primary buyer in the region. Turkmenistan’s gas flows almost entirely east, financed and secured by Beijing. Kazakhstan and Uzbekistan are expanding their energy partnerships with China faster than Moscow can counter.

Türkiye benefits from most of Europe’s diversification. It hosts the Southern Gas Corridor, which brings Azeri gas west and could eventually carry Central Asian gas. Even without new pipelines, Kazakhstan is sending more oil across the Caspian to Türkiye, bypassing Russian routes.

If sanctions ease, Iran could open southern outlets to the Persian Gulf, further sidelining Russia’s role.

Meanwhile, Moscow is cracking: Ukrainian strikes on refineries, the loss of Western technology, and shrinking investment all weaken its reliability as a partner.

The case for pulling out

Russia’s ability to sustain its energy relationships in Central Asia is eroding and will continue over the next five years. Investors who double down on Russian projects are not only complicit in financing aggression against Ukraine, but they are also exposing themselves to stranded assets, unreliable contracts, and mounting reputational risk.

Withdrawing capital is both ethical and prudent.

Redirecting capital toward alternative routes—Caspian shipments west to Türkiye, pipeline expansions to China, and even swap deals involving Iran—accelerates the unraveling of Russia’s coercive energy web. It also positions investors for the energy future already taking shape: one where Moscow is no longer the indispensable hub, but a fading player struggling to maintain influence.

Regional actors are already finding routes and reasons to ensure their independence from Moscow. Kazakhstan announced the new port of Kostanay and improvements to existing ports on the Caspian Sea to develop a “Middle Corridor”, an alternate maritime transit route to those passing through Russia.

Central Asia energy: Russia's weakening grip

Kazakhstan's oil, Turkmenistan's gas pivot to China, and Uzbekistan's growing dependence on Russian gas illustrate how Moscow's Central Asian energy empire is collapsing—and reshaping regional power dynamics.

Central Asian energy production by country (2023)

Kazakhstan dominates oil, Turkmenistan leads gas production—each facing different pressures from Moscow

The big picture: Central Asia produces massive energy volumes, but transit routes remain the key vulnerability. Kazakhstan exports 73% of its oil (mostly through Russian pipelines), Turkmenistan redirected nearly all gas exports to China (away from Russia), and Uzbekistan increasingly relies on Russian gas imports—up 400% from 2023 to 2024. Each country faces a different facet of Moscow's energy leverage.

Kazakhstan oil production and exports (2018-2025)

Production hits record highs, but 80% of exports still flow through Russia's CPC pipeline

The transit trap: Kazakhstan's oil production reached 96.2 million tons in 2025—the highest ever—driven by Western-operated fields (Tengiz, Kashagan, Karachaganak). But 80% of exports flow through Russia's Caspian Pipeline Consortium to Novorossiysk, giving Moscow leverage. Kazakhstan now builds the "Middle Corridor" across the Caspian to Türkiye and new ports to reduce Russian dependence.

* 2025 figures are annual targets based on 9-month actuals

Turkmenistan gas production and exports (2018-2023)

Trending Now

China replaced Russia as primary buyer—gas now flows almost entirely east

China's takeover: Turkmenistan exported 47 billion cubic meters of gas in 2023, with nearly all flowing to China through pipelines financed by Beijing. This represents the clearest example of China replacing Russia in Central Asia. Russia, once Turkmenistan's main buyer, has been sidelined as Beijing secured long-term contracts and built the infrastructure to capture Turkmen gas.

Uzbekistan gas: production vs Russian imports (2018-2024)

Despite domestic production, Uzbekistan imports growing volumes from Russia—feeding Moscow's war chest

Feeding the war: Uzbekistan produces about 45 billion cubic meters of gas annually but increasingly imports from Russia—surging from 1 billion cubic meters in 2023 to 5 billion in 2024. These deals carry political weight beyond economics: they provide Moscow with revenue and reinforce dependence. Gazprom uses these contracts as leverage, making Uzbekistan a key example of how regional energy ties soften sanctions' impact on Russia.

Azerbaijan and Armenia, longtime players in the regional energy market, signed a peace deal on 8 August that makes energy independence achievable for both Baku and Yerevan.

As the region builds independence, Russia’s war in Ukraine forces post-Soviet states to choose: diversify or get pulled into Moscow’s war economy.

Russian energy is not and has never been just a commodity. It is a weapon whose power depends on fragile and declining regional relationships. Pulling investment now is not only the right choice morally, but it is also a wise choice strategically.

Read also

-

Analysis of two months of deep strikes explains what Ukraine really targets at Russian oil refineries

-

Naked truth: drone strikes leave Russia begging for fuel imports

-

Ukraine’s drones flew 1,400 km to strike Orsk refinery — Russian propagandist blames Astana and calls for Kazakhstan invasion (videos, updated)

Central Asia energy: Russia's weakening grip

Kazakhstan's oil, Turkmenistan's gas pivot to China, and Uzbekistan's growing dependence on Russian gas illustrate how Moscow's Central Asian energy empire is collapsing—and reshaping regional power dynamics.

Central Asian energy production by country (2023)

Kazakhstan dominates oil, Turkmenistan leads gas production—each facing different pressures from Moscow

The big picture: Central Asia produces massive energy volumes, but transit routes remain the key vulnerability. Kazakhstan exports 73% of its oil (mostly through Russian pipelines), Turkmenistan redirected nearly all gas exports to China (away from Russia), and Uzbekistan increasingly relies on Russian gas imports—up 400% from 2023 to 2024. Each country faces a different facet of Moscow's energy leverage.

Kazakhstan oil production and exports (2018-2025)

Production hits record highs, but 80% of exports still flow through Russia's CPC pipeline

The transit trap: Kazakhstan's oil production reached 96.2 million tons in 2025—the highest ever—driven by Western-operated fields (Tengiz, Kashagan, Karachaganak). But 80% of exports flow through Russia's Caspian Pipeline Consortium to Novorossiysk, giving Moscow leverage. Kazakhstan now builds the "Middle Corridor" across the Caspian to Turkey and new ports to reduce Russian dependence.

* 2025 figures are annual targets based on 9-month actuals

Turkmenistan gas production and exports (2018-2023)

China replaced Russia as primary buyer—gas now flows almost entirely east

China's takeover: Turkmenistan exported 47 billion cubic meters of gas in 2023, with nearly all flowing to China through pipelines financed by Beijing. This represents the clearest example of China replacing Russia in Central Asia. Russia, once Turkmenistan's main buyer, has been sidelined as Beijing secured long-term contracts and built the infrastructure to capture Turkmen gas.

Uzbekistan gas: production vs Russian imports (2018-2024)

Despite domestic production, Uzbekistan imports growing volumes from Russia—feeding Moscow's war chest

Feeding the war: Uzbekistan produces about 45 billion cubic meters of gas annually but increasingly imports from Russia—surging from 1 billion cubic meters in 2023 to 5 billion in 2024. These deals carry political weight beyond economics: they provide Moscow with revenue and reinforce dependence. Gazprom uses these contracts as leverage, making Uzbekistan a key example of how regional energy ties soften sanctions' impact on Russia.