At least three of Russia’s largest banks are reportedly exploring bailouts from the Kremlin, Bloomberg News revealed in a report cited by The Telegraph. Borrowers across the country are increasingly unable to repay loans, exposing rising financial fragility in the war-weary economy.

The request for state support marks a new phase in Russia’s economic troubles, where years of war-related spending, sanctions, and labour shortages are colliding with falling revenues and rising inflation.

Officials have instructed banks to restructure their books to disguise the scale of bad loans, but that tactic is running out of road. As The Telegraph reports, the government may soon need to intervene more directly to stabilize the sector.

Economy strained by war, sanctions, and inflation

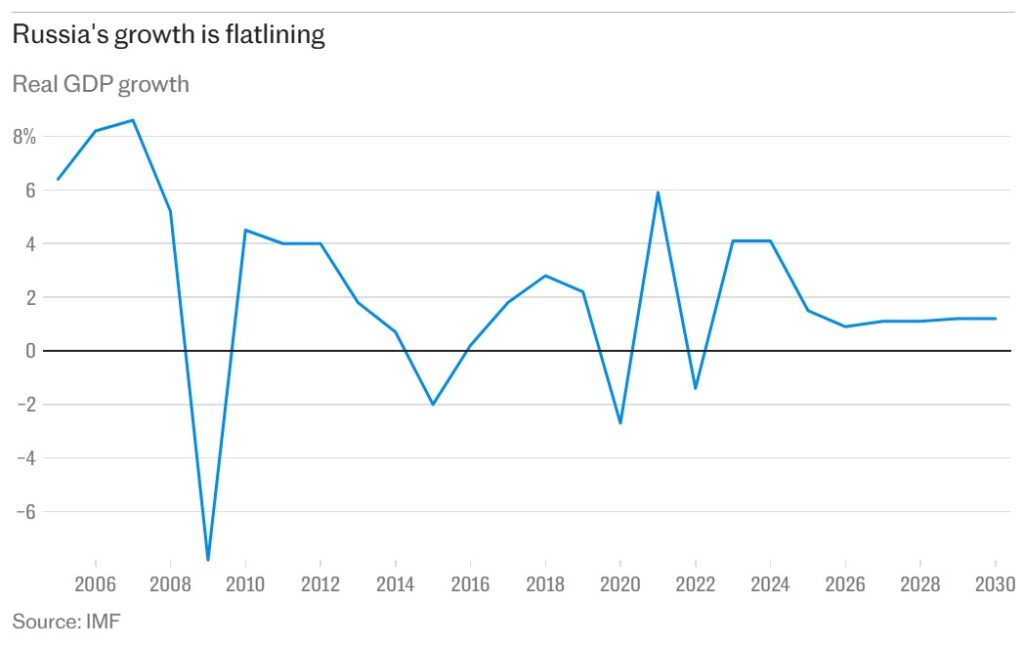

Though Russia’s economy officially grew 4.3% in 2024, much of that expansion was driven by military spending—one in every three roubles spent by Moscow now goes to the armed forces.

Behind the headline growth, key indicators point to a downturn. Business activity has dropped to its lowest level since the 2022 invasion began, and Goldman Sachs forecasts just 0.5% GDP growth in 2025. The private sector is weakening, labour shortages persist, and inflation has entered double-digit territory, driven by soaring food prices. Even potatoes are now in short supply, The Telegraph notes.

Oil revenues drop, currency under pressure

Russia’s critical oil revenues have plunged by a third compared to last year, with prices falling from $85 to $67 a barrel and access to international markets limited. The Bank of Russia’s 20% interest rate has failed to tame inflation, while high state payments to soldiers are further straining public finances.

Goldman Sachs also expects the rouble to depreciate by up to 30% against the US dollar this year, which would raise import costs and drive inflation higher still.

Global isolation could deepen

President Donald Trump has threatened to impose 100% tariffs on US imports from countries trading with Russia unless President Vladimir Putin agrees to a deal on Ukraine. If enacted, this could further isolate Russia’s economy from global trade networks.

As The Telegraph puts it, “The banks are quietly bracing for the worst.” With key sectors under strain and financial institutions now seeking state support, Russia’s economic resilience may be wearing thin. However, it remains unclear whether these challenges pose a critical threat to the Kremlin’s ability to sustain its war in Ukraine.