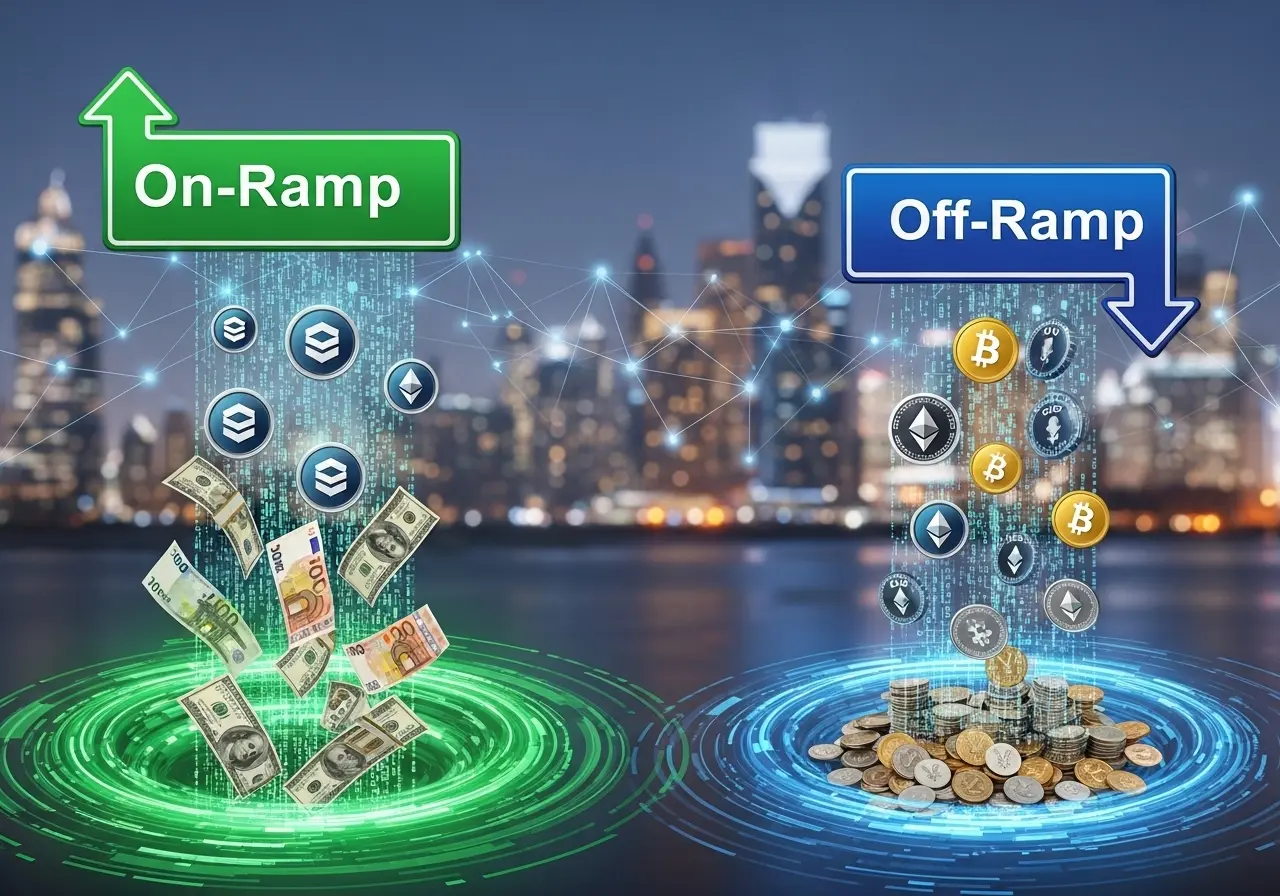

In today’s fast-moving digital economy, crypto is no longer just a buzzword — it’s a full-blown financial frontier. But before diving into Bitcoin or Ethereum, you’ll need a way to bridge the gap between your traditional bank account and the decentralized world of digital assets. That’s where crypto on-ramps and off-ramps come into play. They’re the entry and exit doors of the crypto universe. If you’re in Europe and looking to buy cryptocurrency with SEPA, you’ve probably already used one, maybe without even knowing it.

These ramps make crypto accessible. Without them, entering the market would feel like trying to join a poker game with no chips on the table. Let’s break down how they work, why they matter, and what features traders should look for.

Fiat-to-Crypto conversion via ramp solutions – how it works

Crypto on-ramps allow users to turn fiat currencies — like euros or dollars — into cryptocurrencies. Fiat-to-crypto conversion is the first step for anyone looking to enter the market. Think of it as the on-ramp to a blockchain highway. You register with a platform, pass the required KYC (Know Your Customer) checks, and choose how you’d like to pay — SEPA transfer, card, or sometimes even Apple Pay.

The platform processes your fiat payment, executes a crypto buy order through a connected exchange, and delivers your assets to your wallet. Just like that, you’re in.

On the flip side, crypto off-ramps allow users to sell their digital assets and receive fiat in return. Whether you’re taking profits or cashing out for expenses, off-ramps complete the circle. These services usually send funds directly to your bank account once you sell your crypto and pass any required AML (Anti-Money Laundering) checks.

What to look for in crypto off-ramps and on-ramps

Not all ramps are built the same, and choosing the right one can make or break your user experience. First, check for user-friendly crypto platforms. A clean interface, easy onboarding, and transparent instructions go a long way, especially for those still wrapping their heads around blockchain basics. Here’s a quick checklist to help you evaluate ramp services:

- Low and transparent crypto exchange fees. Watch out for hidden charges that can eat into your profits.

- Regulatory compliance in crypto. Make sure the platform meets KYC and AML standards.

- Strong cryptocurrency liquidity. High liquidity ensures smooth and quick transactions at market prices.

- Security features. Look for two-factor authentication, cold storage, and solid reputations.

- Payment and withdrawal flexibility. SEPA, cards, and multiple fiat options give you more control.

The Importance of bitcoin on-ramp solutions and how they drive crypto adoption

When people talk about entering the crypto space, nine times out of ten, they’re thinking of Bitcoin. A robust Bitcoin on-ramp doesn’t just serve individual users — it’s a catalyst for adoption on a larger scale. If someone can buy BTC with minimal friction and full transparency, they’re more likely to stick around, trade more, or even explore DeFi and NFTs.

The smoother the ramp, the broader the adoption. Bitcoin on-ramps that support SEPA transfers, offer multi-language support, and provide localized compliance features are helping bring digital assets to mainstream users across Europe and beyond.

In many ways, these on-ramps are the front door to the entire crypto economy. And when that door is easy to open, more people will walk through it.

Crypto on-ramps and crypto off-ramps are the unsung heroes of mass adoption. They turn fiat into crypto and vice versa, but more importantly, they make digital assets feel usable, real, and accessible to everyday people.