On paper, Russia’s economy looks like a fortress: GDP rising, defense spending at record highs, oil billions still rolling in. No wonder many ask if sanctions have failed — or if Putin’s war economy is strong enough to sustain his war in Ukraine indefinitely. But a June 2025 report from CSIS — one of Washington’s most respected think tanks — warns that this fortress is hollow, and the cracks are already spreading.

Russia’s economy only shrank in 2022 but grew in 2023 and 2024. Why do experts say it’s collapsing?

Russia’s “growth” is fake — a wartime sugar high before the crash.

Yes, GDP fell 2.1% in 2022, then rebounded with 3.6% growth in 2023 and 4.1% in 2024. But that wasn’t real recovery — it was deficit spending on weapons that get blown up in Ukraine.

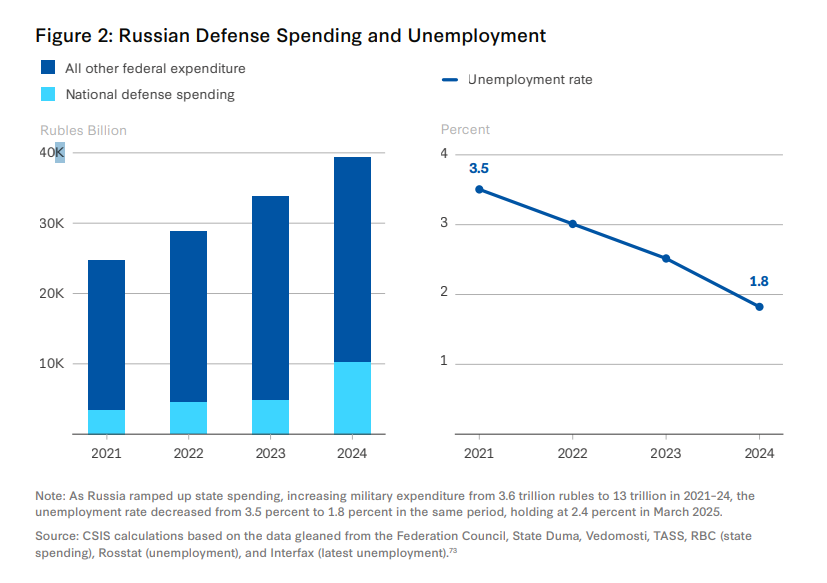

Moscow poured a record 13.5 trillion rubles ($145B) — 6.3% of GDP — into its war machine in 2025. That kind of “military Keynesianism” doesn’t build prosperity; it just keeps factories busy cranking out tanks.

Now the bill is coming due:

-

GDP growth slowed to just 1.4% in Q1 2025, with a 1.2% contraction after adjustment.

-

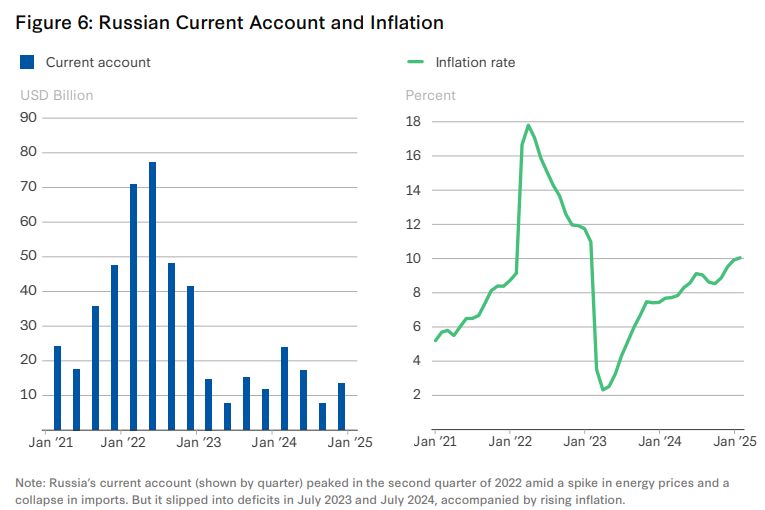

Inflation hit 10.2% in April.

-

The central bank is stuck at 21% interest rates to avoid collapse.

-

The budget deficit is swelling to 1.7% of GDP.

This is classic stagflation: fake war-driven growth hiding a shrinking economy and soaring prices. Putin can brag today — but Russia is already sliding into crisis.

How can Russia have a labor shortage with 140 million people?

Russia is in a self-inflicted “labor famine.” Since February 2022, 1–2 million workers have vanished from its economy:

- 600k–1M fled abroad to escape the war

- 300k–500k conscripted in mobilization

- 800k volunteered to fight in Ukraine

- ~1M killed, wounded, or missing

The result: 73% of businesses are understaffed, while defense plants poach workers with salaries 40,000 rubles ($500) above civilian jobs.

The cracks are already visible:

- March 2025: manufacturing suffered its worst slump in 3 years

- April 2025: Russia’s top business lobby warned of “zero growth”

- Even Putin admitted in March 2025 that the fight against inflation was “strangling growth.”

And it’s not just Russia. Western companies that rely on Russian suppliers are watching production shrink in real time — proof that the war is choking not only Russia’s economy, but global supply chains too.

Why should I care about Russian inflation when I don’t live in Russia?

Because Russian inflation is already in your wallet — you just don’t see it yet.

Russia’s inflation hit 10.2% in April 2025, forcing interest rates up to 21%. That pain doesn’t stay inside Russia. To dodge sanctions, Russian firms burn $10–30 billion a year on shady commissions, and those costs get passed into the global price of oil, metals, fertilizer, and grain — the building blocks of everything from your phone to your food.

Here’s the hidden link: disrupted supply chains and higher transport/insurance costs drive up commodity prices everywhere. Russia makes critical inputs for semiconductors, aircraft parts, and agriculture. As Russia’s costs spiral, global alternatives rise too. Their inflation becomes your higher grocery bill and gas price.

Isn’t Russia still making billions from oil sales? Doesn’t that make its economy invincible?

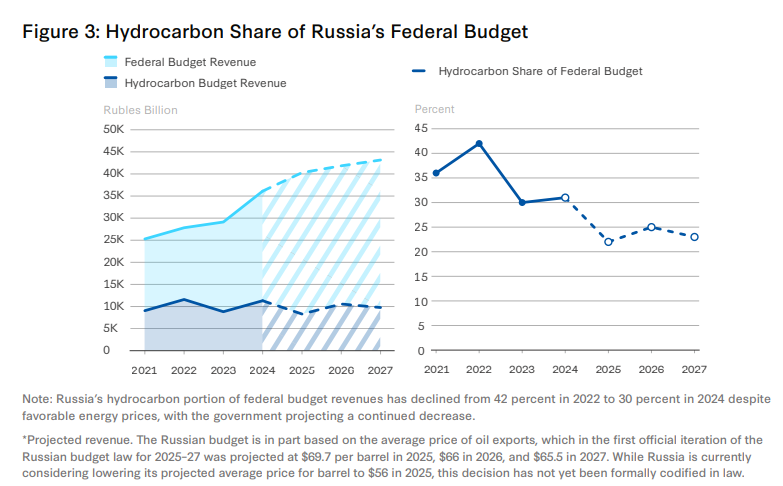

Russia’s oil revenues are collapsing in slow motion — and Putin’s war budget hangs on them more than he admits.

Oil made up 42% of the budget in 2022, but by 2024 it was down to 30% — even with high global prices. Sanctions forced Moscow to sell crude at a 15% discount, with shipping to India adding $10–15 per barrel.

Here’s the danger: Russia’s 2025 budget assumed $69.7 oil, but forecasts are already down to $56. In April 2025, Trump’s tariff threats sent Urals crude below $50. Every $10 drop = $10–15B lost revenue. If oil hit $30 again — as during COVID — Russia would lose as much money as it spends on the entire war.

Bottom line: Putin can brag about oil billions, but his lifeline is a knife-edge. One global shock, and the war chest collapses.

If Russia has China, why would Western pressure matter?

China is keeping Russia afloat — but that makes Moscow weaker, not stronger.

In 2024, Russia imported $115B in goods from China — 72% above pre-war levels. By 2023, 76% of battlefield-related deliveries came from China and Hong Kong. And now, 53% of all Russian imports are Chinese — meaning Beijing could cripple Russia’s war effort overnight by simply enforcing existing sanctions.

Despite talk of “yuanization,” Russia still can’t escape its need for dollars and euros. Meanwhile, China enjoys steep discounts on Russian oil, gas, and raw materials.

This isn’t partnership — it’s economic colonization. Beijing gains leverage, Moscow loses sovereignty. And for the West, the pressure point is clear: make China choose between Putin and global markets, and Russia’s lifeline snaps.

I keep hearing Russia’s banking system is stable. What’s the real risk?

Russia’s banking system looks stable — but it’s built on quicksand.

Businesses owe $446B in loans, half to defense firms on subsidized rates of 5–6%, while everyone else pays 18–19%. At the same time, with interest rates at 21% and inflation near 9%, Russian savers get 11% real returns just by parking money in banks — deposits jumped 70% in 2024.

The entire system now depends on depositors’ trust. But here’s the trap: nearly half of government debt is floating-rate. If the central bank raises rates, debt costs explode; if it cuts, inflation spirals.

That’s the classic setup for a banking crisis — politically connected loans propped up by nervous savers. A shock — sanctions, a battlefield loss, or a ruble collapse — could spark a bank run and bring the system down in weeks.

How long before Russia’s war economy cracks?

Based on 2025 data, Russia can probably grind along for another 2–3 years under current sanctions — but only if nothing goes wrong.

What could speed up collapse:

-

Oil < $50/barrel: Already happened in April 2025, hitting budget revenues immediately

-

Stricter sanctions enforcement: Especially on China’s dual-use exports to Russia

-

Global recession: Trump’s tariff threats already rattled commodity markets this spring

-

Banking crisis: 21% interest rates keep savers in banks — until confidence cracks

Russia’s National Welfare Fund — the rainy-day reserve — dropped 24% in early 2025 to just ₽3.39T ($39B). At current burn rates, that cushion won’t last long; even the central bank has warned it could be emptied if oil collapses.

And remember: Russia is running its economy on war spending — defense outlays at 6%+ of GDP — the highest since the Cold War. That means Moscow’s “growth” depends on pouring money into weapons that get destroyed in Ukraine, not building lasting prosperity.

Bottom line: The system works — until it doesn’t. History says Russia might stagger on for 2–5 years, but unlike the USSR, today’s Russia can’t wall itself off. Global markets, sanctions, and war costs make it vulnerable to shocks that could accelerate the crash overnight.

For Ukraine and the West: the pressure is working. But it’s a test of stamina — keep it up, and Putin’s war economy will eventually break.

What this means for you

Russia’s collapse isn’t guaranteed — but the odds are rising. Labor shortages, runaway inflation, oil dependency, and record war spending are the same pressures that have broken other wartime economies.

-

Investors: steer clear of Russian commodities and watch for ripple effects in global supply chains.

-

Policymakers: sanctions are working, but only if pressure is steady and sustained — collapse takes years, not months.

-

Everyone else: Russia is more dangerous now, but less sustainable long term. The next 2–3 years will decide whether Putin’s war economy holds — or breaks.